A post was merged into an existing topic: What about Gold?

Hello,

I was looking at Bond ETFs and if Hedged ones are better or not… But that’s not my question here.

I just don’t understand how the hedging works, or at least it doesn’t work how I imagined it to.

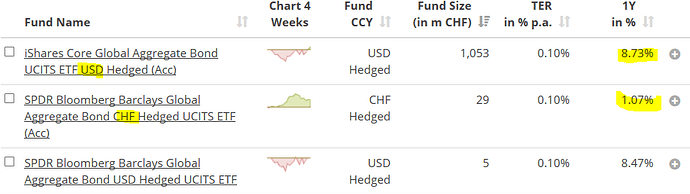

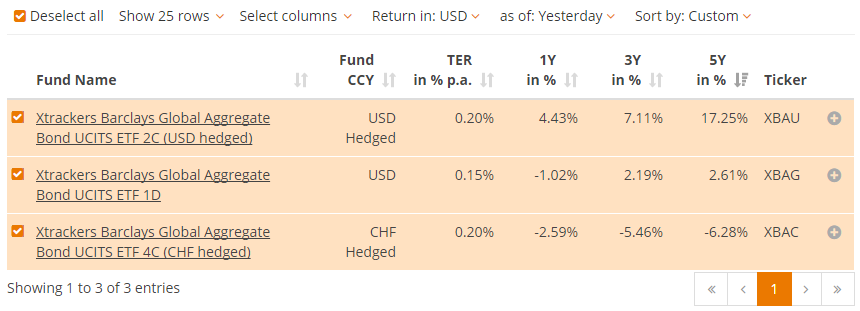

For example look at this 2-3 ETFs. They are all tracking the same underlying thing, but wo are hedged in USD and one in CHF.

Why is there such a big difference in performance? Epsecially considering that USD and CHF have almost been 1:1 in the last year? Does that mean the hedging to CHF itself caused 7% more internal fees? Could someone please enlighten me? Thank you.

Well, let’s see…

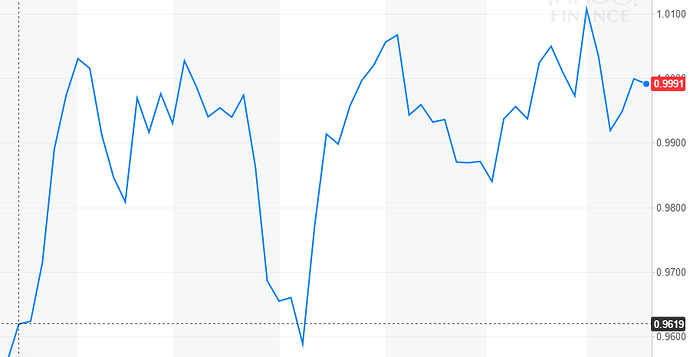

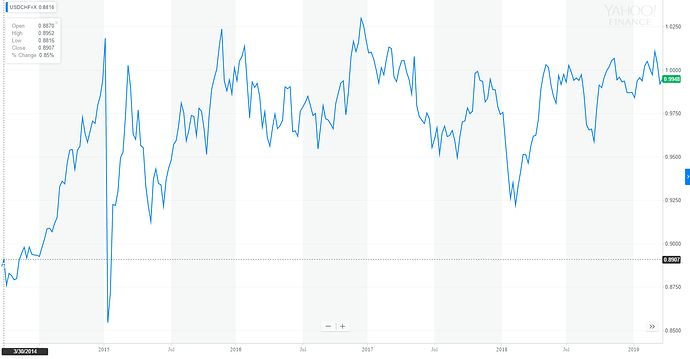

1 year: USD went from 0.96 to 1.00 CHF

5 years: USD went from 0.89 to 1.00 CHF

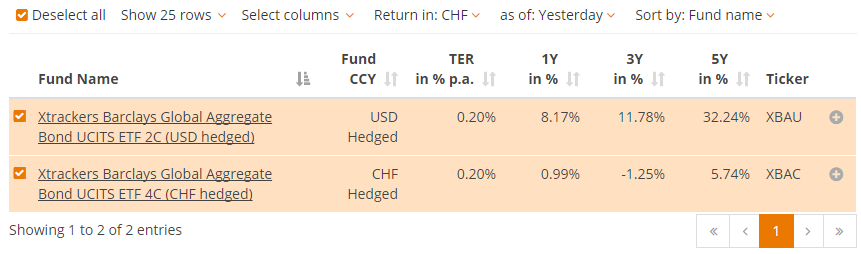

You got me, no idea why the USD one made 32% in 5 years, and CHF less than 6%. Maybe CHF hedging is just so much more expensive. Or maybe since probably half of the stuff is in USD, then they don’t need to hedge it, so it’s cheaper.

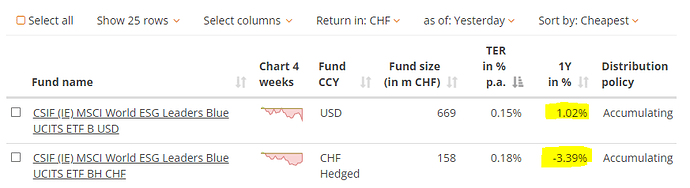

Here the unhedged one, and all returns in USD. The hedged USD one did a much better job than unhedged. I guess if you hedge and your currency gets stronger, you win. If the hedged currency gets weaker then you lose.

