It is a bit more complicated than that.

Furthermore, I see so many questions/assertions about dividends and buybacks that I thought that writing a memo on the topic would be beneficial.

So here it is! (Warning, this might be lengthy).

Quick definition

Dividends and buybacks belong to a set of tools called capital allocation, which describe how the company generates capital, and how it will use it.

Sources of capital

The company can get capital by several means:

- operating cash flows

- taking on debt

- raising new equity

- “float”. This is a special case where customers or suppliers give you money a long time before you have to pay them back, and in between you can do whatever you want with the money, for often a 0% cost of interest. Example: Insurance premiums. Customers Loyalty or gift cards. Any situation where a customer pays upfront and gets delivered wayyyyy later).

Uses of capital

Once some cash is available, the company can use it in several ways:

- reinvest it in operations

- buy new businesses (M&A)

- distribute it as dividends

- pay back debt

- buy back shares

- do nothing (waiting for good opportunities)

Ok, but which one is best? Are there any source/uses more efficient than others?

It’s… complicated. We will see that the best use is often depending on the context, that’s why we should first figure out what kind of business we have to deal with.

Types of business

For the sake of simplicity i will divide businesses in three categories: the ok ones, the bad ones and the dream ones. The distinction is made on the sole criteria of return on invested capital.

The OK business

This is what most people have in mind when we think about a business: the business invest capital in some assets (factories, inventories, etc) and get yearly X% return on this capital. If the company reinvest those X% in the business, it will get X% again, compounding the capital and the earnings at a rate of X% per year. X is not incredible, but satisfying enough to continue operations.

This is a logic of “put more to get more”. As an analogy, imagine a bank account paying 5% per year (I know, not in Switzerland).

If you put $100 in the bank account at the beginning of the year, in one year you will have $105. You can keep those extra $5 on the account, in which case at the end of year 2 you will have $110,25. Or you can distribute this $5 to yourself as “dividend”, in which case there is only $100 left in year 1, and there will be $105 again at the end of year 2.

The bad business

A bad business is one where you need to put in always more and more capital, to get back less and less returns. The initial return on capital, X, is small, and it declines as you need to put more capital.

A good example would be Berkshire Hathaway in the 60’s. Berkshire was operating only in the textile business at the time, which was very competitive at the time. The initial return on capital was not high (around 4%), but all the earnings you would get, you would need to reinvest them in more modern looms, because this is what competition was doing. If you don’t change your looms, then you would lose market share/revenues and your profits will shrink to zero in the long term. If you do change your looms, you have just reinvested all your cash in machines just to get at the same level of profitability. You can never get some cash out of the business.

Of course, Buffett’s genius at the time was to realise that he should not play this game, and redirect all of the earnings in more interesting businesses. That’s why instead of staying in the textile business, he bought some insurance companies to generate float so he can buy even more businesses.

To come back to our bank account analogy, a bad business would be a bank account where , if you put $100 at year 0, you would get only 101 at year 1. But if you keep the additional 1 in the account, it will earn way less than 1%, so maybe at year 2 you still have $101, without being able to generate anything on your capital. If you add another $100 to get to a total of $201, next year you will get $201.5. You get the picture: disappointing and decreasing returns on incremental capital.

If you want other examples of bad businesses/industries, think airlines/automakers. For fun, try to count the number of bankruptcies in these sectors, this is staggering. Actually, try to find airlines that never went to bankruptcy before being recapitalised. There are not that many. Hint: Swissair is not one of them.

The dream business

At the other extreme, you have the dream business: it generates more and more returns for less and less incremental capital.

Imagine a bank account paying where you put $100. At the end of year 1, you have $105. You decide to take the $5 as dividends, so you get back to $100. But at the end of year 2, you don’t have $105, you have more, maybe $110! You need very little incremental capital to grow profits in a big way. That’s a dream business! You can spend the earnings, and next year you will get even more money.

An example would be MSCI. As you may know they publishes financial Indices, like the MSCI World Index or the MSCI Emerging Markets Index. In the institutional world they are the gold standard to be used as benchmark.

