Hi guys. I got a letter from the tax office. I requested 161 CHF return, they awarded me with only 50 CHF.

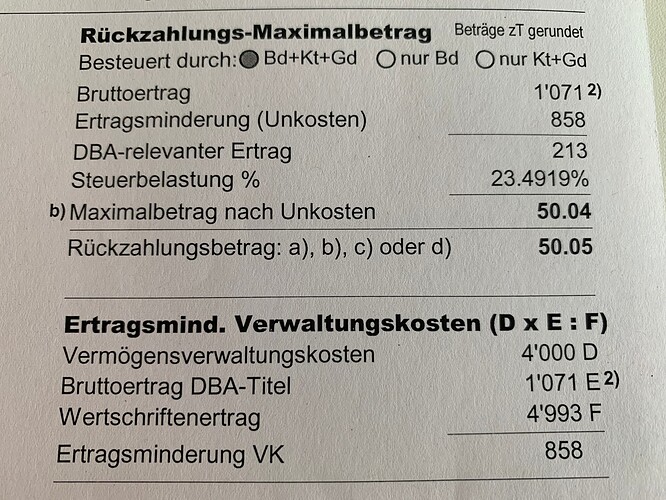

Here’s the calculation logic:

This is my last year of DA-1 return, because I replaced my VT with TSLA, which so far pays no dividend.

But I don’t quite get this calculation. Up until now, I would always get my refund in full. In 2021, I earned 1071 CHF dividend, for which I payed 161 CHF withholding tax. Then they reduce the dividend by “Unkosten” of 858 CHF. Why?

The formula for Unkosten:

Dividend x Self-Management Cost / Securities Income.

1071 x 4000 / 4993 = 858

What is Securities Income again? (Edit: I checked, this is the sum of my IE-domiciled + US-domiciled dividends for 2021). Still don’t get why should this be deducted from my dividend. What’s the logic behind it?