Hi all,

I have asked a consultation to see what they offered now. I would be happy to get a 4.1% in EUROS at 1 year deposit.

They are offering me like below in the CIC bank. Do you guys have any opinion or risk about this product? I find it very competitive for my EUR savings.

Risk is low for <100k, since the esisuisse protection covers 100k.

I haven’t personally shopped around for EUR rates, but 4% seems good, yes.

I get 3.5% at DKB (Tagesgeldkonto). A bit more flexible, a bit less interest.

Have you checked at wiLLBe? Their CHF interest is good and they also offer EUR account.

Thanks @rolandinho ! I have the money at the moment in IBKR giving around 3.39% but as you know the first 10k are not considered for the interest calculation. I made the math and I see with CIC I could get up to 2570 EUROS more per year, so to me it’s a no brainer at the moment.

Any other has experience with CIC Flex?

Thanks

Inst CIC Flex for min 5Mio?

Side note: google doesn’t show anymore when a link is a pdf ![]()

This is great, and will replace my WiLLBe Account. To date, I have run through 3 different high interest savings accounts already. Key learning is that until we reached a new equilibrium, its key to prevent longer account lock-ins that prevent later moves. The CIC’s 3 month lock-in is just about the max I am currently willing to accept.

A post was merged into an existing topic: CHF accounts with best interest rates: discussion

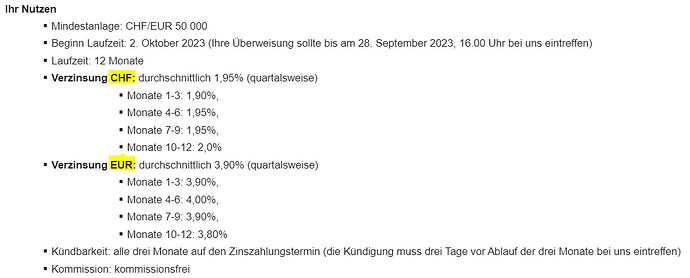

About the FLEX term deposit:

Term starts: 2 October 2023 (your transfer should reach us by 4pm on 28 September 2023)

can we add additional cash after 28th Sept?

Term: 12 months

Interest CHF: average 1.95% (quarterly, months 1-3: 1.90%, months 4-6: 1.95%, months 7-9: 1.95%, months 10-12: 2.00%)

Callable: every three months on the interest payment date (notice must be received three days before the end of the third month)

Does it mean that we don’t have the choose the length period in advance, every 3 month we have the chance to get out partially or even all our cash, right?

I belive Neon has some kind of limit that we can transfer out every month.

Does someone know how much can we cash out every month from Neon?

And from wiLLBe?

8 posts were split to a new topic: wiLLBe banking app

how is the process to open the FLEX term deposit?

can we open it online? their website don’t look very modern

i’m still in the process of opening an account (cic on)

Be aware of “your transfer should reach us by 4pm on 28 September 2023”,

so don’t wait too long

In order to transfer money out of wiLLBe, firstly we need to mark the destination bank account as “validated account”. Does anyone know if I can have more than one “validated accounts”? or instead if I add a new one the one already added is gonna be deleted?

If we want to make a transaction from neon to another bank, firstly the money should be in main account first. Does the transaction from neon spaces to neon main account count for this 50k limit? or transaction between my neon spaces and main account does not count and only count the transactions from my main account to my external bank account? thx

I have more than one.

You need to call 058 268 16 00 and they will send you a link to open an account. Money can be deposited until Sep. 29 for the current offering. They will send you a link right away and you can proceed online (ID scan, selfie, etc.) - takes about 5 minutes. Just did that, now waiting for them to open my account.

You are right.

But no sense. I don’t understand why charge with a fee with when you transfer money between neon spaces. The money don’t leave at any time neon system.

Considering the restriction that transfers can only be made from the main account. If you have your cash in a space you will only be able to send ie PostFinance 25k in a month.

25k from space to main account + 25k from main account to PostFinance = 50k limit

Now, I am understand why. “Space” in Neon jargon means “saving account”. The cash you have in your main Neon account has 0% interest.

According to this article, Credit Suisse / UBS offers pretty good conditions for short term deposits at the moment (1.8% for 3M)