You will also need to clear your cache on some website if you had not selected professional investor previously. You may use another browser or Incognito tab.

Is there a reason not to choose the largest and cheapest fund SGLD with TER 0.12%?

Also physically backed, USD unhedged

Yes, I don’t want to think currencies basically given CHF is my current and fairly long-term (hopefully!) primary currency.

I don’t think it is the largest nor the cheapest.

Why SGLD over GLDM?

Isn’t there Xetra-Gold (ETC) for 0% TER?

In Switzerland only for Professional Investors (over 2m in liquid assets, not real estate).

Are you sure? Most brokers allow execution only services regardless of pro status (that’s the key difference with EU regulations).

I just checked it seems to be available on SQ/PF, I assume it’s also there in IB.

I think diversifying between silver and gold (and possibly other precious metals/commodities as well is a sound move, compared to just keeping one. There are infinite variables that can affect future price developments.

Personally, I have two concerns about gold. These are:

- A shift away from traditionalism to westernism/modernism in India could severely impact demand for gold. The requirement for bringing gold into a marriage has long been a major driver in the demand for gold, and a move away from traditional Indian values could greatly reduce that.

- Part of the demand for gold by central banks could hypothetically be replaced by central bank digital currencies and possibly tokenized securities.

I don’t see those things happening in the very near future, but I see them as realistic enough possibilities to warrant some diversification to other commodities.

With regards to using ETFs to invest in precious metals, I think it’s important to do the math. If you plan to hold your investments long term, buying physical bullion can work out cheaper, in spite of the bigger spreads and other costs.

Example:

Buying and holding a 1kg gold bar for 10 years, assuming 3% total markup/markdown on the spot price (CHF 83,767) at buy and sell: CHF 2513 (CHF 3013 if rent a safe deposit box for CHF 50 per year).

Cost of holding CHF 83,767, in the ZKB Gold ETF A with a 0.40% TER for 10 years: CHF 3285.

Of course, this is a simplified calculation based on the assumption that doesn’t account for price growth. But it does show why using ETFs for things like precious metals, bitcoin, etc. doesn’t always make sense.

Zulassungen

Die Inhaberschuldverschreibung Xetra-Gold ist seit 14. Dezember 2007 für den regulierten Markt (General Standard) an der Frankfurter Wertpapierbörse (FWB®) zugelassen.

Zulassungen für den öffentlichen Vertrieb in:

- Deutschland

- Österreich

- Luxemburg

- Großbritannien

- Niederlande

- Schweden

- Norwegen

- Dänemark

- Finnland

- Schweiz: Der Vertrieb in der Schweiz erfolgt nur an qualifizierte Anleger im Sinne von Artikel 10 des schweizerischen Kollektivanlagengesetzes.

It says so on their website (Performance: Kurs & Wertentwicklung)

But then, I don’t know how strict this is enforced / controlled.

That’s for marketing purpose afaik (whether the broker/advisor can advertise this to you), Swiss regulations are lax for execution-only trading so if you initiate the trade it’s not usually restricted.

Thatt product has depot fees of 0.025% aka roughly 0.3% p.a. They are charged to your broker. Chances are that the broker passes theese expenses through to you.

So its paper, and more expensive than an ETF.

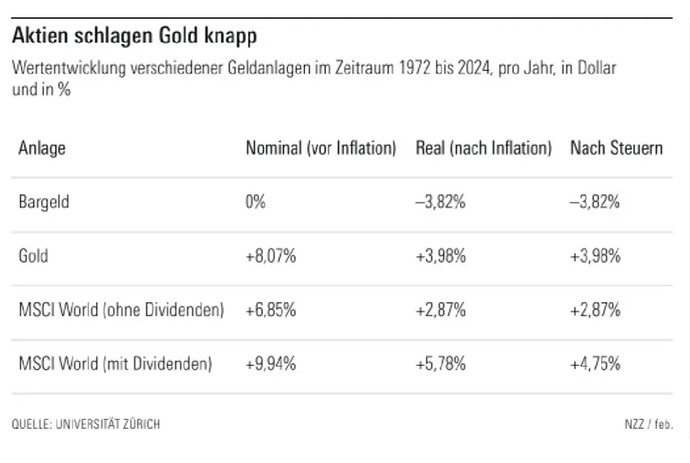

Not bad returns for an unproductive asset.

