Why wouldn’t it? They can’t raise money in the open market like a company would.

(which actually kinda sucks for them since it can leave a lot of money on the table compared to a company issuing shares, here it’s the existing shareholders that pocket the premium)

I bought <18 as the outright premium became attractive. The one to sell is still CSLP.

STA still with a cheaper premium than DRPF but of course there is always the risk that the deal won’t happen. Bought some STA before buying DRPF.

All relatively speaking of course.

But they did issue shares and diluted the value. This is why the final value dropped about 5% from before the issuance. i really don’t think that anyone made money there. It was more or less a dilution.

If you fully executed your subscription rights, you were not diluted.

The price dropped because the new shares were issued at the NAV. But you also got the shares cheaper as existing holder.

I think everything went according to best practice.

The merge is another story… ![]()

I have a theory question

Let’s say these 4 funds add up to a total NAV of 5 billion with ratio

65% CSLP + 15% DRPF + 5% RES + 15% HOSP

And total shares created of new fund is 1 billion shares (this means NEWFUND has NAV of 5 CHF/share)

if an investor owns 100 CHF of DRPF , would they be replaced with 20 shares of NEWFUND?

Second question, if the moves in market price of fund values are as follows

Minus a% for CSLP and p% for DRPF

Plus b% for RES and c% for HOSP

Would the market price of NEWFUND move by X% where

X = 0.05b% + 0.15c% - 0.65 * a% - 0.15*p%

If X= 0% then this means the merger resulted in no net value creation.

I would agree with both calculations.

Also, the market will probably price it correctly. I assume there wont be much arbitrage opportunity for the average joe.

I actually think I made one mistake

The number of replacement shares wouldn’t depend on actual value of DRPF shares but the NAV value of DRPF shares

So 100 CHF of DRPF would mean 75 CHF aid DRPF based on NAV and this results in 15 shares of NEWFUND

Checked a few fund mergers. All happened at NAV ratios.

Current NAV premia

| ISIN | Bloomberg | NAV | Px | Premium |

|---|---|---|---|---|

| CH0026465366 | DRPF | 14.56 | 18.8 | 29.1% |

| CH0100612339 | STA | 108.89 | 124 | 13.9% |

| CH0031069328 | CSLP | 110.39 | 146 | 32.3% |

| CH0118768057 | HOSP | 76.19 | 94.6 | 24.2% |

| 29.5% |

With that STA (Residentia) still the cheapest despite 25% jump on Friday.

NAV weighted average premium currently stands at 29.5%. There is borrow and short selling possible on CSLP and DRPF.

Thanks for sharing

I would be happy to see how shareholders of DRPF & CSLP react to this & if UBS would share any presentation publicly. I hope so

Since premium is not only market sentiment but also includes things life deferred capital gains, I think market already did the math for us and priced all these Funds where they should be.

Such mergers would need some sort of voting by shareholders , right?

Skimmed the prospectus, that doesn’t seem to be the case. The fund direction can do it (if the funds are similar enough and have the same direction, which I assume is the case for UBS/CS funds), I think it only needs finma approval after that.

Eg check §24 for GREEN.

Yes, that’s how I read it as well

Only the funds that are a SICAV have shareholders votes generally speaking. This is the case for Procimmo, Bonhote, Edmond de Rotschild and soon for Streetbox next year.

I still cannot comprehend though, how is following possible . A fund trading at premium to NAV is merged with a fund trading at Discount to NAV using NAV as exchange ratio.

To make is clear, let me try to explain a bit with an example.

- Fund A (NAV 1 billion, Market value 1.25 Billion) is merged with Fund B (NAV 1 billion, Market value 0.75 Billion) to create a new fund C (NAV 2 billion, Market Value 2 Billion)

- Lets say Fund A was 100% owned by investor A. Fund B was 100% owned by investor B.

- Now Investor A owns 50% of Fund C which has market value of 1 Billion. Thus loss of 250 Million

- Now Investor B owns 50% of Fund C which has market value of 1 Billion. Thus gain of 250 Million

- This essentially means value transfer from Investor A to Investor B

- And Fund manager can do this without approval of Investor A.

How is this possible & am I understanding this whole situation correctly? It would be great if someone was expert in M&A and clarify how these things are possible.

In my mind, above will only make sense if NAV is the only real value & everything else is fictional number. But we know that every fund in Switzerland for real estate is traded at AGIO which is on average is higher than 20% (perhaps much higher for RESIDENTIAL funds). Does it mean that AGIO is a pure market premium and can disappear with actions like mergers ? This would make investing in these funds very risky.

Of course the agio can dissapear in litteral seconds

My personal take is that indeed those funds are riskier and can trade away from fundamentals (like most/all closed end funds). Also given that the rebalance on friday took quite some time (and it’s not always very liquid), I don’t necessarily believe everything is fully priced it (even the merger).

What I’ve heard make sense is that you should keep those for decades and buy them for a given yield (so you don’t care that much about the market value but more about the cashflow it generates). The value will change but the dividend amount is pretty stable (I guess like some kind of riskier bond).

