There are several flaws with the approach you mentioned. I watched the video you linked in your first post, because I don’t like to dismiss ideas if I haven’t checked them thoroughly.

Flaw #1: the guy picked dates when Crypto was in full bull market (01.01.2017 until 01.02.2018 and 01.12.2020 until 20.04.2021) This is important, because the strategy consists of buy and hold while rebalancing. It wouldn’t have worked if you started to invest in December 2017 and bought every month until March 2020.

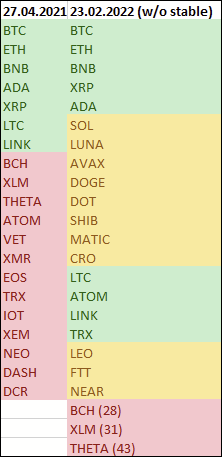

Flaw #2: he picks the top 10 / 20 / 30 coins in his backtests. THE problem is: you only know in hindsight which coins are the best 10/20/30 performing coins. You can do the check easily yourself: look at the coins from the video. He talks about top 10 coins (while showing a top 20 portfolio…) Look at those top 20 coins from 27.04.2021 (when the video was released). You’ll find the following coins:

BTC, ETH, BNB, ADA, XRP, LTC, LINK, BCH, XLM, THETA, ATOM, VET, XMR, EOS, TRX, IOT, XEM, NEO, DASH, DCR

Open coinmarketcap today, sort by market cap, and you’ll see different coins in the top 20. Because I’m interested in back-tests, I did it:

So out of the top 20 coins from 27.04.2021, only 9 of them would still be in the top 20 today.

Flaw #3: you need to know the top 10/20/30 coins BEFOREHAND, not in hindsight. In his video, he’s showing the top 20 coins (MC) on 27.04.2021. He starts his backtesting on 01.01.2017. Back then, other coins were hyped. I would have to check my old Excel sheets and notes again, but I remember things like ETC and BSV. Not sure where I can check which coins had the largest MCs back then (yes, I could check manually for every coin on Coinmarketcap, but that’s not the idea). Some of the coins you can see in the video (e.g. LINK) didn’t even exist in 2017, or with a tiny MC.

Flaw #4: of course coins other than BTC/ETH have more potential to grow when you are in a bull market. The MC of BTC and ETH is pretty huge (together they account for 60.2% of total crypto market today), so the potential for growth is limited. Unless some really big fish decide to invest more into crypto market (e.g. investment banks).

Flaw #5: pandaanalytics is no longer working. I tried with different browsers to create a portfolio, but the page just goes blank. Which is also one of the comments under the video.

Summary: if you actually want to backtest properly, you need to find out the top 10/20/30 coins

at the date when you start the backtest, because you don’t know which coins will be

top 10/20/30 in 4 years. Which brings us back to the crystal ball voodoo.

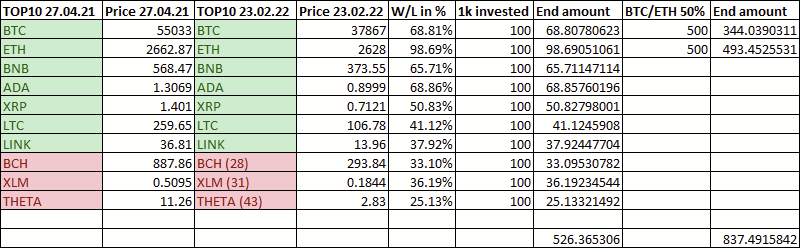

To give you an idea, how the portfolio from the video would have performed, you can check the following table:

If you invested 1k USD on 27.04.2021, you would have ended up with:

- 526$ when holding the top 10 coins (without rebalancing, for simplicity)

- 837$ when holding BTC/ETH (without rebalancing)

- 688$ when holding only BTC

I’m sure it’s not better if you check top 20 or top 30 coins from 27.04.2021.

So, coming back to what I said yesterday already: back-testing is great, but if you hand-pick the dates and also don’t consider that you can’t pick the top 10/20/30 coins of the future, it might be better to just stick with BTC/ETH if you want to have exposure to crypto.