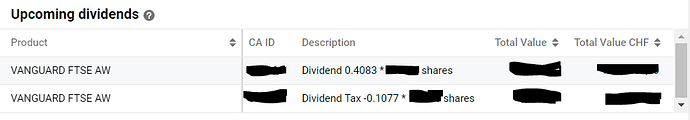

This is the first time I’ve seen this. The ETF is VWRL. The listed dividend tax is 26.4%. Perhaps this is an internal error and the tax won’t be applied when the dividend gets paid out. Or perhaps they’ve really buggered something up…

All my forms (W8, etc.) are up to date.

The same happened with me(i have the same VWRL).I believe this is an internal bug.

Why would the W8BEN matter here? You hold an Irish ETF. I think Corner Trader did one time charge me withholding tax and then reverted it.

This is the relevant part then

Glad to hear that it is not just me seeing it. Pretty sure nothing has changed in IE-CH tax treaties between 2019 and 2020 so yeah, this must be a bug. I will contact them if the tax actually gets applied upon payout (for now those numbers are just displayed because we passed the ex-div date).

From the number, it sounds might be Germany’s tax rate.

Today, the “dividend tax” has magically disappeared…

Hi folks,

I got the same for VUSA on Degiro, and a similar tax rate, 26 something %

Here https://www.vanguardinvestor.co.uk/investments/vanguard-s-and-p-500-ucits-etf-usd-distributing/distributions, I see VUSA is distributing 0.2892€ per unit and Degiro is paying the same exact amount.

Question: is this amount (0.2892) already taxed somehow?

Can anyone explain?

Thanks!

What is the domicile of this ETF?

Ireland

So, yes US kept 15% withholding tax on the dividends that got sent from US to Ireland. You’re getting 85% of the dividends the US companies paid, that’s the 0.2892 euros.

I‘d phrase it like this:

No - you’ve received the gross amount of the ETF distribution „untaxed“.

However, the sources of it, that is the dividend distributions (from stocks held by the fund), from which the ETF will pay a share to you (after administration and other costs) have already been already taxed - and that tax is non-recuperable (to you or the fund).

You‘ve received the ETF‘s distributions in full.

But the ETF itself received only a part of (gross) dividends from U.S. stocks.

Great! Thanks for explaining.

So this would leave me the obligation to declare income to whichever country I am a tax resident of, right?

Yes.

Even if they had withheld (subtracted) withholding tax. In most countries/jurisdiction, you’d still be obliged to declare as income - and often as a gross amount (so more than you’ve actually received in cash).

So I receive, 0.289€ per share, than Degiro will get their cut.

I need to declare 0.289 as income and whatever Degiro charged as expense. Did I get this right?

Do they? It seems to be in USD, not EUR, doesn’t it?

I don’t know about DeGiro. They might also credit the distribution to your account with “taking a share” (save for, maybe, currency conversion).

In principle I would think so, though it might depend on canton ![]()

For instance, I would read these costs as being deductible in Zürich. For simplification purposes, there is often a flat-rate option where you don’t have to prove these costs in detail (it might even save you more than declaring in detail).

If DEGIRO withholds withholding taxes though, these do not qualify as asset management costs - but might be recuperable by form DA-1 and.

You’re right, it’s USD not EUR

Degiro charges “Degiro corporate action fee” after each Dividend payment is credited to my account.

Thanks for the info @San_Francisco !

Do you have a Custody account? Can you match this fee to something in their fee schedule? Like (from degiro.ib):

- Dividend Processing:

– [€ 1.00 + 3.00% of dividend (maximum 10.00%)] - Repayment bonds and other corporate actions:

– [€ 1 .00 + 0.02% (maximum 0.25%)]

Do they also actually match the stated calculation methods?

I have Custody, yes.

Regarding the dividend tax I have always been charged 10% because the dividend values I receive are so low

For example, I received dividends of $6.86 and they charged $0.69 that is 10%

Next month I am scheduled to receive $26.6 , so Degiro should tax me $1 + 3% * $26.6= $1.7983 , remind me to let you know how that works out

Yes, with a Degiro custody account, you get charged a fee of 1EUR + 3% (to a max of 10%) on dividend payments.

What started this thread was the appearance a withholding tax being charged on a dividend payment (presumably on behalf of the government where the account-holder is based). Switzerland has no such tax, but most other countries served by Degiro do. Thus, this was likely a bug or some other internal error and the problem appears to have been rectified since I first posted.

I had exactly the same. First i saw an entry which said about taxes. Then i wrote an email to the support of degiro. He said this is a “Quellensteuer”. I asked again if they could tell me which “Quellensteuer” it would be and if i had to apply some documents because i’m a swiss resident. Then he said i should ask my taxaccountant. Then the next day the tax-entry was removed and the dividend amount was still the same as with the tax-entry. so i guess it was a bug

So I got charged $1.81 as “Degiro Corporate Action fee” for the $26.61 in dividends received.

This is in line with what I expected

I edited my previous post where I did the math wrong …