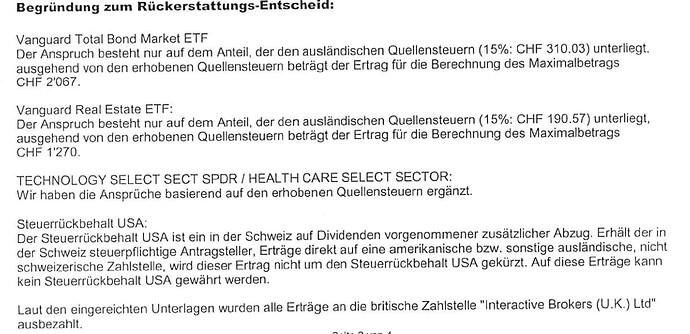

Hi, I got a reply from the tax authority that my DA-1 won’t be completely refunded since IB sits in the UK and is not registered in CH. Is that correct? Any thoughts?

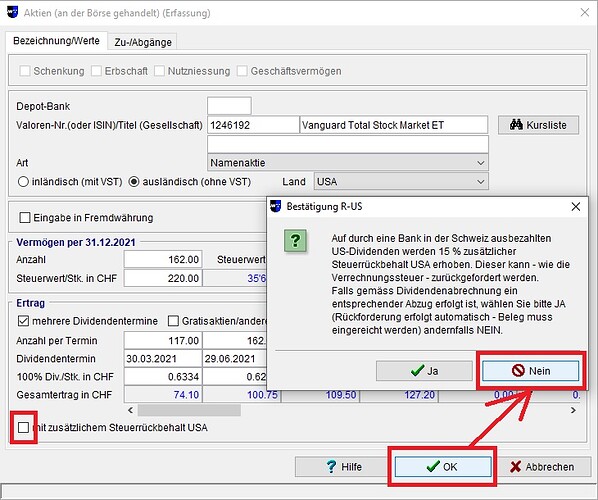

I guess you tried to ask for the extra US withholding, that’s only valid for a Swiss broker. Classic error

2 Likes

By the way, consider yourself “lucky”, you also probably asked for a lot more than was withheld for BND. Withholding for US bonds are well below 15% (usually more like 1-2%).

1 Like

For the one that use GeTax in French/English is there the kind of option as well ?

Yes. You have to disregard the " retenue supplémentaire d’impôt".

2 Likes