There is UBS (CH) Index Fund - Equities Europe ex CH and there is also an equivalent from Swisscanto. I don’t see any CH-domiciled index funds for European equities that include Switzerland, so you may still need a separate fund for Swiss equities.

From a tax perspective, that would be disadvantageous anyway. IE-based for Europe ex CH, CH-based for CH is best AFAIK.

LUX is also good for EU ex CH👍

The UBS fund (Europe ex CH) seems CH domiciled. Does someone know of a IE or LUX option? Also, does someone know whether it is possible to buy Swisscanto funds on IBKR?

So for my understanding

IE based European ETFs lose the withholding tax on Swiss exposure?

IE doesn’t apply any withholding tax for Swiss investors. But Swiss companies deduct WHT for IE ETFs?

correct. But I think the treaty rate is half of the 35%. Not 100% sure though, but we can easily check that by looking for msci Switzerland or similar and its dividends.

E: Apparently we cannot easily check that, as there are none IE domiciled ![]() I only find LU domicile dones and they are swap-based.

I only find LU domicile dones and they are swap-based.

Looks like funds figured it already ![]()

However it would be a disadvantage for EXUS it seems

I don’t think any non-Swiss funds can get the entire Swiss WHT back, maybe US or JP pension funds (like we do with their WHT).

Also part of the yield can be tax-free dividends (“Kapitaleinlagereserve”) I believe. I don’t know if that also is subject to WHT and if not, if foreign investors get that WHT-free.

Tax-free capital gain distribution is not subject to Swiss WHT, so there should be no tax loss on that part for foreign investors/funds.

What is the problem with UBS fund which is CH domiciled ?

Any clarity on which domicile is best for MSCI Europe ex CH?

CH domicile

LU domicile

IE domicile

Are they equivalent?

These two I would say yes.

Based on the tracking errors of UBS (CH) Index Fund - Equities Europe ex CH NSL vs. Amundi MSCI Europe ex Switzerland ESG Leaders UCITS ETF, the CH domicile seems to be better than LU, surprisingly. It’s not exactly the same index but for estimating tax effects, it might suffice. That’s assuming both funds use the net return variant of the MSCI index as benchmark.

It’s well possible that I’m missing a reason why this comparison isn’t useful, though.

Thanks

I believe it’s tough to find right comparison for CH because there isn’t a fund or ETF which tracks MSCI Europe or FTSE Europe and is CH domiciled

The only possible comparison is the one shared by @jay . Amundi LU vs UBS CH tracking MSCI Europe ex CH. They track different indices though

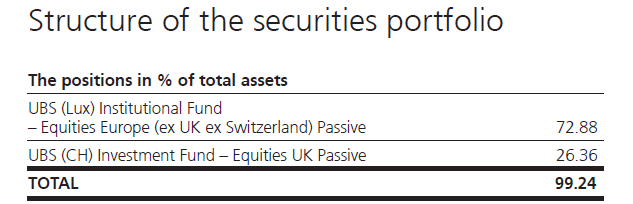

One data point I found though is that UBS Passive Europe ex CH fund (CH0356496742) is actually made up of following. So it could be that this fund is trying to optimize tax domiciles

finpension says for European stocks, IE and LU are equally good. AFAIR I read somewhere that for some countries, IE is better and for others LU, so in the end over all countries it’s more or less no difference.

Comparing the performance/yield of these two ETFs tracking MSCI EMU might provide some answers:

I think when FP talks about Europe, they dont include CH.

So i guess thats why IE or LU works best as per them.

Correct, they exclude CH. Which is what you were asking, no?

Actually I wanted to buy a European ETF / fund as i am trying to balance the portfolio.

But while looking for it, I realized that IE & LU based funds have issue with underlying Swiss exposure because they cannot reclaim WHT (treaty rate). So it is better to use MSCI EUR ex CH and then I came across this fund which is tracking MSCI Europe ex CH and TER is also decent 0.10%.

I was not sure why this fund is domiciled in CH when its better to be domiciled in LU/IE. However, when i drilled down the fund report, it appeared that this fund is actually an umbrella fund with a sub fund in LU (for Europe ex UK ex CH) and another sub fund in CH for UK.

What is still not clear to me is what is the advantage of owning a sub fund in LU. LU fund will benefit from advantaged WHT for underlying European investments but when dividends are paid to CH parent fund, the WHT in LU at fund level would be lost. Right?

Edit -: okay I understand now why they have this parent and sub fund. There is no WHT for funds domiciled in LUX. So using this structure UBS fund enjoys the best tax structure for the underlying holdings in EU and UK.

P.S -: There is no MSCI Europe ex CH ETF domiciled in LU or IE anyways. Amundi has one but it has the ESG filter

Can’t find that on IBKR or Saxo, can you?

If I look at the fund it says there are 3% fees for depositing/withdrawing, looks like a mutual fund to me? Honestly at that point not sure the benefits are worth the fees.