Thanks for the info about Valiant. However, I didn’t find the restriction that the money is blocked for 12 months? Is this hidden somewhere in the terms? Only I see that there is a notice period of 6 months for amounts above CHF 10’000.

What I’m also wondering (without checking the terms): Is there a fee for closing the account…?

Can’t find easily their rates, are they better than Cembra’s?

10k per year without a cancellation notice is hardcore.

Wir Bank is better for 1y with 1.8% no?

Just to make sure noone misses it: If you have a Neon account, you only get your 0.4% if you transfer your money to Neon spaces (“savings account”). If you leave it in your main account, you get 0%!

Is this is kind of a scam by Neon? Yuh offers 0.75% on its main account. So no need to move it to savings / “spaces”

I actually don’t see any reason for me to use Neon anymore: Yuh for my main account, Revolut/Wise for travelling.

As far as I’ve seen: No, you can withdraw your Yuh-money without limits!

50k withdrawal limit per day for money in your Neon “spaces” with 0.4% up to 25k balance, no limits for your Neon main account with 0%.

With Yuh, I get 0.75% without withdrawal limits (up to 25k, and 0.5% for 25k-100k)

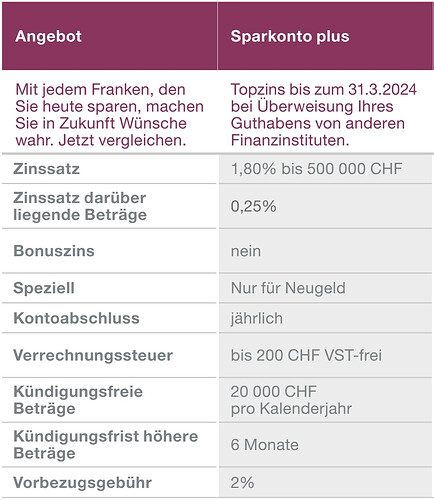

So if I read correctly, these WIR guys offer

- by far the best savings account interest rate (1.8%, for a ~year)

- without any open/close/withdrawal fees

- and up to 20k can be withdrawn without notice (i.e. not blocked for a fixed period of time - also without fees?)

What’s the catch? ![]()

click on: Sicura

Conto risparmio FISSO

1.85 % in CHF => 2 Years

2.97 % in Euro => 2 Years

What do you think about ?

And there seems to be an early withdrawal fee of 2%.

Sorry, too many “kostenlos” bullet points in their webpage so I got excited too fast. ![]()

Still looking good for 1 year.

(On 20k including in/out fees, turns out to ~1.7% p.a.)

Full conditions:

I filled up their form last week but did not receive any news since…

Good eye, always gotta read carefully to catch these sneaky fee leeches ![]()

Blick piece with an overview of the interest rates:

https://www.blick.ch/fr/news/suisse/hausse-des-taux-dinterets-cest-dans-ces-banques-quepargner-de-largent-est-le-plus-rentable-id18461736.html

Thanks for sharing!

“From April 6, UBS will launch a savings account with interest at 1% up to CHF 100,000, valid until the end of June 2024.”

Nice!

Will probably leave my EF sitting where it is then.

(I was considering the switch to WIR, but would need to take into account the increase in UBS monthly fees if I don’t keep min 10k on accounts)

Minimum deposit: 5k CHF

Withdrawals: maximum 10k CHF per calendar year, maximum 6 withdrawals.

Seems to be a clear winner for now. I just don’t understand why moneyland.ch does not show it in the list of savings accounts, Carl @Daniel .

Let’s not get overexcited and forget about real rates: Inflation-adjusted, even WIR returns are nil.

Hence, get any cash that is not emergency cash into VT - ASAP ![]()

The real returns are not nil they are negative because inflation is 2.9%. The interest is also taxable

Great point! It’s so easy to forget about these cold hard facts.

But we people here probably do our part to keep inflation down by buying less stuff, don’t we? ![]()

Well, if I may continue this off topic…

My understanding is that “inflation” you are talking about is looking backwards (price increase of a certain basket of goods and services over last 12 months) while interest rates, especially fixed ones, are looking forward. Currently we know that over last 12 months, as a private investor one could have earned, say, 0.3% on cash deposits while CHF devaluation over the same period was 2.9% or so. So you have lost 2.6% in purchasing power terms. If you were not protected from negative interest rates, then it was more like -0.5% nominal loss compounded with the inflation, i.e. 3.4% loss of the purchasing power.

Now, we don’t know what CHF devaluation we will have in 12 months, but we can already fix the interest that we can earn at least on fixed term deposits. Say, 1.8%. If inflation will be lower than this, we have earned in purchasing power. But I don’t think all these temporary gain in purchasing power can ever compensate past losses. Long term inflation is real and it is visible again.

Of course the best thing we can do with our cash is to find the best interest rate available, no matter what is coming in the future.