Are there any people here running their own companies, or working for small companies, or freelancers?

I’m looking to buy a car and I would like to know what options there are to save on taxes.

The car would be paid directly from my turnover, which means these are the potential savings:

- social contributions

- income tax

- VAT?

However, for a company car to be used privately, the user of the car has to declare 0.9% of the car sticker price for every month they use the car as income in their tax declaration (“für private Nutzung gilt 0.9 Prozent des Fahrzeugkaufpreises”).

This makes the entire calculation a headache.

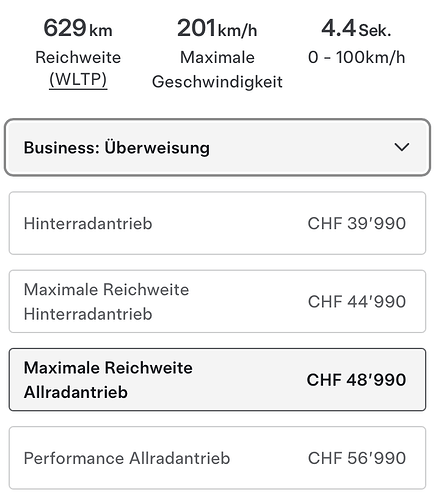

Moreover, there are at least 3 options of buying the car:

- Transfer. Seems like most straightforward. But I wonder, what if I leave the company?

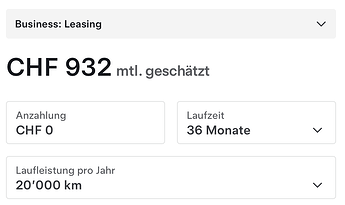

- Leasing. Can you reduce the Anzahlung to 0 CHF? What is the optimal Laufzeit? I heard that if at the end of the leasing duration you decide to buy the car out, the tax office may disagree with the residual value calculated by the leasing company and tax you with a higher amount?

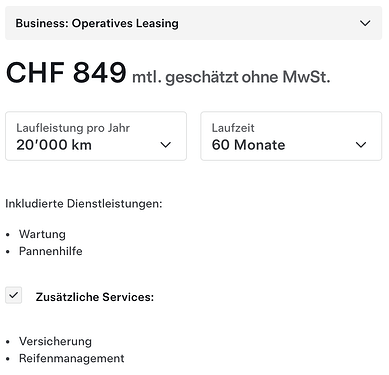

- Operative Leasing. I suppose it’s best to take it with insurance? Seems like the cheapest option, but you don’t get to keep the car.

I would like to hear from someone who has experience in this. What is your best practice and how much % can you save when buying the car as a business expense?