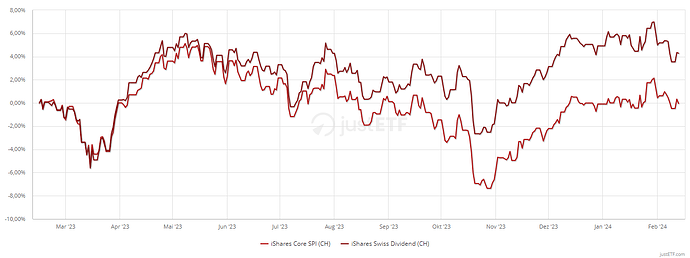

I went with CHSPI (2/3) and SMMCHA (1/3). Don’t like CHDVD, since tax wise it’s not interesting to maximize dividends in Switzerland. Would I start today, I’d probably go only for SLICHA, despite the higher fees, because the Big 3 are capped at 9%.

Late to the party. CHDVD is indeed taxed more, but in a year it made 5% more.

It might be a good idea to start buying it just before FIRE to get some cash at hand.

Indeed you should expect a higher profitability of high-dividend stocks.

Dividend investors will tell you that theory does not extend to reality, and that dividend stocks do indeed do better than the market. I’m not denying that. On average, dividend growth stocks beat the market. But dividends are not the reason. Dividend growth stocks, on average, have excess exposure to the value, profitability and investment factors. That is what explains performance differences. This does not make picking individual dividend stocks a good idea.

(There is no free lunch, the “factors” mentioned are risk factors.)

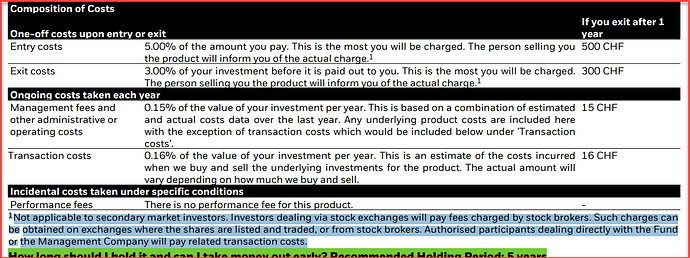

Just as a thought: why no one is considering also the entry/exit costs for these CH ETFs?

Just as an example iShares Swiss Dividend (CH) - CHDVD has from the KID an entry cost of 5% and an exit cost of 3% + ongoing costs of 0.31%.

These are big numbers and might bite your yield.

Feedback: people that have it are still happy?

Maybe a second question: how do we know how much IB is really charging for entry/exit costs? (The KID describes that the “The person selling you the product will inform you on the actual charge” )

Thank you.

This is an ETF see footnote 1.

Please note that this is the maximum that can be charged, the actual cost depends on the distributor.

And those are zero for basically all popular retail brokers.

These costs do not apply to ETFs if you buy or sell at a stocks exchange. I don’t know why this information is there. Well, ETFs are also used as building blocks for different assets allocation strategies, like by roboadvisor, or sold over-the-counter, like in saving plans. Theoretically an entry and exit costs can be changed in these cases, but why would providers do it?

When I find something new about personal finances in Switzerland, I tend to apply the “efficient forum hypothesis”, meaning that if a relevant information exist, it is known in this forum. Like with these numbers: people here use those ETFs, so they can’t be that expensive ![]() .

.

Thanks for all your comments.

@Dr.PI your way to see things is exactly how I thought. To me was really strange that no one in the forum discussed about these charges.

Always a pleasure to be part of this forum. ![]()

Hi there,

My first post, please have mercy ;-). I read about IBKR here and opened an account. I currently have my money on my Raiffeisen E-trading account invested in two funds. One international and one Swiss. ISIN: CH0214404714

I am unable to transfer the later to IBKR. They wrote:

Es ist leider nicht möglich Ihre Positionen CH0214404714 auf Ihrem IBKR-Konto zu übertragen, da sie in unserem System nicht verfügbar sind.

I am therefore looking for an alternative like this: ISIN CH0356569407

But when checking here: https://pennies.interactivebrokers.com/cstools/contract_info/v3.10/index.php

It seems that IBKR doesn’t support this title either. Is this a general problem with IBKR? I want to invest in the swiss market. What are your recommondations?

Thanks in advance,

Philippe

Check ETFs not mutual fund.

E.g. search for SPI ETFs.

The best avialable etfs are:

SLICHA, SLI index, my personal favorite, due to the 10% cap on the top names

SPICHA, SPI index

SPMCHA, SPI mid index

Why SPICHA and not CHSPI? I use the latter as it seems more attractive due to fund size.

Idk I want my home bias from a swiss company and not Blackrock.

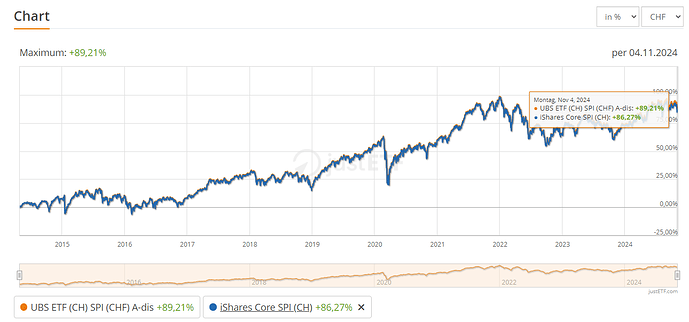

On top of it, it has fared better.

Fund size at a certain point also does not matter. And we are many times past that point.

Note that CHSPI seems to have higher dividend yield (2.9%) vs. SPICHA (2.62%). And that CHSPI holds more (204) than SPICHA (194).

But yeah they are pretty equivalent. No big difference in either direction, so if having it with UBS is important then that’s fair enough.

1:0 for SPICHA then. ![]()

They are probably just reporting the dividend differently. They should be the same,

UBS probably does not include the 10% tax free capital gains distribution. It would explain the exact difference pretty much.

The handful of companies are probably some 0.05% small caps, that will not make any difference.

I just trust a swiss company more to handle the swiss market. They probably have admistrative advantages as well.

But in saying that, CHSPI is of course totally fine as well.

Me gusta slicha tambien.

Best Swiss index, this year I put some money on it to have a bit of home bias (currently 15% on IBRK, the other 85% are on VT). And I’m happy with this choice, better return than the traditionnal SPI.