Well, MSCI business model is very simple: one of their revenue stream is to take a 0.04% annual fee on the Assets Under Management of all ETFs/Mutual funds linked to their indices, as well as the derivatives on these indices.

Why is it a dream business? Well, MSCI does not need to reinvest lots of capital to grow its profits.

1- there is a secular trend of growing assets flowing to ETFs in the financial industry, which benefits MSCI (non organic growth of AUM)

2 - those financial assets tend to increase their value by an average of 7%/year annually (organic growth in AUM)

Combine the two, and you get a business where MSCI can distribute or spend this year’s profits (those are already at a 30%+ return on invested capital, which is wonderful), fully knowing that next year’s profits will be 20% higher without them doing anything. That’s a great position to be in. Standard and Poor’s (SPGI) is in a similar position, not only with its S&P500 business, but also and primarily with its credit rating business, where they charge annually 0.03-0.04% of the debt issued that they rated. As global debt increases exponentially, the cash keeps coming in.

A final example of a dream business is See’s candies, which propelled Berkshire Hathaway to new horizons. Buffett bought it in the 70s for $25 million when it was generating $5 million of pretax income. Since then, it has only needed $30 million of reinvestments and generated in the meantime more than $2billion of accumulated profits…

Misc:

- It should be obvious that, if you have two businesses A and B, both employing $1B of capital, and A is a dreamy business whereas B is an horrible business, A is worth way more than B…

- Of course, these business categories are not static. A business will not stay in one category all its life. for instance, there is always a point, even for a dream business, where investing incremental capital will return disappointing results.

Capital allocation: the job of a company’s management

Knowing all of that, what should management do?

- First, as a shareholder, we would like to assume that the goal of the company’s management is to maximise in a sustainable way the per share value of the business.

- This means that over the long term management should maximise the return on invested capital of the business

- Obviously, as we have seen above, not all businesses are created equally in terms of returns on capital invested.

- Therefore, the primary task of a CEO is to allocate to the best of his ability the capital he has to disposition to return a sustainable and satisfactory return to his shareholders.

Refining the goals:

Now we know that management should seek to maximise returns over the long term, we should define how to do that. Over the long term, the shareholders’ returns will be mainly driven by the return on equity of the business. (If you want more explanation why that is, see this superb twitter thread).

Note: from now on all quantities are understood on a per share basis, even if I don’t explicitly say so.

Because Equity is defined as assets minus liabilities, the return on equity (ROE) will be mainly driven by:

- How high are the returns on the assets employed by the business (left hand side of the balance sheet)

- How much does the liabilities used to finance these assets will cost you (right hand side)

Obviously, you want to maximise the return on assets while minimising your cost of liabilities.

Another point to keep in mind is that you always have to take into account your opportunity cost: what you do with one use of capital, cannot be spent in another use. You have to choose the best choice given your opportunities.

Cost of liabilities

Let’s start with the liabilities, and see how the business can finance its assets.

Raising Debt:

What comes first to mind when you need to finance a business is to take on debt. Obviously, this has an explicit cost: the interest borne by the debt.

This way of financing is usually used in two main categories (with many nuances in-between, i cannot be exhaustive here):

-

An existing business where the returns on assets is not adequate (OK/Mediocre business). As a result, we leverage the business with debt so that the return on equity will be improved. Think about people leveraging a real estate purchase to improve the return on capital invested.

-

a superb business with recurring cash flows and high return on capital. Take MSCI once again: its cash flows are recurring and super stable, so bankers are willing to offer them to borrow at a decreased rate. This allow MSCI to do an arbitrage where they borrow at maybe 2-3% to invest in assets returning 30+%. The ROE is here magnified as well.

Raising Equity

A business can also raise new equity by selling shares to finance its assets. Although there is no explicit contractual cost for management toward shareholders, there is still an implicit one. Shareholders expect an adequate return on their investment, and therefore will expect the business to bring returns much higher than if it had raised debt. Management may deceive shareholders, but it can happen only once. if shareholders are disappointed, it will be very difficult to raise money in capital markets again.

