I just stumbled upon this thread and thought I might add my 5 cents.

It’s important to note that it isn’t a fixed 50%-50% split. It just so happens, that currently USA represents roughly 52% of the FTSE Global All Cap index, which is the index that VT follows. VT practically includes VTI plus a few thousands more companies. If the USA stock market grows at a faster rate than the rest of the World, the share of USA within VT will grow (and vice versa). FTSE Global is a market cap weighted index, so price changes do not trigger the need for rebalancing.

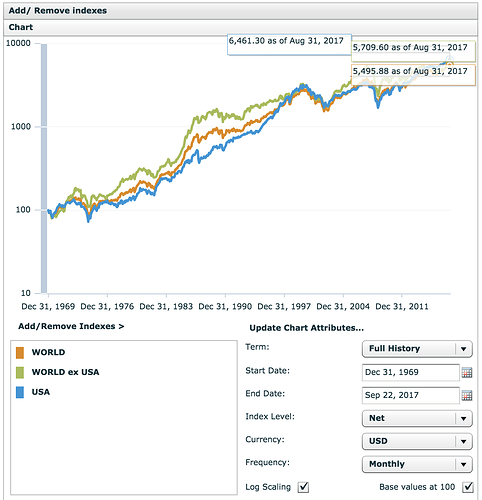

Regarding the question: US vs International, I think it’s worth it to retrack their perfomance over a long period of time. Here is a chart from the MSCI website comparing the total return of USA vs World ex USA (note that MSCI World includes only developed countries).

As you can see, the World ex USA has had a pretty good run in the 80s, but then the USA caught up in the 90s. Since 6 years the USA is constantly outperforming the World. In the long run, both indexes have performed similarly. But it takes a long time, decades, for them to realign. So if you opt for the wrong one today, you may wait another 20 years until it catches up.

The World Index, which includes USA, takes the middle road. I think it can reduce volatility in a very long period. That’s why I think VT is the safer bet than VTI.