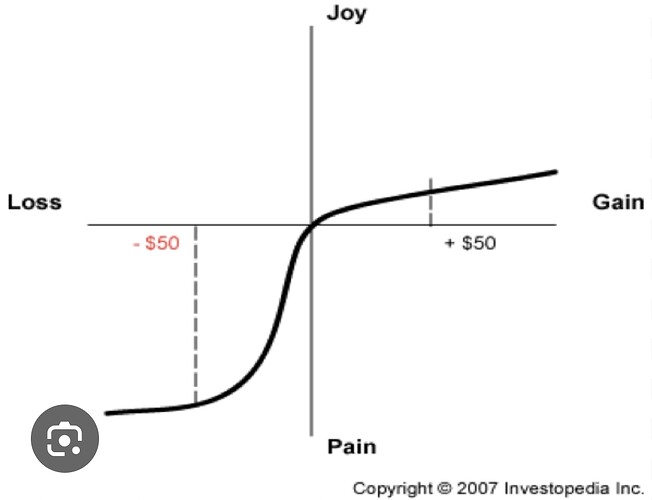

This is the dark side of investing.

Why wait till then?

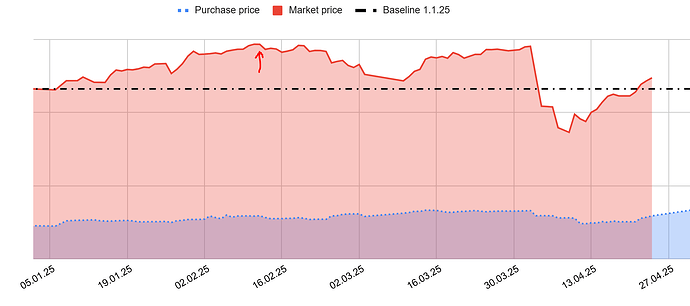

Aren’t you glad that we have another chance to buy at prices from 12-13 months ago? ![]()

Because I don’t want to ever sell at a loss, and don’t have sufficient liquidity to make a real change in my allocation via new contributions in any reasonable timeframe, though I appreciate that this could also be a mental block: not selling at a loss, despite how small it may be, leading to other bad behaviour.

To your second point, yes, but I set down a plan with how much of my liquidity I’d use according to % drops from ATH, and only the first level was breached, so it’s pure old greed!

@Wolverine you’re a solid voice of reason as always! I haven’t planned anything out yet. Good point you make about the sequence of returns anchoring/becoming an anchor around one’s neck ![]()

Thanks for that kick up the butt, much appreciated (not sarcastic!). Everyone’s a genius in a ragging bull market!

Thank you for the thread, @Mirager!

Early February I had the feeling: “What?! It’s been only a month and I already have made +7%. Should I sell all and call it a year?”

Of course, I didn’t, being the fierce mustachian I pretend to be. But I think it could be a valid strategy to leave the table after winning. Don’t we have the following belief about salary: why sell more of your lifetime when you have already made enough?

Me too. I don’t know if comparing it with a job makes sense, as there’s job enjoyment in the mix.

How’d you play out leaving the table after locking in a 7% gain for the year? If you’d left in Feb 2024 you’d miss between 10-15% more, then probably we’d be itching all over to get back in and may have jumped in in Feb 2025, to promptly see a -15-20% drop on top of missed gains to date, then you (not you - a hypothetical investor) we’d be jumping in and out like a bear on hot coals, losing money in every jump!

However way I’ve thought about it I am convinced that the axiom of time in the market works for the VAST majority of people edit: and to capitalize on that I am trying to figure out a “never ever sell” type portfolio.

I was thinking really hard to sell my positions before April 2, as I had a bad feeling about where these tariffs were going. I didn’t in the end. It would have prevented major losses obviously.

But for various reasons I think it was good I didn’t:

- This time it went well. The next time a similar situation comes up, I would be emboldened by my previous success at timing the market and would do it again for sure, only for it to maybe backfire. So maybe it’s a good thing to never have achieved success in timing the market.

- I don’t know if I would have gotten back in at the right time. I wouldn’t have jumped back in until now, as the tariff situation hasn’t been resolved yet. Maybe it’s a sideways market for the next 12 months, I’d still be holding off and then over night stocks explode because a trade deal with China has been reached.

- It’s the first real test of my risk tolerance.

Buying a put as insurance in such a case?

Thats not something to do constantly though…

Very honest and appreciated!

By the way, we are still 17% below ATH (from Swiss investor perspective) ….

So I guess there is a lot of time for introspection

And isn’t it very stressful to constantly ask yourself whether now is the right time to sell?

I guess you would need to check prices multiple times a day?

If you have already decided not to sell - no matter what - you have made that decision for yourself in advance.