AFAIK, hedging cost is the delta between the interests rates of both currencies (so like 3% for CHF/USD). That’s the main reason why bonds don’t make much sense in CHF (CHF denominated or CHF hedged), for amounts where negative interests rates are not charged, holding cash will be cheaper (or you’ll have to go into risky bond territory to get a positive expected return).

And if you want to check the details, https://personal.vanguard.com/pdf/ISGHC.pdf has the formula (Figure 1a).

So, just as an exercise, here are the current forward rates of USD/CHF:

The current spot rate for USD/CHF is 1.00

The forward points = (forward rate - spot rate) * 10000

So 1Y USD/CHF forward rate = spot rate + forward points / 10000 = 1.00 - 0.0338 = 0.9662

10Y: 1.00 - 0.2418 = 0.7582

20Y: 1.00 - 0.4193 = 0.5807

LOL, so they predict we will pay only 0.58 CHF for 1 USD in 20 years.

From what I understand of how forward rate works, don’t you need to plug interest rates for CHF and USD in the formula (and compound them over the period)?

Why not? 48 years ago, you paid 4.30 CHF for 1 USD.

Hedged stock market indexes are usually constructed to use with monthly forwards and roll the forwards every month

USDCHF 1M FWD bid -29.6900 ask -29.3400

This is in basis points and for a single month, so times 12 and at mid point means approximately 3.54% p.a. cost to hedge USD for CHF currently using hedged ETFs

They are not really predicting anything this far into the future of course, this is essentially options and the bulk of the cost you’re seeing here is option’s time value

No you don’t, because here it’s already kinda done. Here you already have the forward points, which is what the market is offering. There is a BID and an ASK.

This is how I understand forward points, if I’m wrong, someone correct me:

If you will have some future returns in CHF and you want to convert them to USD at the current spot rate, the forward points tell you how much CHF you have to pay today to be able to do it.

So you pay 338 CHF today and in 12 months you will be able to exchange 10’000 CHF to 10’000 USD (because today the rate is 1.00).

But if there is BID and ASK, then these are market prices, yes? So someone is willing to give you these rates. So, naturally, they have to be predicting what the exchange rate might be in the future, in order not to lose on that trade?

Big banks can sell you forwards, yes. Unlikely they take much risk for themselves in doing this, that’s not what banks do. There’s bond market where on one hand there are currently people willing to lock up swiss franks for 30 years at 0.2% interest and on other hand people willing to lock up dollars for 30 years for 2.9% interest, probably with some constructions these two kinds of people can meet and the banks will package it up for you as a forward contract, while taking up minimum risk for themselves in the process

So can we simulate how this should actually work?

- I use 10’000 CHF to buy some USD bonds ETF hedged to CHF

- The ETF provider converts these 10’000 CHF to USD at current fx rate

- ETF buys USD bonds with these USD

- They also make a forward contract for 1 month, so that when they sell the USD bonds in 1 month, they can exchange USD back to CHF at the current fx rate.

- If they don’t sell the bonds in 1 month, they just make another forward contract.

Not bonds, currency forward contracts from some big banks. Securities from the original index + currency forwards is what you’re investing in with hedged ETFs.

The bank they bought forward from will do the rest of footwork to ensure buyers and sellers meet. At the end of the month when contract’s up they will settle the difference in cash: either they pay the bank or the bank pays them, and sign a new contract for next month.

But that’s what I wrote in point 3 & 4. They buy the original unhedged bonds from the index + they make the currency forward contract…

Good afternoon,

In this context of inflation and FED rates increase, what is your strategy for currency hedging?

Is it worth it?

Thank you!

Use currency hedging for bonds but don’t use currency hedging for equity. That’s the usual advice independent of inflation.

Buy shares of international companies that have global sales in multiple countries. That way I have a natural hedge to the currencies of those countries

Do you have a source for that?

Interest rate parity theory as I understand it on a basic level would say that if you invest in a USD denominated bond with higher interest rate than a bond with equivalent risk profile denominated in CHF, all other things being equal the FX rate will change over time so that you earn the same return as the CHF bond.

If you are able to predict macroeconomics changes better than the market then there is an arbitrage opportunity to buy futures (hedge) and make profits (carry trade). But as an individual investor you are competing against professional FX and bond traders

Yes, that would be the market expectation in the long term. However, currency exchange rates can be fairly volatile in the short term. See e.g. USD appreciating against CHF beginning of April until mid-May despite higher interest rates.

The main motivation for having a mixed stock/bond portfolio (instead of 100% stocks) is to reduce overall portfolio volatility, as measured in the local currency. As far as I know, local bonds and hedged foreign bonds fulfill that purpose better than unhedged foreign bonds.

This Vanguard resarch paper may be interesting: Going global with bonds. I might have read this a while ago but have only skimmed it right now.

Reviving the topic to see if anyone was an updated strategy for the USD decline vs the Chuff!

If you think you can get better return than what the market is already pricing, you definitely should make an FX bet ![]()