I consider 3 factors, there can be more:

1) Be financially safe

Have safety nets outside of stocks. Diversification of income, strong network, versatile skillset, low expenses and/or ability to reduce them in time of need, emergency fund, … all count.

2) Be psychologically ready

Know it can happen, practice equanimity: enjoy the gains but don’t let that drive your strategy, life or expectations. Accept the losses as a fact of investing that is necessary to also get the gains.

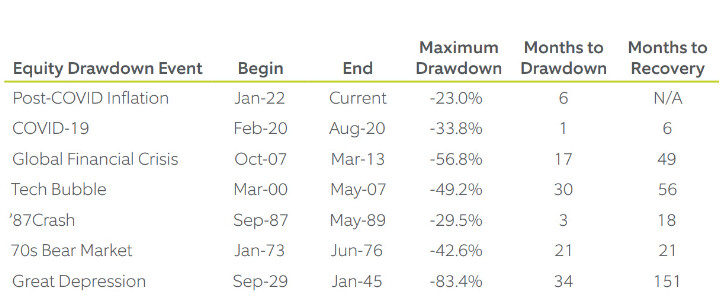

Study past crises and temper your expectations from them (time to hit the bottom, deepness of the drawdown, time for recovery, outside situations (job market, fear that banks might go belly up, armed conflicts/sentiment of the end of the world happening, energy crisis, etc.)).

Healthy habits, interests other than finance that will have your mind elsewhere than focused on the daily losses, good and reliable friends, physical activity, meditation, … all can help.

3) Have an allocation/strategy you can live with and theory-test it to harsher market conditions.

For my own personal assessments, I like to use 60% drawdown, 1-2 years to reach bottom and 2-3 years for recovery, while keeping in mind that 80% drawdowns would be exceptional but are still possible, though that’s what works for me, with a tendency to want to visualize more catastrophic scenarios and apply a positive view on them - another approach might suit other people better.

That allocation can be 100% stocks, it can be levered, in which case, one has to ask oneself what they will do if the drawdown is steeper than expected and try to assess what psychological and financial effects it would have on them.

It can contain bonds, gold, derivatives and other assets. It can include a set of rules. Having an individual strategy that others don’t apply shouldn’t frighten us but it should be designed for us, to allow for us to achieve our objectives and stand firm when the market conditions are less than optimal, including when it lasts for a significant amount of time.

I think it’s really a personal thing. Some people wouldn’t feel affected by a 30% drop at all, others would enjoy the dampening and having an asset that behaves better and the simple act of rebalancing can give a sense of agency at a time when we could otherwise feel helpless, as Tony1337 points out. I would personally want to steel myself against bigger drops than 30%.

Some people can fare well with a 100% stocks allocation, some people can live well with leverage and have the means to handle it even when their assets loose value. That’s not everybody. If someone thinks they can handle 100% stocks after having thoroughly assessed the situation, it’s great and all the more power to them but I would not just assume that 100% stocks will fare well enough for me if I haven’t given some serious thoughts pondering it as well as the alternatives.