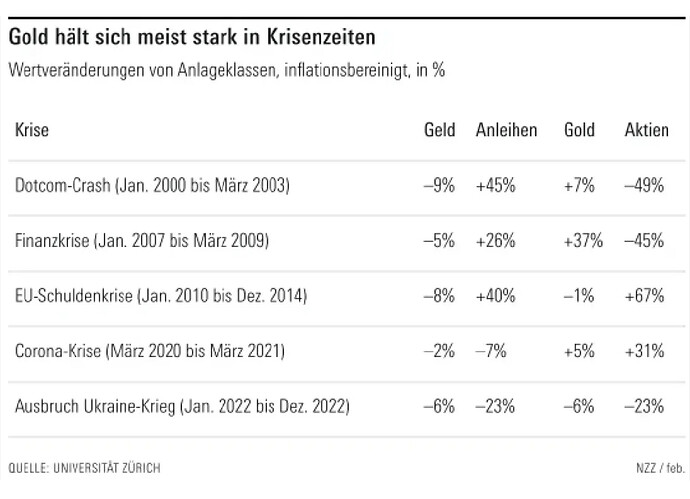

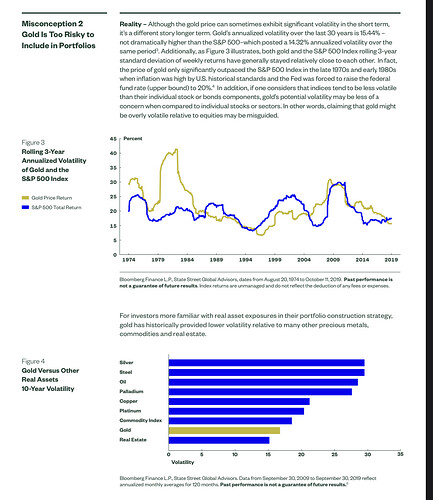

And when you consider the reduced volatility, gold can shine quite ok as an investment allocation in most portfolios IMO.

This!

In my experience shopping around the markup can be lower. Esp. big amounts/ above 250g (your example is 1kg), this can be below 1%, so that the calculation swings even more/faster in favour of physical bullion.

Also, this physical bullion is now in your bedroom or in a safe down the road (local bank branch) which you can really access. Physical delivery really guaranteed.

No fine print of some ETF to study.

PS @Dr.PI maybe we can merge this with the gold vs chf thread, or is this thread more for an silver-gold allocation discussion, OP? Just seems precious metals are slow/quiet threads and splitting may be unnecessary?

Hmm, I am a gold bug and I haven’t yet grasped what influences the price of it beyond inflation fears. Hence I would like to see some evidence of Indians moving the needle. Especially as there recently have been news about 1 billion of them not being able to spend money on discretionary items.

CBDC is just programmable fiat, so it will not work as a store of value. How tokenised securities would be better than normal securities, I do not know. If anything, Bitcoin could be a store of value, if it must be something on the blockchain.

Personally I think Gold is a risk asset and have similar volatility like stocks. It might be uncorrelated to stock and thus it seems less volatile during crisis

Hence I wouldn’t compare Gold with holding Swiss francs (which is title of this thread). Gold does belong in certain portfolios and is part of golden butterfly portfolio. However I also think one needs to be in it for long term as part of strategic asset allocation.

Here we see that gold sales for jewelry manufacturing were nearly double that of central banks, and that is in spite of the above-average central bank gold buying in 2024:

Here we see that India is the world’s biggest market for gold jewelry:

There are better statistics and historical data out there. I might dig it up if I get around to it. An empirical analysis would be required to clarify the direct impact on the gold price. But these simple statistics give a basic picture of India’s involvement in driving up the gold price.

CDBC is indeed programmable fiat, but with a key difference: They could theoretically eliminate the need for clearing houses, which in turn could decrease/eliminate the need to hold gold in clearing houses as a guarantee against the payment of debts. Debts would be settled immediately. The same would apply to tokenized securities. There would, theoretically, be no need to store securities in repositories and settle trades in fiat, so tokenized securities would have intrinsic value and could, hypothetically, be used to settle cross-border transactions - a task in which gold currently plays a role.

Of course, these are just my opinions/speculations. But I think it is important to understand all of the factors that are priced into an asset.

Obviously gold has intrinsic value as a commodity due to its unique properties. I suppose that could be determined by comparing it with similarly rare and useful commodities, while also accounting for cultural/emotional value.

Having re-read everything you might be right! Sorry for the confusion and thanks for the clarification.

Edit: irrelevant point made about NACH funds.

Indians buy gold jewellery because it serves dual purpose (function of jewellery & investment to protect against Inflation)

There are also options to buy gold coins or gold bonds but as I said the dual purpose is more interesting for most people

I don’t think this will stop. It might reduce retail investors are flocking towards mutual funds and ETFs but value of Gold is entrenched in the society since ages