No, 10k max without fees.

All savings account have such conditions (some have higher limits though, like 20k).

New offer by Bank Linth, which has not been posted:

Bank Linth savings account 1.85% (up to 250k), 20k / month withdrawal, 3 mth notice for larger amounts. No fees until 30.6.24, then 7.-/mth for banking package. But same as LLB, no guaranteed interest rate, subject to change at any moment.

So it seems that currently the best choice is the Bank Linth Sparkonto with 1.85%.

They restrict withdraws by 20k/month, but in practice u can get 20k by the end of one month and another 20k by the end next month.

After one year the offer ends and the rate will drop.

Do you think next month there will be better rates than 1.85% in other banks?

Is bank linth a trusted and well known bank? I didn’t know about it before

I personally prefer a more stable offer and not a time limited offer. Bank BSU has for example 1.36%, neon 0.9% on spaces.

If you are really into FIRE you do not have anyways that much cash, but invested ![]()

So if SNB hikes next month rates to 2.5% and Bank Linth offers a new saving account with 2.25% rate. This new rate of 2.25% will not be applicable to my already open saving account, right?

In that case if SNB rates skyrocket another bank, ie WIR, will offer an interesting saving account offer so we could transfer anytime our cash to a new saving account with updated rates.

definitely I have more cash than I should have.

“Neon has an interest rate of 0.9% on the combined total of funds on spaces up to 25’000 CHF. All funds exceeding this limit will generate an interest of 0.65%.”

I will open the saving account in Bank Linth, and as I have already a Neon account and PostFinance, I will split the cash among them.

Sth like 25k in Neon at 0.9%, rest of savings in Bank Linth at 1.85%, and I will still use the PF for my salary, eBills…

With this scheme in case I would need to cash out largely I could in a one month time window 20k x2 (one time end of month, and one time beginning of next month) from Bank Linth and 25k from neon.

In case interest rates hikes significantly (sth I doubt) prob another bank would offer a decent saving account with an interesting interest, and I would open a new saving account there.

I split my savings between Cler and WIR, while I keep the tax money on Yuh.

Indeed, willbe seems a better solution to park cash.

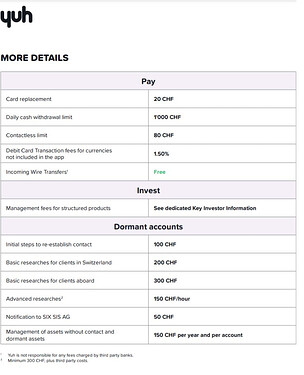

Yuh seems to have account closing fees and account inactivity fees

Are these on Willbe as well?

Do you have a source for that? I don’t see such fees in their price list. They even explicitly state:

Your Yuh account and card can hibernate for as long as you want, and we won’t charge you a thing.

We would be very sorry to see you go, but if you do make that decision, closing your account is straightforward and free of charge.

I can’t find anything now on the closing fee, so maybe yes I confused with something else.

But I found this part on ‘dormant’ account. Maybe I misinterpreted, but it sounded as ‘inactive’ account?

That’s for accounts where they can no longer contact the owner (nachrichtenlose Vermögen). I.e., if mail to you is not deliverable and they also can’t contact you any other way. After 10 years of no contact, the account is considered ‘nachrichtenlos’ according to law. Bank fees for trying to reestablish contact in such cases are normal and not unreasonable.

Inactivity alone does not trigger these fees.

Ah I see, thanks for the correction! One more small thing off my mind ![]()

i had a call with Bank Linth, to complete the process I would have needed to go physically to Rapperswill (if I remember well). This place is not very close to where I am living so I will not open the account in that bank.

So my new plan is opening an account in LLB. Is this bank trustworthy? I haven’t heard about it before.

I will move most of my cash to LLB, keep 25k CHF in neon, and use PostFinance for eBills…

Note that Cembra’s savings account gives currently 1.25% and withdrawal conditions are good.

Could be a good bundled solution especially if you have their mid term notes anyway. But beware of 100k state guarantee limit.

Sounded nice until I saw:

The account management costs CHF 50.00 per year.

![]()

This fee is waived if you have their mid term notes in the depot. I have seen before that it is waived if you keep more than 50k on the savings account, but I don’t see it anywhere anymore.

Would be glad to have some feedback from people who actually opened an account, though.

Alpian: https://www.alpian.com/

Earn 1% of interest on your account’s money for amounts up to 100,000 CHF, and 1.50% for amounts between 100,001 to 250,000 CHF. Credited monthly, no strings attached, and complete freedom to access your funds.

Fee structure: Transparent Fees - Account Conditions & Membership

| Total Assets | Quarterly fee | Investment mandate fee |

|---|---|---|

| More than CHF 50’000 | CHF 0 | 0.75% |

| CHF 10’001 – 50’000 | CHF 22,5 | 0.75% |

| CHF 0 – 10’000 | CHF 45 | 0.75% |

No Fees for the first 12 months with following code: MNLAND

Download app and follow the process.

Nice to see some movement from the Swiss banks. Clientis Bank Oberuzwil offers a saving account that is bound to SARON, but sadly only for amounts >100k.

Thanks!

If I open an account with them, when can they change interest rates again?

What happens if they decide to move the interest rate back to 1%? Do I have to wait another year with 1% interest rate?

I wonder what they or any other bank are going to do if I will give a withdrawal notice for the full amount every month or even week. I remember it was possible to deposit such a withdrawal notice with Postfinance, and then it was valid for some time.