Hi all

I was wondering if dividend paid by distributing ETFs are fiscally treated in the same way as dividends from individual stocks. In refer in particular to dividends coming from countries were most of ETFs are domiciled : Ireland, Luxemburg etc.

Reading the double taxation agreements in most cases there is no distition between dividends from ETF and dividends from stocks.

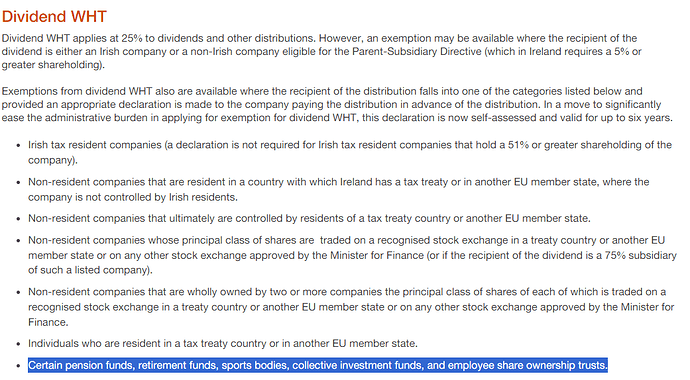

If we take for example Ireland, the country does not apply any witholding tax on dividends paid out by ETFs to non Irish residends. Does the same apply to individual stocks (irish domiciled / irish ISIN) bought for example via Swissquote by a non Irish resident?

Does anyone have any practical experience with this?

Thanks