I think this is why a lot of people prefer wealth managers. You just send money every month. Get a monthly or quarterly report. And after many years, you will end up with more money. That’s it

DIY investing brings advantages of having more returns but it comes with challenges for few

- anxiety to know portfolio is up & down every day

- Assumption of knowing more and making changes

- Regret of making changes at wrong time

- FOMO of missing out on major moves

- Constantly trying to build the best portfolio

- And even with all this , an average investor is under performing 60-40 strategies

Sometimes I feel that DIY index fund investing might end up like Dating apps. The effort to meet people has reduced but it didn’t mean there are more / happier relationships

It wasn’t really like that. It’s not that I was wondering if I should sell, all the time. In the 1.5 years this was the only time I really considered it.

It’s a mind’s game. Do you guys/girls read the MMMs forum? SO MUCH less fretting.

Step one: read some books/websites and realize you can’t predict the future and are no investment genius.

Then set your asset allocation for the next decade, do automatic contributions, buy and hold, RELAX. If selling isn’t an option, you get a much more detached view on market fluctuations.

I think we are losing the most important: We are suppose to be long term buy & hold investors.

All of these discussions about timing in and out, tariffs etc are not compatible.

Embrace the volatility as something good that enables you to make money long term. If there was no volatility/risk there will not be any market premium!

Getting the dividends from VWRL to buy BRK.B shares? What are you going to do if tariffs go away? Sell BRK.B to buy VWRL? Isn’t this the definition of Active?

Getting out after you gain 7% in January? What’s the point? We are not getting 7% every single year. 7% (or similar) is the average expected return over a long period. Really long period! Have a look in the table below. There were only a few cases where a single year return was ~7%

Why many compare current values with ATH and feel bad about the “loss”? Why we do not compare with ATL (All Time Low) and feel happy about the gains? ![]()

I can understand the psychology of someone that put all his money at ATH but I doubt any of us did that!

If you didn’t sell → you didn’t lose (nor won)

We do invest the savings, the majority of which do not expect to use the next e.g. 10 years. Correct?

We do have an emergency fund to cover short-term uncertainties, correct?

I would suggest focusing on having more rational expectations from our investments by e.g. studying past returns, volatility, crashes. Stop analyzing too much, do not pay too much attention to narratives, understand that you are not better than the Market (almost no one is and that’s perfectly fine). All in all continue with our lives and pay less attention to the noise in our portfolio returns.

With regards to the psychology of dividends, I think most of the people (Mustachians are the exception ![]() ) behave correctly (less stress - not panicking in downturns) for the wrong reason: They think dividends as free money

) behave correctly (less stress - not panicking in downturns) for the wrong reason: They think dividends as free money ![]()

In any case if it works for someone that is perfectly fine. Especially if we are talking about a World ETF like VWRL vs VWCE.

Unfortunately the dividend narrative doesn’t work for me:

- I learned quite early the irrelevance of dividends in the total returns

- I guess I am too lazy to invest them. I have 1 year dividends just sitting around. Wish I had VWRA instead of VWRL

- Perhaps I would be tempted to do something Active with these.

- Dividends are taxed. Capital gains not. (irrelevant of course to Acc Vs Dist)

PS: Sorry for the long post

Great post!

Nope, that’s not right. The dividend irrelevance theory says that whether a company pays a dividend is irrelevant to that stock’s future price. They are not at all irrelevant to total return because they are part of total return.

Specifically for BRK.B, it’s going to my kids. Being somewhat active should stop being a bad word, we’ve been over that more or less everything is active from target date fund to flipping futures on 1min candles.

Wrong reason → right result = who cares? ![]()

I disagree. The superior investment mindset belongs to those that invest for the total maximum return. A portfolio of stocks that eschews dividends is a corollary of that.

… half the readers off to google corollary ![]()

![]()

To add something more substantial:

Agree that the only significant endpoint is total return - after fees and taxes - .

Disagree on specifically avoiding dividend paying shares - because past returns don’t predict the future.

Let’s not play with the words. It is irrelevant if your total returns were produced exclusively from stock price difference or solely from dividends or a combination of the two. (leaving taxes and other costs aside)

Specifically for BRK.B, it’s going to my kids. Being somewhat active should stop being a bad word, we’ve been over that more or less everything is active from target date fund to flipping futures on 1min candles.

No problem with that. The point is that you can do the same by selling. There is no real benefit.

And yes there are a lot of flavors of Active.

Wrong reason → right result = who cares?

Didn’t I say the same? ![]()

Disagree on specifically avoiding dividend paying shares - because past returns don’t predict the future.

I guess missing the dividend paying shares is suboptimal because you are missing a big part of the market. On the other hand missing returns due to taxes is also not good.

Not sure which one is better.

I intentionally do not discuss about the specific characteristics of dividend paying companies that could provide more exposure to other risks on top of the market (like Value, Low volatility etc). I am not an expert…