Now that’s what I call an Angel for Distressed Businesses ![]()

![]() Maybe you can make tax deductions for charity?

Maybe you can make tax deductions for charity?

Right!

I’ll double check.

I’ll post in the tax deductions thread!

Call me greedy but I got myself today a cup of coffee and 5k of CS shares at 2.69/share ![]() My stockpicks “fun” portfolio still had some margin up to the 5% I allow myself to play with.

My stockpicks “fun” portfolio still had some margin up to the 5% I allow myself to play with.

Another excuse is that I need some more dividend generating stock to cover the extra 5 CHF swissquote custody fees starting from next year ![]()

does CS give dividends this year?

It did for 2022 but it looks like it did not in 2021 based on their website: Dividend & Swiss tax values – Credit Suisse

They’ve paid out dividends every year “for ever”, even during the Financial Crisis of 2008/9.

For FY 2020 paid out CHF 0.10 in spring 2021, for FY 2021 paid out CHF 0.10 in spring 2022.

At the same time they borrow funds at 10% interest from Saudi, Qatar etc. or raise capital by creating new stock (sold at a discount to big investors).

Ponzi-style…

They’re hoping for Santa Claus to bring them some cash, because they’ve been good guys this year ![]()

Wow, crazy stuff indeed!

Guys, I will give my 2c regarding the CS stock.

In Portugal we have one bank listed (BCP) which, when you zoom out, has lost 99.94% of its value.

It can always go lower. I had friends that only traded that stock because “it’s the largest bank in Portugal”, “it’s going to be bought out”, “It will start paying dividends again”.

What happened in reality was, losing a big % of your capital, losing nights of sleep and hours of your life researching news about this shitty bank.

So, you can try to rationalize it as you want (gambling money, whatever), but in the end, investing in VT or a S&P500 ETF will outperform CS shares and you will have less headaches.

Another thing, the share price is irrelevant.

If I cut a pie in 2 and give you 1 slide or I cut a pie in 4 and give you 2 slides, you have the same amount of pie in the end. The thing with CS is that it’s a shit pie no matter how many shares you buy

Nice chart comparison, I like to zoom out effect which is pretty scary ![]() I just don’t think a worldwide top 100 bank in terms of size like CS compares with probably a national bank like BCP.

I just don’t think a worldwide top 100 bank in terms of size like CS compares with probably a national bank like BCP.

Because I am not really educated about this kind of product. Have to take a look. Thanks for the suggestion ![]() .

.

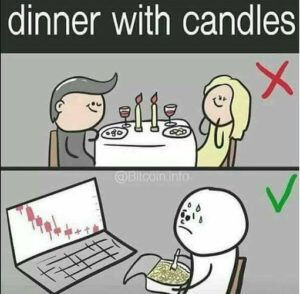

By the way, I haven’t entered CS yet. I am waiting to see a green candle on the daily charts. No one care, but hey, so is life ![]() !

!

In order for CS to go bust, it would first have to lose its too big to fail status. The government could do that, but hasn’t so far, and I imagine it’s a bit of a process.

P.s. I would consider a purchase of CS stock as a bit of a risk/gamble, since its intrinsic value is difficult to determine. But the choice here is between a CS stock and a coffee. I’d take a lottery ticket over a coffee.

There’s a potential fallacy is in thinking “It’s price has now approached almost zero. But it’s too big to fail, so it’ll survive. And eventually it’ll make good money, its debt will decrease and therefore the stock will rise (from almost zero hopefully) to old heights.”

Is it too big to fail? Probably, at least from a Swiss perspective. Would there be political will to prevent it from failing uncontrolledly and save many or most of their operations? Probably.

But we don’t know how that “political will” be carried out. Especially when the government gets involved and can make legal what needs to be made (even if normally and today it isn’t).

From financial recapitalisation to a restructuring of their entire business or bankruptcy, there’s many conceivable ways how it could be “saved” - and our stock still become nearly worthless. Maybe an entirely new stock gets issued or something.

The price of the stock is the least concern, even if only pennies or cents and not exchange-worthy. They can always reverse split to big up the price and be back in business.

Zooming out is a very fitting term.

Everybody can look up the current price of a CS share, and the long-term trends over the years have been posted further up.

However, no-one has spoken of the current price and price trend of CoC (the “Cup of Coffee”). So here goes:

Basically CoC is at an ATH, and up 2.1% YTD. In the last 10 years CoC has risen 6.8%. We all know the trend is your friend, however I think I’ll wait for a pullback before opening a position in CoC. ![]()

"Café crème so teuer wie nie

Der Preis für einen Café crème stieg bereits 2022 so stark an wie nie in den letzten zehn Jahren. Konkret lag der Preis in der Deutschschweiz bei rekordhohen 4,39 Franken. Gegenüber 2021 sind das 9 Rappen bzw. 2,1 Prozent mehr. Über zehn Jahre gesehen stieg der Preis gar um 6,8 Prozent bzw. 28 Rappen. Zum Vergleich: Im Jahr 2012 hatte ein Café crème noch 4,11 Franken gekostet.

Am teuersten war der Café crème 2022 einmal mehr in der Stadt Zürich. Bei 4,68 Franken lag hier der Preis - das sind 6,6 Prozent mehr als im Deutschschweizer Durchschnitt. Nach Kantonen ist der Preis im Kanton Zug mit 4,62 Franken am höchsten. Es folgen die Kantone Zürich (4,58 Fr.), Luzern (4,45 Fr.), Aargau (4,38 Fr.) und St. Gallen (4,36 Fr.)."

Nice perspective rolandinho. Now if only that cup of coffee could be wrapped up in a coffee commodity future or stock…

2.20-250chf in Ticino.

Update accordingly ![]()

… for the others, be aware that a CS share might cost like a coffee in Lugano and not in Zurich…

I am a man of my word, so here I am.

I’ve always wanted UBS shares, you know!

Never thought getting them would be such a nerve-wracking adventure, though.

It was a gambling bet from the beginning, sometimes you win, sometimes you lose. ![]()

And truth be told, I feel really sorry for the employees. They don’t deserve this. Me, I bet a couple hundred francs and I lost. But for them, this is bitter.

Guess that was it for the coffee then.

But hey, at that price, we can still get the plastic cup. ![]()