what about the UBS direct residential fund. It is a direct fund so all the taxes are already paid for. What I did not understand is the premiums and how can this be bought / redeemed?

https://www.ubs.com/ch/en/assetmanagement/funds/asset-class/ch0026465366-ubs-direct-residential-pd001.html

I am about to buy a new 3.5 room apartment in Zurich to rent out as an investment, with the assumption that real estate object in German speaking area in Switzerland can appreciate steadily and mortgage on real estate can provide me some leverage. Just a very rough number, probably with 500k down payment and 1000k mortgage.

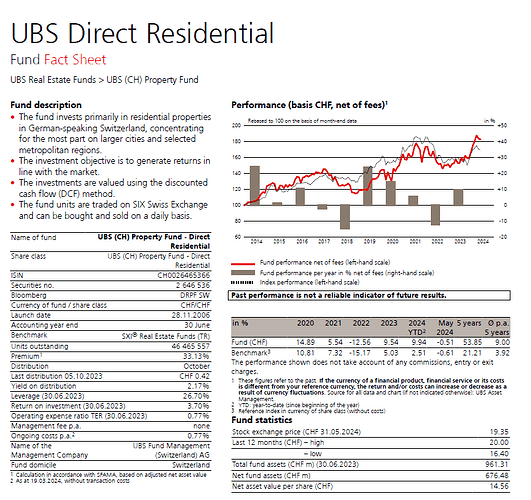

Under the same assumption, I found that UBS Direct Residential Fund is doing exactly what I am planning to do but at a larger scale. Then I wonder maybe go with this fund is a better choice? It’s more liquid for sure and it maybe provide a better return than mine.

And here is the fact sheet

https://www.ubs.com/2/e/files/RET/FS_RET_CH0026465366_CH_EN.pdf

Hope to get some input on this comparison. Thanks!

Depends what your goal is. It’s really just about active vs passive in my opinion.

If you buy the property, you have to pay taxes, insurance, find reliable renters and please the bank on a monthly basis. If you go with the fund you can buy and sell with a single click very fast + you are diversified - zero work.

Aside from less work on your side, the fund has the advantage, that direct real estate ownership is taxed at the real estate fund level, while investors are exempt from income and wealth tax on distributions [1].

[1] https://www.immoday.ch/de/medias/actualite/fonds-mit-direktem-grundbesitz-steuervorteile

For the same kind of product? Which are those?

Thank you so much for the reply. I totally agree that being a landlord can be a pain. The more I think about this fund, the more I prefer it to owning an apartment and renting it out.

Now asking in a bit more detailed level.

Do you know how to find the past dividend information on this fund? How much dividend is paid and at what frequency? Also why would it be no tax on distributions? I thought it would increase my taxable income.

And I see in fact sheet that the leverage is 26.70%. How should I understand it? Is it debt/equity = 26.7% ? If with 500k downpayment and 1000k mortgage, the same ratio would be 200%. Is it correct?

26.7% means 73.3% of equity. It is a percentage of the assets of the fund

thanks for the reply. Just to confirm my understanding

so with 100 million equity in the fund

there are 26.7 million debt and asset is 126.7 million. is it correct?

And if correct, it is similar as I buy an apartment for 1.26 million and I put 1 million down payment and 267k mortgage. Is it correct?

There’s a few threads on RE (funds vs personal ownership). This is a good one to start with:

DRPF is indeed one of those RE funds which owns the properties “directly”, and so such an investment won’t appear in your taxable wealth, nor will the dividends be added to your taxable income. This is especially interesting for early retirees (various benefits).

No. The 100 millions of equity are the 73.3% of equity. So there is 36.4 millions of debt for a total of 136.4 millions of assets.

The thing is there is a usually a premium. So you might end up paying 120 millions for it

ah ok. you are saying leverage is 26.70% means debt/asset is 26.7%. Thanks.

Is it the case the most REIT pays out dividend regularly but DRPF keeps the distribution in the fund and hence it’s not taxed as additional income?

They do pay out dividends, but you do not have to pay taxes on those personally. Everything was already taxed inside the fund.

REITs are an entirely different thing.

Owning a property and being invested in some ETFs are two different kind of topics; both have its pro and cons.

If you want to possess brick and mortar and some land, go with option 1. If you just want to have lesser stress with handling the property, then go with an investment.

If you go with an investment, you can also go with a much more optimized stock ETF as VT.

didn’t check the math, but sounds about right. these funds take on regular mortgages against their assets, much like you and me, but at very preferential conditions. that’s why they are leveraged.

Well, that’s the point of this and similar threads. Direct ownership Swiss RE funds are very different from ETFs in many aspects.

There is no question that there is a premium. What I want to know more is that, compared to directly buying an apartment to rent, which premium is higher? And how to calculate the premium? Can you share some ideas?

Take a look at Crowdhouse/FoxStone/Crowdli and such. Fractional ownership, you can spread your wealth into multiple buildings. They come with their own risks though (I’m owning in both concepts).

An Immo Fund that’s 36% above NAV is asking you to pay 1.36M CHF for a 1M CHF apartment with the promise of “easy management”. And when the sea gets tough, it’s going to be massively under NAV, which might make you lose 50%+ on your investment, whereas the apartment you are about to buy is a relatively stable thing, with monthly rents being almost rock stable if you buy a good thing at a good spot.

Being a landlord is a pain, but would you overpay and risk your wealth due to market fluctuations? Yours to decide.

- have a chunk of your money in RE if that’s what you want (direct RE the best probably)

- have another chunk of your money in stocks or otherwise market-driven securities

Mixing the two probably gets you the disadvantages of both with an overpriced Immo Fund with a recession risk.

Your own building might also be under water, it’s just that it’s less liquid (the fund will regularly re-assess the value).

The other difference is that the fund counts the capital gain tax as part of NAV, while if the fund doesn’t liquidate you as an investor might never pay those taxes (so the premium on fund can be explained beyond the extra liquidity).

Negative. Buying an ImmoFund with a price of 36% above the NAV means that you pay 36% more than their discounted cashflow model suggests as value. It does NOT imply that you pay 36% beyond the market. “Normal” real-estate you buy is as well priced materially beyond what these discounted cashflow models would suggest.

You don’t pay 36% more than the current market price, you pay 36% more than an (arbitrarily and conservatively calculated) value.

Compared to direct investment, RE Funds are still an amazing investment. I would in this market not buy any direct real estate (neither with Crowdhowse / Foxstone and the like) but I would buy a Real Estate fund: The logic is quite simple - you get mor evalue for the buck.

Following your example and asking my question again, To buy the 1M CHF apartment with NAV 1M, how much would it cost on the market now? Is it more than 1.36M or less than 1.36M? And how do you calculate the NAV of an apartment?