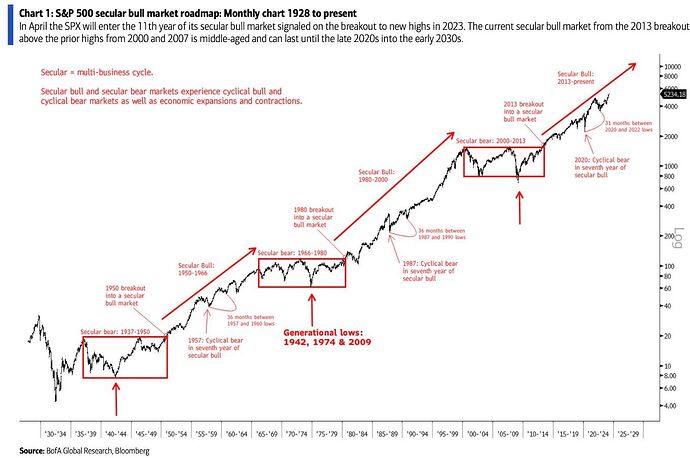

Interesting graph ![]()

![]()

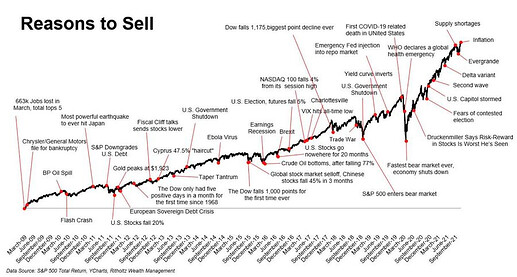

Shorter time frame, but I like this graph (apologies if it has been posted before and that it doesn’t include 2024-2027 yet*):

* Even though my prediction is that 2024-2027 will continue to look like the past.

Now someone to retitle it to “Reasons to buy” and they’d look like geniuses. Bogle’s message: ignore the noise never sounded better.

There’s some NASTY sideways periods in there (1966-1980, 14 years, 2000-2013, 13 years) - that’s my biggest fear frankly, not a flash crash but a soul-destroying grinding 5+ year period of trying to get above water again. That’s where shifting allocations could be the buffer, though it’d still need brass balls.

What’d be interesting to see side by side though is how a global portfolio did in the same timeframe, probably better is my guess ![]()

My personal antidote to this is focusing on steady and reliable cash flows paid out instead of total return.

If the price of my portfolio goes sideways, but my paid out returns are steady or even growing, I couldn’t care less about price. If anything, I can buy more income at cheaper prices.

This is of course influenced by my need to consume part of the cash flow produced by by portfolio now.

If you only care about total return over multiple decades (and it seems, historically speaking, you might need those multiple decades to get across those price wise sideways multiple decades markets), you might be better off from a total return perspective.

If indeed you managed to hold on to your sideways - and occasionally severly dipping - portfolio.

YMMV, of course.

Very true, I also liked what you said here, just didn’t want to muddle the other tread with a reply.

I am personally fond of the idea of dividends as a means to either fund some costs, or direct to a different investment as you say. It’s just that they need a lot upfront before they can get going, plus tax inefficiency. Currently they cover my quarterly trading costs, and that’s good enough for me, but I plan to continue building on VWRL (which is not a high yield ETF as you know) to eventually make enough through them to fund more stuff.

That‘s why I have some allocation to managed futures.

You refer to KMLM? Does it move the needle for covering living costs etc or is it a defensive play? I like how it’s almost inverse to the S&P500.

Exactly. It tends to do well in bear markets and still decent or flat in bull markets.

Backtests are eye-wateringly good with it (of course should not put much importance here). And it‘s tax free (so far, see managed futures topic) in Switzerland.

time-series momentum trend following also has lots of good academic backing.

Anyone looking at china etfs like KWEB (china internet) and KBA (chine A shares 50) given they seems to 60-80% below their highs from mid 2021. Really taking a punt. Max 5-10% of portfolio.

Before somebody mentions, here are the 2 factors:

- meddling from china govt: that has happened already (ongoing) so incremental poking not that big of a worry

- China attacks Taiwan (or even China US conflict): this little gamble of above ETFs would be the least of my worries.

You never know with China how much share dilution they will do and other stuff.

I‘m uneasy enough with the part in my market cap weighted allocation.

At 5-10%, they will. Though at 5-10% portfolio allocation, I’d question how much difference they‘ll make to your overall portfolio (and its performance), even if they do overperform?

That said, a crash and valuation adjustment is something else than securities being sanctioned.

KBA and KWEB and maybe china etfs in general seem to swing wildly over 3-4 year periods. Either it’s the next big thing or total disaster - going by the western news media over last 7-8 years. Never in between.

So the ~10% can give outsized returns (my assumption looking at past swings) and given the low levels today.

As for the situation of securities being sanctioned I think we’ll be in a very different world by that time and the darlings of US megacaps sitting atop VT holdings (and frankly any portfolio) suffering badly.

Any comparison to Russian equity sanction / confiscation is imho misleading.

Screw it. Decided to cut my EM allocation in half. Complete waste of money for the last 5 years.

To what %? In the Boglehead subreddit the VXUS zealots always parade EMs’ outperformance in the 00s, the more I looked at EMs the more I felt it’s a bet more than anything.

Caveat, the last 5-10 years were so heavy on growth and US that it’s probably unlucky/unfair timing. Having said that I have 0% specifically allocated to EMs, whatever is in my all-world funds is good enough for me. I prefer factor investing for my long-term bets.

Bullish signal for EM ![]()

Not far from truth - IEMG is the only green row today in my portfolio.

From 7.4% down to around 3.6%. Not looking back now ![]()

https://seekingalpha.com/article/4680917-no-matter-what-fed-does-lack-of-bears-worrisome

It’s getting dangerous now.

with so many people bullish and already invested, it’s easy to get the opposite effect. Any unexpected event could trigger a lot of those already invested to begin to sell. This is the strange world of how contrary opinion works and shows why, at times, investing can be so contradictory.

I feel that all it takes is nVidia reporting 4.9 bazillion earnings instead of 5.0 bazillion for kids to start throwing their toys out the pram.

Love humanity, hate people…![]()