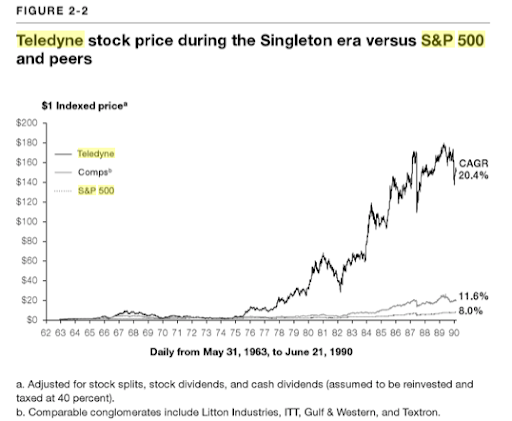

So raising equity is quite expensive. But there are situations where it makes sense! For instance, Henry Singleton (the Jedi Master of capital allocation) bought a lot of businesses in the early part of its management of Teledyne, by selling stock when Teledyne’s share price was expensive and the acquired companies were cheap. Imagine selling stock at 20 P/E while buying at 8 P/E. If the acquired earnings are valued at the multiple of 20 assigned to the mother company, managment added value by selling equity, because it received more than it paid.

Internal cash flows

Another obvious source of financing is the internal cash flows generated by existing operations. But in fact, these cash flows belongs to shareholders, so they should be considered as well like equity! As a result, existing cash flows carry an implicit cost as well: shareholders expect an adequate return on this equity.

Float

This is my favorite one. Not all capital has to be financed by either shareholders or bondholders. In some cases, the assets are financed by willing thirdparties such as the customers! This is the case when for instance people pay premium to an insurance company. There is often a big delay between the premium payment and the payback of the insured claim. In between, the insurance company can invest the premiums in productive assets. Depending how good an underwriter the insurance is, sometimes the sum of the premiums paid are more than the claims reimbursed. Therefore, you can consider than the insurance borrowed money at a negative rate to its clients! Obviously not all insurances are this good, but this is the case of all insurances within Berkshire Hathaway for instance. Over 50 years, the cost of borrowing capital for Berkshire through its insurance businesses has been lower than the rate at which the United States of America borrow money with Treasury Bills. Let that sink in.

Another favorite example is Starbucks and its client cards. Starbucks created a pre-paid card that clients can buy and with which they can pay their coffee when they will come back later. This is another example where clients pay upfront, and Starbucks will deliver goods and services on later occasion. In the time between, starbucks can use the money as it pleases. Of course, this is a revolving fund: when a prepaid card has no more credits, clients will purchase a new one. So the funds come and go, but on an aggregate level Starbucks always has a significant level of money available through this scheme. Even better, Starbucks figured out that clients won’t use on average the last 10% of the pre-paid card: this means that Starbucks is borrowing money to its clients at a negative rate of -10%! Now we are talking about an attractive source of financing…

Returns on assets

Now that we have seen how to minimize the cost of your liabilities, let’s see how you can maximize the return on your assets and deploy capital…

Reinvest in operations

That’s the first thing that comes in mind… but as you can imagine this will depend a lot on the existing business! You don’t want to reinvest capital in a business where the prospective returns are awful! So obviously manager of a OK+ business will reinvest all they can in the business, while managers of a horrible business will try to find other ventures.

The case of a dream business is a bit particular: it will require very little incremental capital. So it is likely that you can reinvest a small bit of capital (on which you will have wonderful returns), but you will need to find something else with the remaining cash…

Acquire new businesses

If current prospects of returns on incremental capital are not good in existing operations, managment may seek to find other business to buy. This is the domain of mergers and acquisitions (M&A).

The aggregate result of M&A is often awful for shareholders, because management is usually driven by ego (they want to be CEO of the biggest company, not the most worthy per share). As a result they tend to overpay for their acquisitions and destroy value for their shareholders.

That said, there are meaningful exceptions if you can find them. The most obvious one is Buffett at Berkshire Hathaway, with a pristine record of M&A. More recently, Constellation Software has built a superb company based on acquitision of vertical softwares. As a result, the priceper share went from 24 CAD in the IPO in 2007 to 1546 CAD today. Other worthy, smaller companies are Judges Scientific PLC or SDI Group PLC.

