Dear all, I tried to deposit money from UBS via using CHF account of IB. I am inputting all the details in deposit screen of IB and choosing international payment on UBS and costs born by payee. I recieve an error saying you must select domestic payment. However when I select domestic payment, it doesnt allow country to be selected UK (indeed anything other than Swiss or Liech) and I hesitate putting the details of Citibank London and selecting country as Switzerland. For the UBS senders, how do you overcome this problem? or do you simply select GB account and perhaps pay more fees? Thanks for your helps!

I’m not a customer if UBS but may I ask why you need to enter the bank’s address for a domestic payment? The IBAN should really be all you need.

I transfer money to IB from two different banks. In CHF from PostFinance and in EUR from another bank in the EU. After entering the IBAN the receiving bank’s details are retrieved and cannot be changed.

What I can do is type in the name of the recipient (Interactive Brokers) but I don’t select/input a country for that. The important part is the notification field which should contain your account number.

This has worked from both banks: to the CH IBAN from here and to a DE IBAN from my EU account. The IBAN is the unique identifier of the receiving account. I was slightly surprised that I couldn’t even enter the SWIFT code.

Is it possibe to just type in the name of the recipient and leave everything else blank?

Thank you for your answer. Not banks but let me say receivers address is a mandatory field that you cant left blank. And when you start payment process the first thing it asks whether this is a domestic or international payment. Obviously when you select domestic payment, it doesnt ask BIC/SWIFT which also made me confused but anyways if I understood correctly you suggest me to follow the domestic payment flow` right? Let me dig a little more. many thanks!

Correct.

I recall PoFi asking for recipient addresses once upon a time but not for a while. The street address of the recipient doesn’t change the payment routing.

My EU bank never asks for recipient address for SEPA payments (it doesn’t differentiate domestic vs foreign within SEPA)

Hopefully tomorrow some Mustachians with UBS accounts can give you precise instructions. Maybe it’s better to wait until then.

Yeah I just settled a standing order for Thursday, so some UBS customer can survive me from going to SwissQuote (which I am very close now  )

)

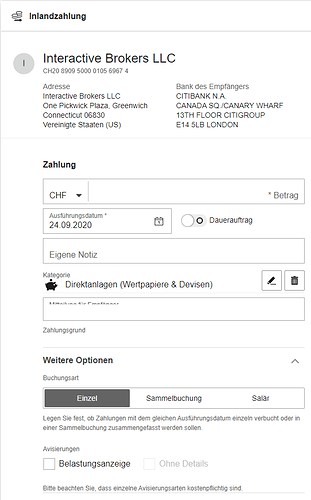

I‘m having a standing order to their CHF IBAN CH20 8909 5000 0105 6967 4, and IB‘s US postcode as the recipient. Though not at UBS at the moment (I could check my UBS online banking only in the evening, since I don’t have my security device with).

Anyway, while I can‘t take a look at the screens myself at the moment, this is what I would do in general:

- In IBKR account management, notify them incoming deposit in CHF (domestic, if applicable) and copy payment details, which should include their CH IBAN

- In my bank‘s online banking make a domestic CHF transfer to that CH IBAN. If needed choose destination country as Switzerland (which it’s not, strictly speaking, but it might be needed for a CHF domestic transfer)

- As beneficiary put IBRK’s street address, post code address and country as indicated in their payment instructions in account management. If it doesn’t accept the UK country or post code input, I would either simply ignore it and try CH - or contact my bank‘s support.

It doesn’t make sense to limit the input in such way. There are many people who live abroad but have a normal CHF/CH IBAN payment account with a Swiss bank (think cross-border workers). As it’s UBS though, as one of the best banks in the world, who generally have their **** together, I would be surprised if they did on their end.

Yes I see, so you suggest that I use IB US address as beneficiary, not the address they provide as Citibank 41 Berkely London one? In the screenshots MP provided, he wasnt inputting the US address at all - so I was planning completely skipping the US one.

Now another confusion - IB provides 2 addresses one their address in US and second the CITI in 41 Berkely, shall I use US one and not the 41 Berkely!

I’m using the UK address for the payment (even though not from UBS). It shouldn’t really matter what you put as the address. The most important part is the right CH IBAN.

Theoretically, you can put any address in there. I assume the bank doesn’t even check the address.

I’m using the following:

Citibank N.A. London

41 Berkely Square

WJ1 5AN London

Really I don’t think the address matters (which country). San_Francisco describes it correctly. Select domestic payment, use the Swiss IBAN, make sure your account details are in correctly and also, equally important, report/log the planned transfer on IB’s site so that they ‘expect it’. This causes problems if you don’t do this last step as money can be lost in limbo for a couple of weeks. Had this happen before.

+1 it’s not an exam where if you have the wrong answer you fail. I’m fairly sure that it will work with a bunch of address. It’s probably not even used unless the transfer fails and there’s a manual validation.

Agree address does not matter but I think people want the confidence to know their money won’t be sent to some wrong bank/address - never to be seen again. Having wrong payees and addresses does sometimes raise flags for banks and delay transfers.

The address is not that important. It’s just there to check if it’s plausible and you are not obviously sending it to the wrong account accidentally.

They gave me their US adress and even that still works for a Swiss, domestic transaction.

Interactive Brokers LLC

One Pickwick Plaza

Greenwich, Connecticut 06830

Vereinigte Staaten

I happen to be an UBS customer and this is what I filled:

Has worked for 10+ transfers.

At “Mitteilung für Empfänger” you fill it like “Accountnumber / Firstname FirstLetterOfSecondNameIfAvailable Lastname”, but it also shows you that in the Account Management of InteractiveBrokers when you create a deposit.

Let’s distinguish clearly:

Citibank (be it at 41 Berkeley Square or in Canary Wharf, what I’ve also seen) in London is the bank that keeps IBKR’s the bank account. If you‘re asked for the receiving bank’s address, you might enter it accordingly. Though why should they, for a domestic transfer within the Swiss clearing system (to which, yes, on an exceptional basis, even foreign institutions can be connected)?

The beneficiary should be an Interactive Brokers entity - and I would copy the details from the deposit notification in account management.

Looks good to me.

Thank you very much all the details guys, much appreciated!