What would you do with all the cash? They’re printing money (70% margin?), how much capital can they deploy? (also does it cover enough to balance the dilution from RSUs)

Difficult to answer, but maybe some acquisitions. Could also help them to diversify their client base.

Pay off debt, if any, make acqusitions to become even more monopolistic (they did a good job acquiring Mellanox), invest more, lock up suppliers, HBM and other upstream components, lockup TSMC manufacturing capacity, distribute a special dividend, and most importantly reduce profits by producing a low cost GPU with tons of VRAM so consumers can buy a GPU with a decent amount of VRAM without the need to sell a kidney! OK. that last one might be just for me!

Piggybacking off this, NVDA’s ESPP (1-15% of base salary) uses a 2 year lookback when setting price. I dont know if their details are disclosed in fillings, but wouldn’t suprise me to see rather large share allocations for ESPP program if your purchase price was 12$.

Although ESPP limited to 25k the ammount is likely not that large compared to normal RSU awards.

I was reading an article about Meta and Google employees (already not known for being poor) being very jealous of their increasingly rich Nvidia counterparts…

Talk about entitlement…

I think it’s common tendency to link your salary to your talent and your net worth to your abilities. And when someone else trumps you, it breeds jealousy.

However the reality is that luck, right place right time, supply demand balance of certain skills, and your environment plays much more importance in your net worth rather than your own abilities.

People should be humble, and have peace with what they have. Otherwise they would always find someone else richer and „less deserving“ in their eyes.

Slow but steady kind of corresponds to the attitude of value investing ![]()

https://www.visualcapitalist.com/berkshire-hathaway-1-trillion-club-how-long/

Seems to me the market is actually a bit more chill than I thought. Sort of a “soft nVidia landing” Yahooist Teil der Yahoo Markenfamilie

Then again I’m an optimist, as Churchill said it’s no good being anything else.

Also a very happy BRK shareholder, bought my first (and only, to date) 4 shares of BRK.B on Jan 8th, 29% up YTD, cost basis of $365. A position I intend to build on ‘till the sun don’t shine, and leave to my kids.

Let’s see what the US rate cuts will bring. Theory says small cap should boom, let’s see, not overweighing small cap but hopefully the overall sentiment will rise all boats. Market did fine with non-zero rates anyway, no need to have zero interest rates anywhere, breeds recklessness imnho.

I’ve always wanted to buy but always found it to be a little too expensive. I guess, I will never be able to buy it ‘at good value’ because Buffett will buy back at that point.

It was the same with gold. However, a few opportunities did come up and I bought on some dips and held my nose and bought at values I didn’t think were good value.

Now I also bought into emerging markets, which until now I had almost no exposure.

Yeah, same as @PhilMongoose – can’t really bring myself to buying it since the market almost always puts a premium on it. Oh, and no dividend.

Plan is to buy the dip when Buffett joins Munger.

I recently started screening through the MSCI Emerging Markets equity index and – FASTgraphs wise – saw interesting stuff … but then again just the other day at work I chatted with a portfolio manager trading EM and heard stories about Taiwanese (or was it South Korean?) companies sometimes sitting for weeks and months on dividends past their due payout date because of currency control regulating capital flows … and felt discouraged again.

Maybe a non issue if you’re not income oriented.

That‘s like the biggest plus of it ![]() I don‘t like taxes

I don‘t like taxes

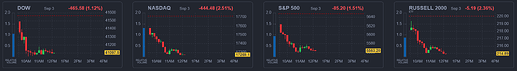

Nice start into September, historically allegedly a volatile month.

Anyone buying dips today? I mean, sorry, not dips, but in 2024 terminology blood-in-the-street market crash opportunities available today?

I’ll go first:

- Unum Group (UNM)

- SFL Corp (SFL)

- Patria Investments (PAX)

Only dipping my toes, hoping for less shallow … blood puddles than today further down the month.

It doesn’t seem to be the year of the end-of-the-month DCA strategists like myself ![]()

The market cold-heartedly decided to arbitrage away your market timing strategy.

(Please let us know when you’re ready to deploy your new timing strategy and roughly when you plan to start … ![]() )

)

BRK the lighthouse ![]()

Almost an uncorrelated asset ![]()

To add a little local color here’s the headline from Switzerland’s largest newspaper blick.ch:

Everyone panic now.

(But orderly)

The panic was visible in Semi conductors. NVDA down 10% in a day. Being a multi trillion dollar company , 10% means something

Tough for small players to rescue unless big funds buy the dip.

I have to say US market might be more vulnerable to these sell offs because it’s priced for perfection. If AI exponential growth story breaks then market can drop because of re-valuation and not necessarily earnings growth.

In the meantime, BTC is in bear market (if 20% rule applies to store of value asset classes).

Oh noes, SMI is +9% YTD now, we all gonna die