Return cash to shareholders

If there is no attractive opportunity to buy businesses or to reinvest in operations, management will have to return the cash to shareholders. This can be done in two ways: dividends and buybacks.

Shares repurchases

Buybacks, or share repurcharses happen when the company buys its own shares on the secondary market and cancel them. The total number of shares is then reduced.

We should first notice that in this case, we are returning capital to exiting shareholders. For the remaining ones, there can be three possibilities:

- the market was efficient and management bought back at fair value: in this case, no value is lost nor gained for remaining shareholders: value spent in buybacks is gained back by the smaller denominator when we compute the Return on Equity. Depending on the geographic area, this can be a very tax-efficient way to return money to shareholders.

- the market was inefficient, and managment bought back share at a lower price than share value. This is ideal: less cash was spent than the value received. Remaining shareholders get a bigger part of the remaining pie. Value is created by management.

- the market was inefficient, and management overpaid for the buybacks: this is not optimal at all because too much value was abandoned. Management destroyed value.

Determining the exact value of a business is a complicated endeavour, but nevertheless it is often telling to observe how management thinks about buybacks.

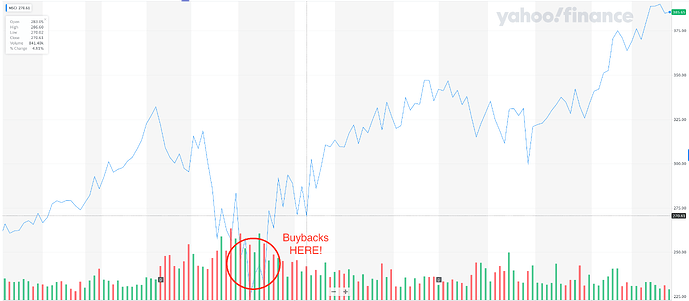

For instance, up to February 2020, MSCI, drowning in cash as usual, had stopped doing buybacks for some time. However, when the COVID-19 crisis occurred, the company bought back plenty of shares, at an average price of $250 per share, which was 30% lower than what it had traded at beforehand.

On the other hand compare this with Google, which has a superb business, but a poor capital allocation strategy: the board was buying back shares continually before the crisis, but stopped completely doing so when uncertainty occurred (and the price was even more attractive.)

Buybacks can be very attractive if done at a low price: once again the best example was Henry Singleton, who during the decade following the crisis of 1974, bought back 90% of the business at depressed prices. The value per share skyrocketed, and so did the share price on the long term

Dividends

The last use of capital on the list is dividends. Dividends are usually an inefficient way of returning capital to shareholders because they are usually taxed twice (corporate tax, plus shareholder income tax). However, a dividend is a sound capital policy if:

- you have a superb business with no need for capital and growing earnings, and you cannot buyback shares because of an elevated stock price

- You run a crappy business, you don’t have any attractive M&A opportunity. In this case you don’t want to buy back your shares (why would you like to buy back a crappy business?), so you’d better return the cash to shareholders.

Note that although dividends are the least efficient way of allocating capital, it is only the case if the management is good at capital allocation. if it isn’t, then for sure shareholders are better off with the cash (one bird in the hand is better than two in the bush…).

What should investors do?

Now what should you do of this lenghty memo? Well, if you are a passive investor, you don’t care much because you’ll likely buy every company on the planet. But i hope that this memo has answered some theoretical questions anyway.

On the other hand, if you are an active investor, two of your primary tasks are to:

- figure out the quality of the business (i.e Return on invested capital, and barriers to entry)

- figure out the quality of the management

By evaluating management, i mean making sure that a CEO understands his role and checking that his capital allocation makes sense. This is very important, and likely to be the biggest driver of your long-term returns. So don’t hesitate to run away if you see a CEO making weird acquisitions, or reinvesting capital in a crappy business, or contradicting itself when talking capital allocation. This will likely not end well.

Finally, if you would like to know more about capital allocation, a fantastic (and short) book on the subject is The Outsiders by William Thorndike. You won’t regret it!