So who would get my wealth if I am a resident of Switzerland, unmarried, both parents alive, one sibling?

Order for CH is parents then siblings.

If you hold a different passport you can opt to follow that countries rule (but you have to have expressed it somewhere, I think defaults would be CH rules)

Edit: VZ has a tool Erbschaftsaufteilung: Berechnen Sie, wer wie viel erbt l Rechner | VZ VermögensZentrum | Unabhängige Vermögensverwaltung, Finanzberatung und Pensionierungsplanung

Could you be more specific? Who gets how much? And what happens if there are no parents, siblings, spouses, kids? Do they look further for kids of sibling? Cousins?

…unless you opt to keep it separate (séparation de biens/Gütertrennung) by prenuptial agreement?

Which brings up the question, although maybe not for this particular thread:

Shouldn‘t Mustachians choose to do so? Is it realistic or (how?) likely to find a partner that is equally as frugal as yourself, being a Mustachian? Wouldn’t a less frugal partner benefit disproportionately (more) from a marriage in case of death - or divorce?

Unless you‘re marrying a spouse that is equally frugally as you are, it can be argued that one should contract for separating finances.

See the link I added, should allow you to try various scenario.

My understanding in that case is 100% Parents and your siblings will receive if your parents are not alive

100% to your parents. If one of them is dead, the other one gets everything. If both are dead, 100% to your siblings. If one of them is dead, his/her kids get the share. If your sibling has no kids, the other siblings get more. If there are no siblings, everything gets repeated from your grandparents.

If no family is around from your grandparents down, your wealth goes to the state.

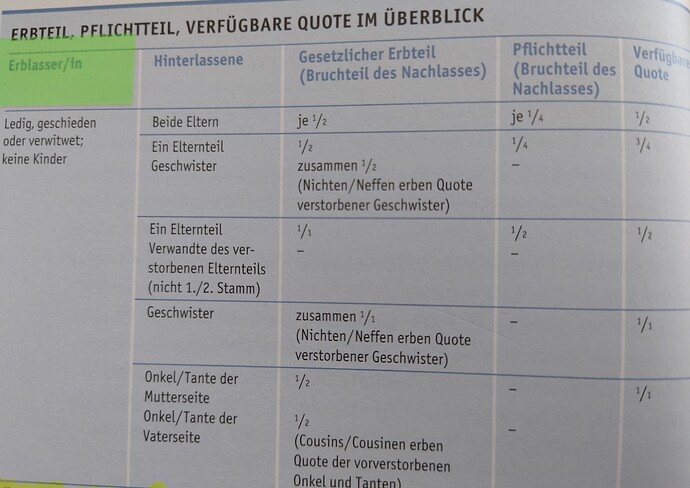

If one of your parents is dead and you have one or multiple siblings, the surviving parent will only get half of your wealth and the other half goes to your siblings (or more precisely, the descendants of the dead parent). Or am I misremembering this?

This tool isn’t very useful, in my opinion. E.g. if I select one parent and siblings, the result is simply 100% “Nächste Verwandte”. It doesn’t show any details.

You are right. The rest should be correct.

Indeed so afaik, each parent has 50%. If one parent is not alive their share is divided among the siblings.

So surviving parent gets 50%, each sibling gets 50%/number of siblings.

(edit: saw afterwards everyone said the same  sorry about the noise)

sorry about the noise)

Being single & with no children, you may want others to inherit (some of) your money, partner or something, and not that cousin that always irritated you or that bitchy aunt or the estranged father who left your mum just after you were born.

This is where the “frei-verfügbare quote” comes into play - but only if you define something in a will.

For such cases it is important to consider a will, even if far away from “expected average life expectancy”.

As long as my parents get it all, I’m fine with the default.

So nothing for the GF or siblings?

I read “20% for each GF”. Good way to remain fair even after your death

If my parents get it, I trust that eventually it will end up with my sister anyway. Already now they have transferred the ownership of the flat in Warsaw to her, so I also need to trust that they will treat me fairly in the end.

Regarding gf that’s a tough one. I would not expect any of her estate if sth happened at the current point in time. We’re not married nor do we have kids or common possessions. Who deserves how much of your wealth is a difficult question.

I do have a will, maainly to make sure my assets in my home country are taken care of without put burderns on my wife to have to solve any issues back there.

Hi,

I did a search and didn’t find anything related to this topic and I’m also not sure where to put this thread.

Has anyone done a living will and thought about estate planning? I am asking because since I had my child, I started thinking how to best take care of him financially and non-financially should something happen to us or one of us.

Thank you in advance for sharing your experience.

We were recommended an Ehe- und Erbvertrag and we went with that

With my wife, we had two children, about 6 months and 2.5 years after purchasing an apartment. The down-payment depleted most of our savings, we had a significant mortgage, and most of our “wealth” in the apartment value. We were both working 80% after the birth of the 2nd child.

At that time, we got a life insurance for each of us. The intent was that the surviving spouse would not need to sell the apartment to provide the inheritance to the children. We insured an amount decreasing by 5% per year over the 20 year duration of the contract (assuming our liquid savings would get re-built over the years, making the life insurance payment less and less necessary…)

We also had godfathers and godmothers for the children, to take care of the non-financial aspect in case of double-death.

Fortunately nothing bad happened in these last 20 years, life insurance contracts expired worthless and both children are young adults ![]()

Today we still have a mortgage on the apartment, but we have enough cash and liquid investments that we could reimburse it if interest rates become unacceptable. No more life insurance needed at this stage.