on the market, you would currently pay more than 1.36M, if you wanted to buy a house that (by a real estate fund) was valued at 1M.

That would be my guess as well. Btw, how is the NAV calculated anyway? Would you have some example of the calculation?

are you sure it’s the DCF and not the Net Asset Value (= value of all properties held) as the name NAV suggests?

that has some details, e.g. page 4.

How do you calculate a Net Asset Value? RE Funds generally use a DCF calculation.

The important thing is: There is nothing like “A Specific” NAV. Its always a Guestimate. Given how Swiss RE Funds are governed, there is an incentive for Fund Companies to keep the NAV at a lower end - hence, Swiss RE Funds naturally have an agio of about 15% in average.

I guess purchase price as assessed at purchase time + either some arbitrary magic to calculate appreciation or a regular re-assessment of properties. It shouldn’t be THAT hard, there are multiple companies that are doing this + Swiss Re is long ago in the risk business, so they should know how to evaluate a portfolio.

The valuation of the fund must then be the:

- net value of the assets it’s holding (relatively well established)

- the (discounted) cash flows the assets are generated (very well established)

- multiplied by the actual market sentiment (random)

Yes, a direct RE investment might also be under water, but it will probably still generate stable revenues in between, and you have the option of choosing the re-evaluation cycle for yourself with an 10yr fix mortgage (and take hopium for the rest ![]() ), and the market sentiment could be much less (typically Zürich has zero vacancies, even for the crappy places).

), and the market sentiment could be much less (typically Zürich has zero vacancies, even for the crappy places).

I’m not saying OP would not possibly massively overpay for the direct purchase of the property + opportunity costs of 500k down + tenant risk + being a landlord risk. That’s ofc still there and needs to be assessed.

Isn’t the RE fund also generating stable revenue as well? It’s still paying out the rents beyond the potential appreciation and premium/discounts. You also don’t have to look at the price and only get the dividend (then it feels similar to direct ownership).

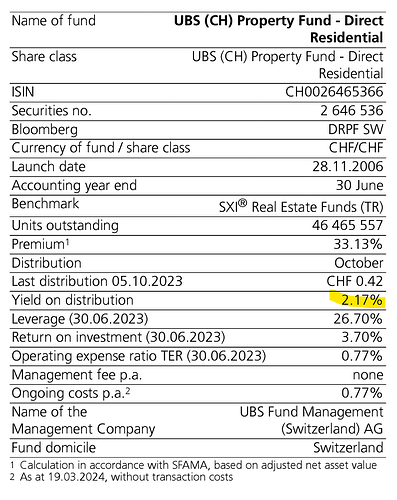

yes they do. 2.17% in the referenced UBS Fund.

I’d be damned if I’d put my money into anything netting 2.17% +risk when I can get 1.8% on a sparkonto in Switzerland, risk-free.

it’s not the same exposure. At least for me the goal would be exposure to my local real estate market, to hedge rent increases.

I think that you need to learn a bit more about Swiss RE funds. You will then learn a few things - among others that Buildings are (currently) priced lower than individual flats. This is what you monetize with Swiss RE funds.

And please, don‘t have a look at distribution yield. What you care about is the Profit generated, Minus the profit due to valuation change. This figure, you put in comparison to the Re Funds Share Price. That figure, you then compare with the Post Tax Profit generated on Buy to Let Flats… and tadaa you see you have a positive Investment case.

Had a brief look at the annual report, looks like that this fund distributes about 100% of the net profit ex. Re-valuation gains. So we can start with the 2.17%.

Normal Real Estate Ownership costs about 0.4% Wealth Tax - lets assume 25% leverage effect so 0.3%. Normal Real Estate Ownership further costs about 35% of Capital Income Tax. Both Tax taxes won‘t apply here. So 2.17% of distribution here equates to: (2.17% + 0.3%) / (65%) => 3.8% Net Profit with a Buy-to-Let Flat.

Generating 3.8% of Profit on Real Estate however furtther requires at least about 1% more rental income, to cover for re-renting and maintenance cost.

So long story short: please show me any buy to let objects you can buy with an (at 25% debt) net return of 3.8%, or even 4.8%. Swiss Real Estate Funds are currently more attractive than direct ownership.

Clearly, the question is of Swiss Real Estate was the right Investment for you but if thats the case, I would recommend RE funds over direct purchase.

In my view, EVERY Swiss Investors Portfolio should have 10-20% in Swiss Real Estate Funds.

Though you may already have a large exposure through pension fund.

You can neither re-balance with your pension funds money nor can you eat it. Returns there partially depend on RE but in case RE prices explode, you are still not guaranteed to get a matching return on your Pension Fund. I think that the second Pillar Money (unless we talk about Freizügigkeit) should not form lart of your assets allocation decision.

OK that’s fair enough! Thanks for checking, indeed enticing… ![]()

My crowd-owned objects are going at 5 to 9% yearly yield, but at ~60% financing, before appreciation.

What you have with a fund is years of negative buyback scenarios despite a liquid instrument and despite the facts that house prices didn’t really decrease until about last year.

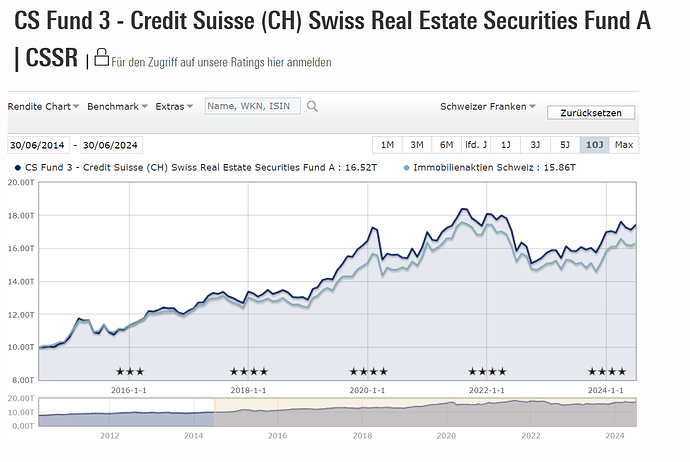

The CS fund for example didn’t generate a rappen of appreciation since Jan 1, 2020… and it costs 1.5% TER. Plus 5% commission at buy time. ![]()

What you have with direct ownership is years of not knowing where you stand ![]() so this is at least way more transparent, even if not that stable, price-wise.

so this is at least way more transparent, even if not that stable, price-wise.

Why? Less volatility, same returns?

Can you elaborate on that? Trying to follow your thought.

Isnt the tax advantage already factored in before calculation of the distribution yield?

When you rent a flat and you see that it was crowd owned with a return of 5-9%. What do you do? You dispute the initial rent, you for sure win the case and your entire return is toast. That risk is materially lower with RE funds as they learnt the lesson and less and less show rental yield per Flat (plus they stick closer to the laws). Co-owning was otherwise as well good, as you buy buildings and not flats. But the Problem is that you have a defined term only amd attract transaction cost after 5-10 years.

Approx the return of a 35% shares / 65% bonds, bit with different return distribution. Its one of the verry vew assets with re-balancing bonus

The thinking was that at 25% Mortgage, you buy 1M but only with 750k. So if 0.4% wealth tax applied, it was on the 750k only but not the full million.

As always, there are good and there are bad funds. We hence just buy the Index. Where did you get the 5% from? KIIDs state a MAX amount, not the applicable one.

I really appreciate the research here. Thank you. See such discussion is my goal when creating the thread. I was also trying to read the annual report but my german isn’t good enough and understand it without substantial effort.

Now I do need to read several times your post ![]()