Class A shares in Berkshire Hathaway plunged 99 per cent before a trading pause was initiated.

Some trades executed at a price of $185.10 per share instead of over $621k.

No offence, but aren’t there trades like this every day? One just doesn’t know them in advance unless, well, your explanation here.

To me, this is all speculation, whether it’s GME, AMC or BRK — you trade these because of the greater fool theory. You invest in these because of fundamentals (and, for clarity, none of these are fundamentally attractive, IMO).

Sorry if I completely misunderstood?

huh? We are talking about A shares of Berkshire Hathaway, Warren Buffet’s company, one of the biggest in the world. Not some random meme stock.

This is clearly some kind of error in the system. BRK will not just plunge this much. They have over 100 Billion laying around in t-bills alone ![]()

I assume they’ll undo the trades?

To answer myself: I guess this is related to some technical issue on trading platforms.

Not the first time this happened, not the last time.

In short: noise.

You find BRK A shares at <$200 not fundamentally attractive?! ![]()

I apologize, I didn’t follow the quotes (and the average prices) as closely as needed to unterstand this trade suggesstion.

Did some trades really go through? I got a message from a colleague to look at BRK.A, looked and it was at $185.20, along with the CNBC news that NYSE had an issue in the system and had suspended trading. That was within minutes of the glitch.

I tried to put a limit order at $190 but it didn’t go through:)

I really wonder what happens in cases like that. I guess they reverse the trade even if it does go through? I mean, glitch or not, the orders didn’t do anything illegal.

I saw someone on twitter got his position auto-liquidated at that low price, as he was trading on margin and got the liquidation due togoing below the requirement.

Not 100% sure what that means, does it mean it did get fulfilled, he did buy BRK.A at 185 on margin, but he was such a pleb that he didn’t have liquidity and lost it?

That’s like the btc pizza story!

As I understand his berkshire was part of the collateral for his margin, probably got margin called due to the collateral going down 99%. Would expect it to be reversed though.

As expected the trades during the plunge have been classed as mistrades. Financial Times writes: LSEG data recorded a handful of trades at a price of $185.10 per share, compared with a previous price of $621,484. NYSE said after markets closed on Monday afternoon that all trades at or below $603,718.3 would be cancelled.

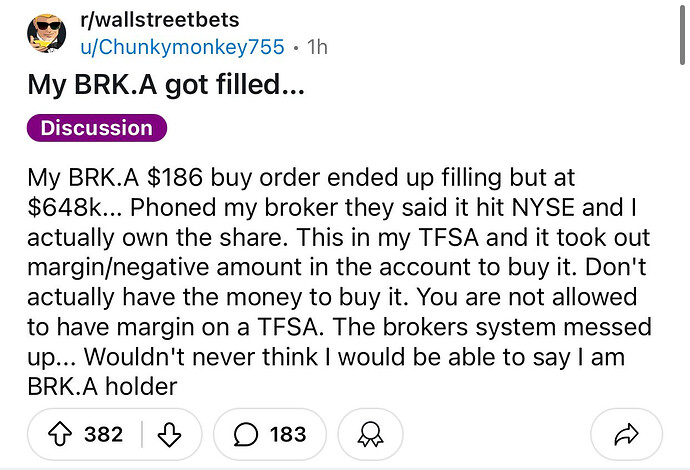

I was reading WSB several people managed to buy at $189. Though their brokers reversed their trades after the glitch was fixed. One unfortunate sould also managed to buy at $189, but placed a market order which was not reversed, but re-priced to the full value of BRK and since it was down on the day, he had an instant $16k loss and a massive margin headache to deal with!

Certainly another Excel formula story !

Imagine if you had defined a stop loss and it got triggered at the bottom ! ![]()

When there is this kind of volatility your limit order will not be executed but a market order could have !

As far as I understand it (I once saw it in an interview somewhere, but I can’t remember where), the respective exchange reverses this. So it depends on the exchange and not the broker.

A trading glitch on the New York Stock Exchange earlier month has cost Interactive Brokers $48mn after its customers tried to pile into Berkshire Hathaway shares following a 99 per cent plunge.

[…]

The loss stems from Interactive Brokers’ decision to take over a substantial portion of the trades through its platform “as a customer accommodation” after NYSE on the day told the brokerage that it would not cancel Interactive’s deals as the broker had asked.

I don’t get yet how they lost that money. What does “taking over the trades” mean?

Link is paywalled also.

https://www.morningstar.com/news/business-wire/20240626609524/interactive-brokers-trading-notice

From what I understand, they took over the trades from the clients (and sold the shares at a loss).

That evening, the Company determined to take over a substantial portion of these trades as a customer accommodation. The Company also promptly filed claims for compensation with NYSE. On June 25, 2024, NYSE notified the Company that it had denied those claims in full. As a result, the Company has realized losses (including losses on certain hedge transactions) in the amount of approximately $48 million.

I’m surprised the exchange gets away so easily from this.

Yes, the people who bought at inflated price after the mispricing made a mistake, but still, it happened due to the exchange messing up in the first place.

I guess they have a solid contract/lawyers.

What do people expect putting market orders on brk? Seems to me it was working as intended (they fixed the mispricing and reopened the trading)