Hello everyone,

I’m new here and have been exploring mustachian posts. I stumbled upon an article discussing a problem similar to ours.

Here’s our situation:

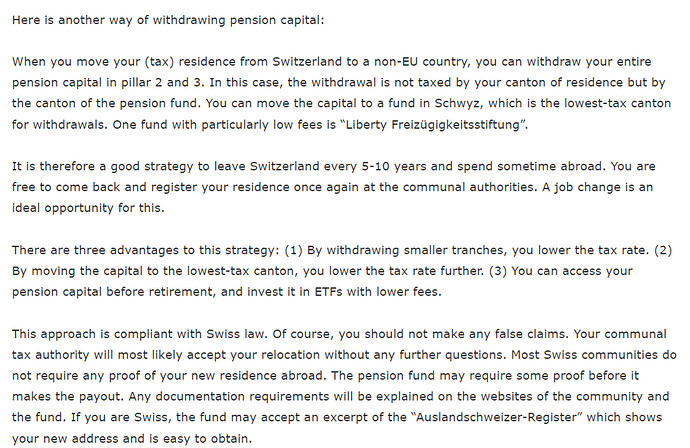

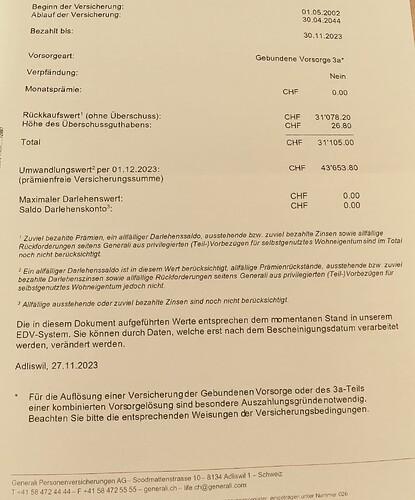

My wife, who worked for over 20 years, was advised by a family member to open a 3a life insurance account with Generali, which she did. In 2018, she stopped working but started a 3b account, and the company labeled it as a “combination of 3A & 3B life insurance” account. Currently, she pays around 320 CHF monthly into this 3b account.

We’re planning to buy a house this summer using a mortgage and would like to use our 3a accounts for this (I’m about to open one myself). Recently, my wife contacted Generali to inquire about her account. They mentioned she has 39,600 CHF, which can be transferred to another 3a account or used for a mortgage. If withdrawn in 2044, she might receive around 70,000 CHF (or possibly 117,000 CHF, but she wasn’t sure). We’re unclear if this amount is from the 3a account alone or both accounts (3a&3b). We plan to meet with them to get all the details.

We feel that Generali is not being transparent, as my wife has likely contributed more than 70k CHF. After reading a blog post, we realized we might have been uninformed about such practices.

My wife is frustrated and wants to terminate the account as soon as possible, but I am looking for the best solution.

Here’s where it gets interesting:

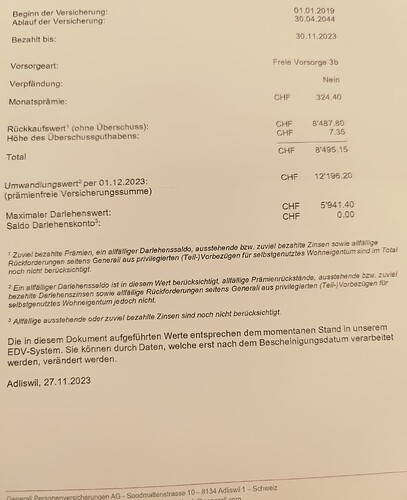

As a dual citizen of Switzerland and Turkey, I can help my wife in obtaining Turkish citizenship through our marriage (we haven’t applied yet). If she deregisters in Switzerland, moves to Turkey, and registers with my family there, can she withdraw all the money from her 3a & 3b accounts without a high fee of Generali? We understand there might be taxes by the state, but we’d rather pay those than let the company profit unnecessarily.

This idea came to me from a comment I read about deregistering in Switzerland to access 3a funds, then returning and reregistering to potentially pay less tax.

I’m open to any suggestions you might have.

PS: I also wanted to mention that we’re aware of the option to invest in ETFs through her 3a at VIAC or finpension. However, we’re considering this as our last resort/plan.

Thank you in advance.