So you are saying that everyone expected S&P 500 to fall down like this in march?

In fact, it reliably happens every five years.

Here’s the proof for n=1: the last time this happened – even more severly! – is 2020.

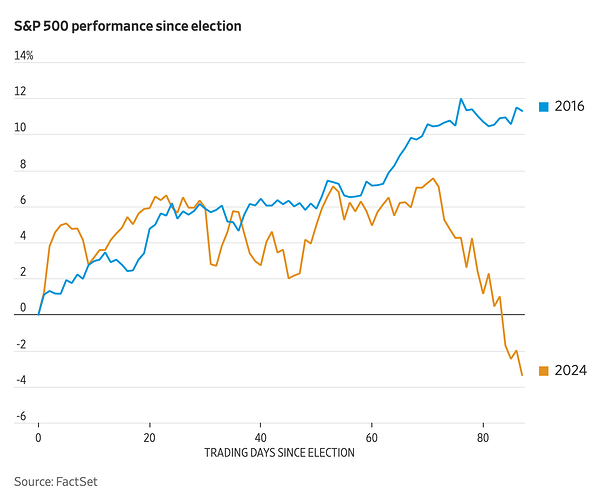

I'll see myself out.Personally not in March, but some time between November 2024 and June 2025 ![]()

And I’m hopin’ it ain’t stoppin’ ![]()

You are hoping market keep crashing?

Of course, I need it and have cash to plug ![]()

If I believe some (stupid?) people on internet, it will crash (again?) around the 21 of april

What’s on the 21st of April?

Well there is a theory about 90 days after the inauguration something should happen becaus that guy did a thing. So if it happens there will be again a PR nightmare. I’ll let you google it because it is honestly a bit of a stretch to believe it.

Ah, similar to other truisms like “sell and May and go away, but remember to come back in November”?.

Finally at -10% from ATH on VTI.

Not yet in VWRL though, but in the right direction ![]()

Edit: hey let’s be specific, I make it -9.8% for VTI right this minute ![]()

My policy is to invest quarterly. Done for march.

Let’s wait and See.

I can never tell if the Braveheart HOLD meme gifs are meant as “hold, don’t sell” or “hold, it’s not yet time to buy the dip” in these kinds of situations. It’s kind of neat how it’ll appear to confirm your bias no matter what you think about the future movements of the market or about the utility of market timing.

Exactly, I believe in this forum it means “hold, it’s not yet time to buy the dip”, or certainly I interpret it this way.

Frens, this is only determined in hindsight.

Hold. Or not.

It’s easy, the answer is: yes.

Today’s S&P500 movement makes me question the idea that “missing the 10 best days in 50 years beings your return down by 99.99%” (not quite, you know which one I mean). How did they estimate that? We are still under ATH so money in before the drop of the last two weeks are still underwater so what gives?

I think they just remove the 10 best days and recalculate.