The question was asked a lot in the context of investing, mostly converting CHF to USD in order to buy US ETF or stocks. But here it’is a bit different and not covered in previous posts.

I would get more than 3000 USD per month in shares from my employer, locked on a special brokage account in US where I can only sell spot past a certain duration (unlocked each month) and transfer in USD. I have to receive these USD on an account under my name. And in the end I want it converted to CHF to a Swiss account under my name as well.

I tested with a smaller amount, I could get the USD on my Revolut free account (after it got blocked a week for additional verification…). Now I can convert in Revolut and send the CHF too my Swiss IBAN, but then above 1250frs per month I have 1% fee on top of Revolut rate (0.15% markup as I read), so fees would cost slightly more than Revolut Premium subscription that have no fee for any amount but still the markup. But would they bother that I don’t spend these CHF on my Revolut card and just transfert them further ? Is there a risk they block my account or it’s normal usage ?

I could as well transfer to my Interactive Broker (IB) account and exchange then at a slightly better rate than Revolut for a fixed 3 USD fee (if I’m right). But then I don’t want to invest much more now, or maybe a small fraction of this amount, like 5% top, or even zero some month. So most of the converted CHF will be send back to my Swiss account.

Again, is it allowed by IB or will they block my account by doing so ?

Other options : use Kraken to convert the USD, there is a fixed fee of 3 USD to receive USD. I could even convert to USDT from Revolut with no fee and send to my exchange wallet (for a fee this time) and then buy CHF with it and transfer to my Swiss account (for 1 CHF fee). Real USD transfer + convert to CHF is the second cheaper after IB, assuming it’s allowed.

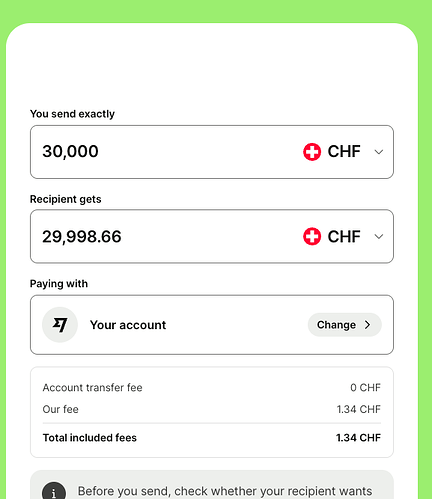

I checked Wise (with Neon or directly) but fees are much higher.

I checked ibani too. It says 0.4% fee when I check now but the total CHF output given I estimate a spread on the rate of about 0.05-0.1%, so it’s not really good either but still slightly better than Revolut Premium for these amounts.

Also is there any of these scenario that would put me under the “professional trader" flag from tax point of view ?