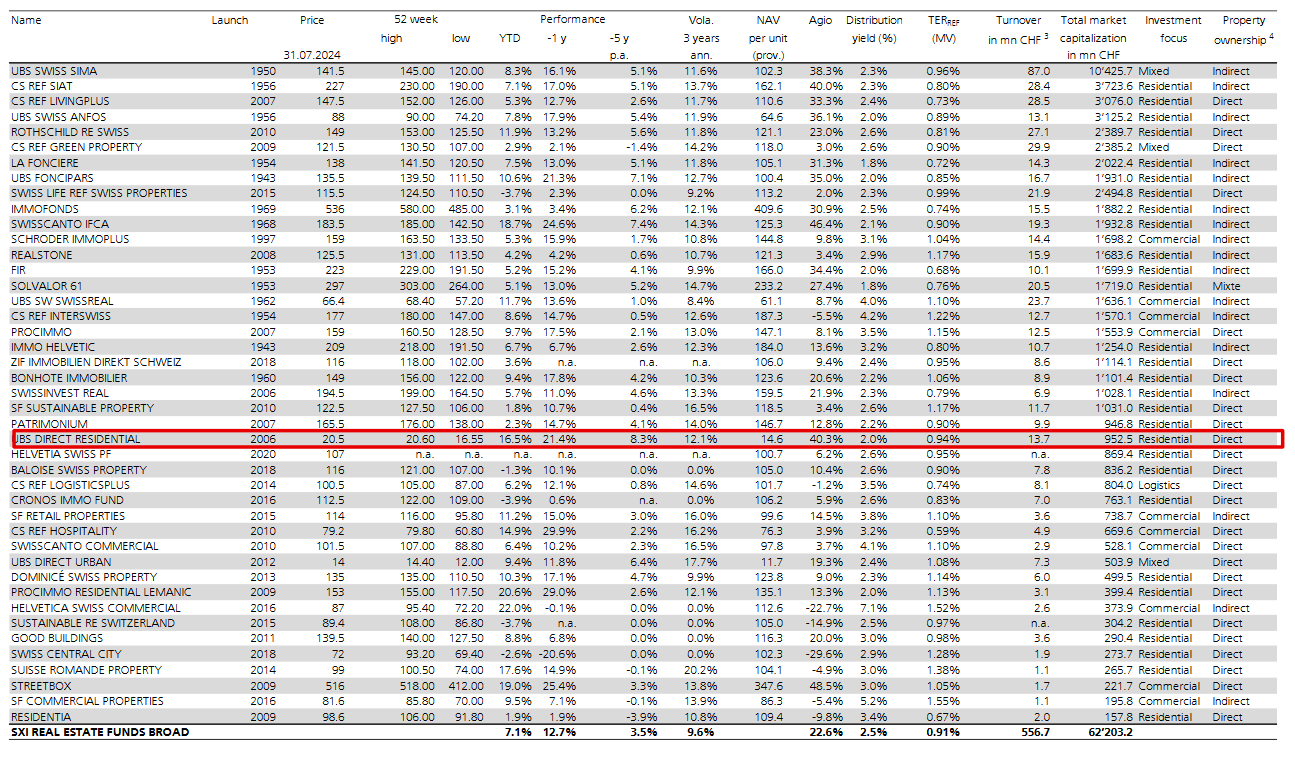

UBS Direct Residential new issue presentation had a nice overview of RE funds, direct and indirect with their premia etc.

There seem to be direct residential real estate funds with all kinds of premia. Theoretically I would pay more for funds with higher turnover, better risk-adjusted yields, lower fees etc.

Regarding the fund merger discussed above- of course nobody knows what the premium will be on day 1 of the new combined fund. Maybe it’s 40% then nobody loses any money and there are only winners. Maybe it’s -10% and everyone loses money. Imagine you have to place an order on day 1. You probably know the NAV/unit but what limit price are you going to enter? I guess few will be willing to sell the unit suddenly at 20% less than before, that would speak for a relatively stable premium. The current rapid changes are just because there is an element of technical arbitrage (buy the lower premia funds, sell/short the others). Most fundamental long only holders of the units probably don’t care. Friday’s volumes were only a fraction of units outstanding for all the funds.

For me, it is mainly a learning experience on how this works. I am happy that I got to learn this before I invested significantly in Direct RE Funds. This also helps me understand the inherent risks of closed funds where fund manager can do whatever they want. I will see how this turns out by 2044 for my holdings in DRPF.

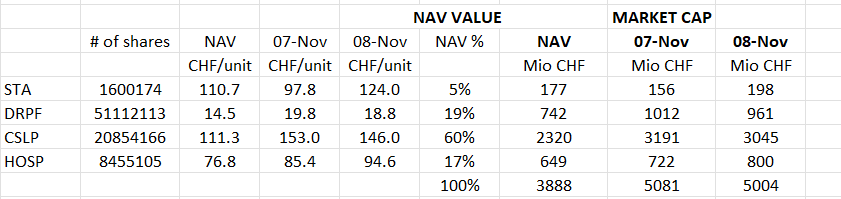

I did some math, and some data collection.

- If the current premium/discount paid by investors (as of 7 Nov) holds in future, then Newfund will have market cap of 5.081 Billion CHF and NAV of 3.888 Billion . Effective Agio 31%

- In this case, DRPF shareholders would lose approx. 5-5.5% in notional value. Similar loss should be expected for CSLP.

- The final fund will be 65% residential & have an effective yield of 2.47% based on market cap of 5.081 Billion

- On 8th Nov, this value dropped by 1.5% as an initial reaction

- This move obviously improves prospects of STA & HOSP to have higher stability and that is why we see bigger price action on these funds in +ve direction.

- Lets see what happens in next 20 years

The residential part will be higher than 65%. I looked into it as well. If you check the “mixed use” portions of their portfolios, they give a breakdown of what % of that mixed use is also residential (in the annual/semiannual reports). Basically I counted the reverse, 100% - “Definitely commercial portfolio share”. I.e. landbank I counted into resi as I don’t mind owning land. With that you’re closer to 75-80% residential/landbank.

Ahh I see. Yeah I ignored mixed use . But perhaps it’s also including some residential

Funds like these qualify as active funds, no?