American exchanges are the cheapest. European ones tend to be 1-2 orders of magnitude more expensive, and some (like LSE) will also hit you with a hefty stamp duty, although it seems to be now charged only for plain vanilla stocks, not ETFs.

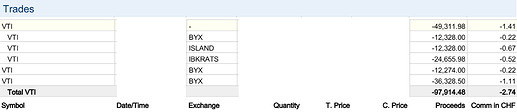

I bought $100k worth of VTI paying less than $3 in fees in total. On BYX + ISLAND + IBKRATS according to my brokerage statement. BYX (BATS) is especially cheap, they reward you for removing liquidity, i.e. if you place an order that can be immediately matched with someone from the order book, like buying at market price.

Here (some details photoshopped out, but the rest are real numbers):

SWDA/IWDA are European UCITS-style ETFs, not traded in US. An example of a US-based MSCI World index tracking ETF you can buy is URTH, but I’d rather buy a much more liquid and lower cost VT. It’s from Vanguard, which is IMHO a bit more reputable and generally less greedy than Blackrock (iShares). Here’s a list of some global funds: http://etfdb.com/etfdb-category/global-equities/. Look out for most liquid (high AUM) and low cost (TER) funds. Note that they are not all the same and track different indexes. Small caps and EM are often the main differentiators. MSCI excludes EM for example, MSCI World + EM would be MSCI All Country World.

Buying a US-based fund instead of EU is also beneficial from US dividend taxation perspective. A disadvantage could be US inheritance taxes, but for swiss residents that’s a concern starting from a net worth of several millions thanks to US-CH estate tax treaty.

Also, in the above dialogue IB is actually asking you not for exchange (it’s “SMART” - auto selection), but rather for exact product type. AMB:IWDA is traded in EUR, and LSE:IWDA is in USD, LSE:SWDA in GBP, that’s the difference. IB should route your order to cheapest exchange(s) automatically, but can’t make the decision for you which of these three currencies you want. Look at Products, Exchanges and Contracts Search | Interactive Brokers LLC or https://pennies.interactivebrokers.com/cstools/contract_info/ for details on specific IB symbols