Thanks for explanation. In that case, screw them. I’m closing this account.

In my case it’s even worse because, I’d have to basically pay 0.20% (min. 20 CHF) per transaction until I’d get to 75k. So 4*20 CHF would be 80CHF/year for just keeping a backup broker account in Switzerland doesn’t make much sense.

For your info, I was told that to close account one needs to close his positions, transfer money and send them a letter by mail asking for closing account.

How to transfer out the money from Corner Trader?

More like 140 CHF, to 0.20% CT fee, add 0.15% stamp duty.

As far as I remember, you have to send them your IBAN and ask them to send it.

Hi, I got late to this and I’m paying way too much to CT!

“Request security transfer form from CT, fill it, close accouot”

Does this mean I can get all my shares on CT and transfer them to another broker?

Correct. I just transferred all my shares ov VWRL from CT to Swissquote. I got a form by Swissquote that I had to fill out and send to CT by letter. (quite) a while later I now have the shares on Swissquote.

Can you tell why you switched from CT to SQ?

I’m a bit confused. CT is chewing my gains with its inactivity fees (and I’m not eager to do small trades with huge commission fees).

SwissQuote:

- Zero account maintenance fees

- Low quarterly custody fees – CHF 50 maximum <<<— What does this exactly mean?

Interactive Brokers:

- Low commission fees

- Not swiss, not a bank

- $20 per month if you have less than $2,000 account balance and if you don’t generate minimum $20 in commissions. $10 for accounts having at least $2,000 account balance, while no inactivity fee for US clients choosing IBKR Lite plan.

IB Lite

- No inactivity / custody fees

- Not clear what’s the drawback for me here

https://www.interactivebrokers.com/en/index.php?f=45500

DeGiro

- Not Swiss / Not a bank

- Low fees

- No custody / inactivity fees

I’m missing out something? I might trade more frequently if I had low fees, however having a swiss bank as a broker is sure a safer feeling. I also want to avoid custody / inactivity fees because let’s face it, I’m not rich enough

It’s well known that SQ charges 50 CHF per quarter of “custody” or “inactivity” fee, but if you trade, the costs are discounted from this fee. And in Corner Trader it’s 35 CHF per quarter, but I think there you just need one trade to make this fee disappear.

I don’t think that’s right. It’s a standard custody fee, is min 15 max 50 a quarter (a certain % of value of depot). Nothing to do with inactivity & not a credit to your trading fees.

" Die Depotführungsgebühren sind auf 50 CHF pro Quartal gedeckelt. Man blättert insgesamt 0.025% pro Quartal hin, das Minimum an Gebühren sind 15 CHF im Quartal. Somit kommt man auf Depotführungsgebühren von 60 bis 200 CHF im Jahr."

→ This is max $10/month (down to 0), as any transaction fees are essentially deductions from this amount first.

→ It’s that it’s not available for CH residents (yet).

https://www.interactivebrokers.com/lib/cstools/faq/#/content/faq%3A%2F%2FpageId%3D76129181

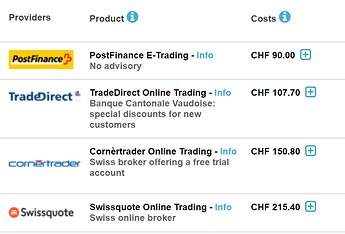

You’re right, I remembered it wrong, sorry. Moneyland has a nice comparison and summary of each broker fees.

Custody fees for private clients and asset managers: 0.025% (min. CHF 15, max. CHF 50) quarterly (+ VAT).

So if you have a portfolio worth over 200’000 CHF, then you pay 50 CHF per quarter.

Is there an account on IB for people with less than 2000 usd? I hope no one here is thinking to open and manage an account with less than 2k for more than a week/month…

Out of curiosity I checked the cheapest brokers on Moneyland with the following scenarios (only trading Swiss ETFs):

| Scenario | In Custody | Value per Trade | Trades per Year |

|---|---|---|---|

| Light | 100’000 | 5’000 | 6 |

| Medium | 200’000 | 10’000 | 6 |

| Heavy | 500’000 | 20’000 | 6 |

| Retired | 1’000’000 | 5’000 | 6 |

| Inactive | 200’000 | 0 | 0 |

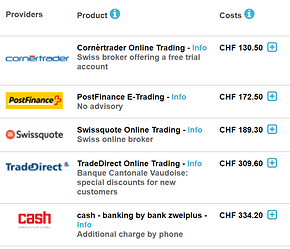

Light:

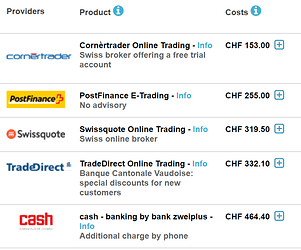

Medium:

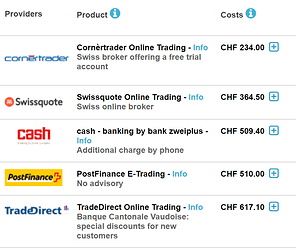

Heavy:

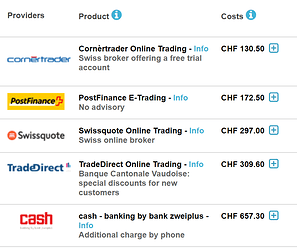

Retired:

Inactive:

I’m tempted to go DeGiro or IB to avoid all those fees but I’m not sure about the risks of not having a swiss bank behind my money. Any opinions on that?

You won’t be holding CHF right? Why does it matter if it’s a swiss bank (besides paying more for “feeling” better)?

I really wasn’t happy with CT. It was the brokerage account of my girlfriend, not mine, which is with IB. For her I just wanted something simple with a good UI and good support. Might just be marketing but I feel SQ is a bit more refined or user-friendly if you will.

The initial reason to switch was the inactivity fee, but it was just the one thing to make me change. I wasnt happy with CT before.

So, I’m opening a IB account, and I have a couple of questions about the security transfer, as I get some of you went through that already (for most of my positions it still costs less than selling / rebuying).

International Assets (I guess that’s the only way)

- Limitations

- We keep all positions in the firm name (street name) ??

- We will not provide invididual registration of holdings. ??

- Advisors and Fully Disclosed Brokers can request inbound international transfers for a client account but the client must create a position transfer. ??

Could someone explain these terms?

1 and 2 : They will not register your name in the shareholders’ register of the compagny. That means you won’t get invited to the shareholders’ meeting and you can’t vote. (It is already the case at CT)

3 : You must first fill a transfer form in IB. Then give it to your broker. And the requested international transfer of assets will happen.