Moi Kokko,

Nice to see fellow Finnish people here on the forum

I have pretty much the same set up as you being 26, single and came from Finland to Switzerland straight from the university (i have a business background). I can share some takes on my experiences living in Zug.

I came here a bit over year ago first for half a year internship and then stayed full time. Salary wise that is in the ball park what I’m getting in Zug (though i think that by changing the firm it could be 10-15k higher). My net income (i.e. money i get on my bank account every month) is roughly 82% of the gross after all deductions (taxes, social security, pension etc.). I think that ETH Salary calculator gives most realistic view on what to expect tax and deduction wise.

Mandatory health insurance for me with maximum deductible is about 190 CHF per month and supplementary another 60 CHF (i don’t really consider this as a cost as the supplementary insurance pays same amount for my gym membership.)

In a WG (shared apartment) I have been paying 1100CHF per month but now i’m moving in my own apartment that costs 1450CHF per month (Note that it took me about 5 months to find and get this apartment as in Zug the demand for cheap apartments i.e. below 1500CHF is crazy)

For groceries prices (in lidl) are pretty much the same as in Finland except meat and fish is more expensive, from Zug you cannot really take advantage of German or French prices without a car.

Public transport I do not have anything else but Halbtax (180CHF/year) as I live 5 min walk away from work. However the occasional bus ride and train ride to Zurich costs around 60CHF a month. In this category I would also add a provision for flight tickets as I’m sure you want to visit home every now and then (for me around 4 times a year 350CHF per flight with Finnair i.e. 120CHF per month)

Phone I have no cost as my employer i paying this. Cheapest option is probably prepaid Lycamobile with limited internet usage.

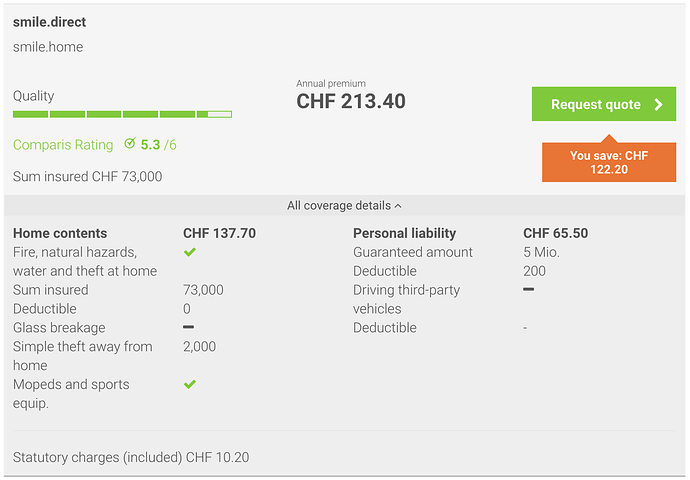

Internet/Electricity/Utilities have been included in my rent so no additional cost (my flatmate have been taking care of these). For houshold insurance I have Baloise younGo that cost 120CHF per year and i believe it is the cheapest option with best coverage if you are below 30.

Gym membership for me is 1420CHF/Year (Migros fitness) which is probably one of the most expensive options available, however, I have access to all migros gyms in switzerland and here in Zug they have the best opening hours, convenient location for me and also really good saunas  I could also think that this cost is 500CHF less as the supplementary insurance is paying this part but i want to consider that the insurance is free and i’m paying for the gym

I could also think that this cost is 500CHF less as the supplementary insurance is paying this part but i want to consider that the insurance is free and i’m paying for the gym

Additionally I would add some buffer for seemingly random costs you may not be aware. To name few I have faced: Serafe (local public broadcasting tax paid per household) about 360CHF/year, In Zug 100CHF/ year for fire protection, Initial costs registering to the local municipality and getting your L/B-permit about 100CHF, changing your drivers licence after a year about 160CHF, changing the name plates in your mail box and door 80CHF etc. Even though many of these costs are “one off” i would at least mentally take these into account.

Also assuming that you don’t know many people in Switzerland before coming here I would increase the budget for going out for some beers you will find your self going to the bars more often to see new people

So all in all in Zug I consider saving 3000CHF a month possible but a bit stretch, 2500CHF should be doable quite easily when you avoid the biggest money mistakes.

If you need any other help or comments from Finns perspective, shoot me a message!

Also have met few Finnish guys working in Pulp/Paper industry here in Zug so they might have better knowledge on the Job market side.