Dear all,

Looking into some other finance blogs, I stumbled over this article which catched my attention (in German):

https://www.finanzwesir.com/specials/alpha-strategie-alpha-fonds

And I must have to say I think he has a point.

The article in short :

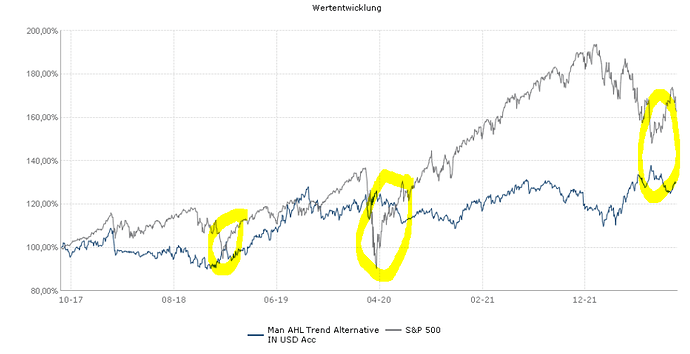

You can increase the performance of your portfolio by reducing the volatlity drag of classic equity ETFs by using trendfollowing funds, which are uncorrelated to the passive market (called Crisis-Alpha in the article). The more volatility, the better the trendfollower funds.

Practical problem : this trendfollower funds are using futures for practical implementation of this strategy, are rather expensive and ask for rather high initial deposits. Furthermore, it seems difficult to weed out the good from the bad. Finally, these funds do not like private investors, since they generate a lot of regulatory costs, at least in the EU, maybe less in Switzerland.

Did anyone of you implemented this type of strategy ? Anyone thinking this is just BS ?

In all honesty, I think the has a point, but it is rather difficult to implement due to availability of the funds (as well as the quality). Furthermore it is rather difficult psychologically, since in an upward trend you are always lagging behind, potentially for years. You only see the effect when there is a crash, but then it is jackpot.

For more detail how the trend followers are working, and that they are working well for a long time :

https://www.finanzwesir.com/blog/trendfolgestrategie-was-ist-das

And how to find good funds :

https://www.finanzwesir.com/blog/alpha-fonds-finden-auswahl-privatanleger

(all in German, could not find any equivalent in English which is readable in a short amount of time)

Disclamier : the author started its own wealth management using this strategy, but at no time is he telling to advertise his funds, on the contrary, he gives a lead how to choose the right funds on your own.