I believe that the US economy is not linked to the US stock market. People might have huge issues, but the Stock market can still go up. I believe that’s some sad reality the americans have to accept or fight back.

On the other hand, less regulatory burden and lower costs of employment should make it easier to generate new jobs during recovery in US than in rigid Europe. Just like in 2009-2020.

What less regulatory burden are you talking about?!

Actually what they are proposing - 15$ min wage, impossibility to lay off employees, no share buy-backs, no divi and no bonuses for the next 3 years, 1-2 reserved seats on the board for employees reps etc. etc. - in my book that’s more regulation than before… Imo they should just let all the weak/poorly managed companies crash and then rebuild from scratch with new owners and (hopefully) wiser management…

People that don’t earn money don’t spend money.

People that are incentivized to go to work sick, will make the spread harder to contain.

There is so much writing on the wall that the US will be hit harder than most of Europe.

One measure that probably many have been taking though is buying more guns. :\

FT gives 30 days free access to their CORONAVIRUS BUSINESS UPDATE

I think today I am going to rebalance towards asien markets. I believe it will take a bit longer for Europe and US to recover. Has someone any suggestions for ETFs? I am interested in China and Southkorea, specifically in the healthcare industry.

You may be a tiny bit late ![]()

Nikkei225 +7%

Kospi +9%

I hope this is finally it.

I don’t know any sector specific ETFs for these countires, but for China you have KURE (listed in the US). It’s not an outstanding performer to be honest, the Chinese e-commerce and internet etf KWEB is doing better. CQQQ (Chinese tech) and EMQQ (em-wide tech) are also good.

Ah no, I think it’s not too late. I am also thinking currently the russians and OPEC try to push the gas fracking business in the US out of business - it is some kind of powerplay they are doing right now, who knows maybe it just looks like they are having a dispute when they actually agreed on dumping the oil price. But I believe Asia will come out stronger from this market crash than the western countries, it seems their society has just the better culture to cope with this kind of virus.

“Luckily” I am already invested in KWEB thanks to you!

I like EMQQ thank you for sharing!

ehm.

People, especially managers, tend to maximise their own income. They might crash a company just to make more money. It’s not like they will lose money…

I was doing my internship in a company where people said this about the former CEO, the company was just sold/bought by another company.

Tuesday, day of the ups:

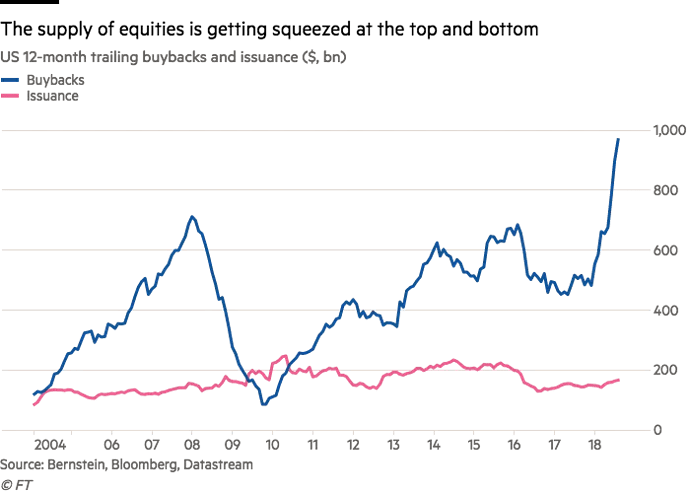

I heard about the following practice. A company keeps having big income and they don’t know what to do with it. They have no solid ideas for development/expansion. Instead of raising the dividend they decide to buyback their own stock, since “there is nothing better that we could do with our capital than to invest in ourselves”. After some years the stock is pumped up nicely. Lower number of stock means the earnings per share are higher and some other metrics also look better. But the managers know when the income starts failing and they will sell their stock when they see it. This way they can pocket much more than they would through dividend.

This article also describes the problem of capital fleeing the public markets:

The basic agreement around public markets for most of the 20th century was this: owners had to open the books, quarter after quarter, and in return they got access to the private savings of ordinary citizens.

What we’re seeing now is that corporations have access to enough private savings of wealthy citizens that they’re walking away from the deal.

MCHI is a bit broader (and cheaper TER) for China than KWEB/CQQQ - depends what and how much you want to overweight.

Here a quick comparison in tab 3: ETF comparisons - Google Sheets

P.S. If you don’t want approximately “double” the exposure to Alibaba, Tencent etc. - makes sense to just stick with VWO (last column) and buy more of it. ![]()

I just got fired yesterday, I was working in a “big law” firm (which for lawyers is equivalent to working in investment banking in finance, high expectations, pressure and workload). In the last days you could litterally feel the management getting nervous/upset as the economy is slowing down.

Of course we have the chance to have unemployment money in Switzerland, but getting fired is never really nice in a curriculum vitae nor a good experience. First time that happens to me.

On a different note, If I may brag a little, I sold all my third pillar investments in funds end of January 2020, after good returns in 2019, I said myself something will go wrong, that’s too good to be true.

I wanted to start investing my savings and reinvest my third pillar, but I’m at doubt now, hard to know when the timing will be good.

The blue line shows stupidity from managers in general. They should buy back when their stock is cheap (i.e they spend less money than value received) and do something else when it is expensive. But no, they squander their cash. The blue line should be totally inverted…

for those interested, i highly advise the book The outsiders from William Thorndike on the topic…

Comparing MCHI to CQQQ is basically comparing SPY to QQQ :-). Works the same also as far as returns and volatility goes.

Sorry about that and also sorry that this forum gives us only the “Like” button and nothing better.

Yes, as I wrote “depends what and how much you want to overweight”. ![]()

@Mr_Beanz Very sorry to hear that, it must be a tough experience. Hope you and your close ones bode well through all this. Cheers

Thanks for you kind messages I shall survive, I am single in my thirties so I should be able to bounce back quickly I hope.

I believe this status was probably one of the relevant factors in their decision, as most of the colleagues of my age are young fathers. Another colleague in my situation is probably also going to be laid off in the coming days. And to be fair, my layoff wasn’t a complete surprise either. But the timing is rather bad and I think the current situation worsened the situation.