Thank you very much @Gesk and @Wolverine. I just wrote VIAC if they would handle that for me. I’ll report back once I hear from them.

You’ll be fine. I did just that and lost over 10k+ in the process. But I know I will make up the difference in a few years. Excel doesn’t lie!

I just sent off my cancellation. Hooray! As promised: VIAC’s response (paraphrased):

The transfer form from VIAC (can be found via Transfer -> move existing 3a) also cancels the previous policy. Typically, the previous insurance requests further (unnecessary) documents in order to delay/prevent cancellation.

According to their experience, it takes Helvetia about 5 weeks to complete the process.

Congrats!

I have a question: I’m actually with Generalli, and it seems that I can’t see what they are doing with my money. They only send me documents for tax, and the policy I have with them…

Do you find it normal? Cause, I don’t really know if it is, but I like to monitor from time to time, how my money is growing…

I don’t consider it right, but it’s kinda to be expected that they don’t tell you too much after all I read about those contracts… Have you tried asking them how it’s coming along?

They won’t give you any information unless the annual reporting of your investment. But, you can call them to have detail about your investment and they have to give you an answer about your request.

I’ll be not surprised if they told you that they cannot give you the information you asked for and that you have to ask them again and again (transparency…).

mh… okay. So it’s not specific to generalli? good to know

And I’m think I’m too lazy to ask them that often ^^’

Aren’t there automatic email senders? I guess that way it would not cost you too much effort…

I don’t know about Generali  But with my previous “financial advisor” I could phone him to have some detail about how my investment was allocated, otherwise I just have an annual report which contains less information than the ingredient shown in a bag of pasta at Migros…

But with my previous “financial advisor” I could phone him to have some detail about how my investment was allocated, otherwise I just have an annual report which contains less information than the ingredient shown in a bag of pasta at Migros…

You can try to contact them if you want, or maybe you can use Generali App ?

They have an app? I didn’t know it. I’m also contacting them through my financial advisor.

I’m thinking about open an account in VIAC, but, as I heard it everywhere, but I guess I’ll spend more time gathering more intel. I’m still at the beginning of my contract with generalli, the loss shouldn’t be that big for now…

I think they have one, or maybe it’s just their marketing department that are showing a “fake” app to promote their 3rd Pilar product ?

Before VIAC I was with Zurich and I lose all my investment (CHF 4’400.-). Just be sure that you are ok with the lose of your entire investment since the first year of premium is only invested for your risk insurance.

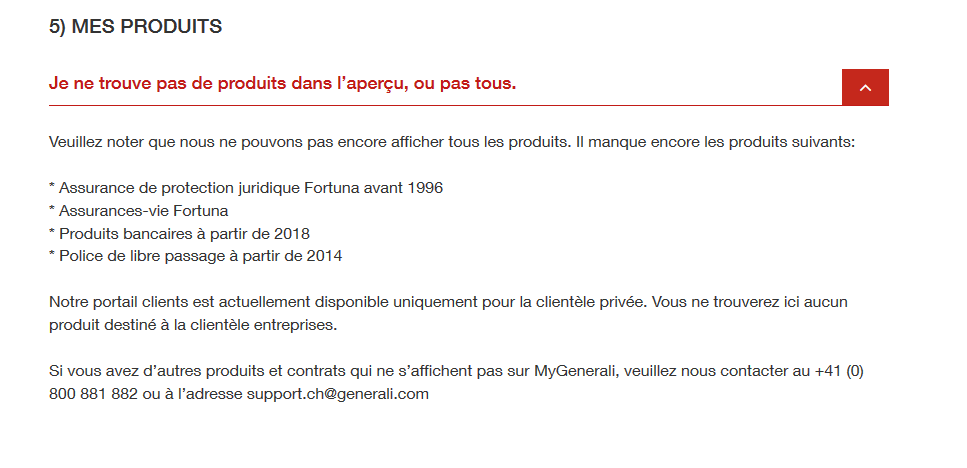

So I dig up a bit, and apparently, you can’t use the app for life insurance yet, as you can see in the screenshot.

I think I can be ok for losing that amount if I know I can make it up elsewhere.

As I arrived at the end of my 1st year with them, I have to make a decision.

But for now, I guess I’ll read all I can about VIAC and if life insurance are really as bad as you guys make it appear ![]() I’m still new to this.

I’m still new to this.

I ran into the same trap. For now I only have paid it for the past year, but it was the maximal amount…I also signed it with Helvetia and there you can also invest it into funds

https://www.helvetia.com/ch/web/en/private-customers/pension/private-pension/unit-linked-life-insurance.html

You can only select a few funds from helvetia and some others that are not written down anywhere.

So before I cancel it, I wanted to make sure, do you guys think the VIAC or Frankly are definitely better?

As maentioned before, I am in my first year and I would loose the full amount of 2020 to Helvetia. Waiting for the first 3 years to pass so that you have the “buy back”-option would probably result in a similar loss. What do you guys think?

List is here: Current range of funds of Helvetia | Helvetia.ch

There’s a lot of high fee funds, the helvetia funds seem to be >0.5 TER. Some of the UBS ones are ~0.25%. But I guess there are fees on top from helvetia side, and you should compare it to the cost of having a separate life insurance.

Thanks for the link! It looks like they reduced all the funds to Helvetia only funds. (Previously offered funds can be seen in the drop down menu.)

I can see other funds on that page, but yes no idea if they’re eligible.

Judging from the fact sheets, the funds partially seem consist of ETFs (the most agressive one holds 21% of MSCI World ETFs). So you will not only pay the fund’s fee, but also the ones of the ETFs within.

Am I right in assuming that lowering the amount one has to pay to the insurance to a minimum can only be done with the buyout option? Or how does this work?

Hi, @Ardius, @CryingSofa, could you please share the steps to cancel life insurance and transfer to VIAC?

From here, looks like I only need to liaise with VIAC?

Also strange that I started in 2016 (with max 6768) and i received the letter with buy-back value of 19k.

More info here:

Correct. You need to open a VIAC account, then fill out the transfer form, send it to VIAC, and fend off your previous insurer’s henchmen. They’ll probably call you to persuade you to retract your cancellation.