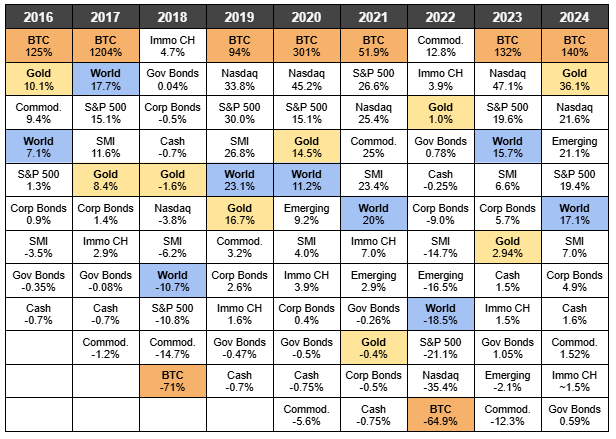

I want to look at the gold price (and every other asset) in CHF. Every once in a while, it gets a win.

Gold was 600$ in 1980 and dropped until 100$ in 2003.

It recovers its 600$ on 2007

Chasin recent performance might not be that smart…

That’s when a bit of market observation comes in handy: Looking forward, I see a case for inflation (= case for gold)

'+ tariffs make goods more expensive in the short run

'+ politicians like to go into debt. More money makes prices go up

'+ conflicts make goods scarce and prices for goods go up

'+ because history might rhyme, some expect a 70’s style second inflation wave

'+ Europe style regulations for energy transition and ESG will cost to goods

'+ many BRICS countries buying gold reserves for their central banks (= case for gold)

'- With “drill, baby drill” in the U.S., fossile energies might stay down. Solar and wind gets cheaper and cheaper (less inflation)

'- with lots of existing debt, interest rate increases would wreak havoc with economies. So central banks keep them down and inflation stays down. Still a case for gold as bonds don’t pay enough.

'- CH inflation for 2025 is estimated at 1.9%, so rather low and in the sweet spot

'- Younger market participants believe Bitcoin to be digital gold (= no case for gold)

I must admit: I am a gold bug. Therefore I tend to see the world through my gold-tinted glasses ![]()

Why do Germany-domiciled ETF/ETCs (e.g. Xetra, EUR) have 0% TER,

While Ireland-domiciled ones (e.g. iShares, USD) have 0.12% TER?

Any reason to pick the latter one vs. former?

Both “physically backed” and seem to have same past performance/volatility.

Inflation hedge for centuries yes. But short term it’s a risky asset.

More informations on RR as usually:

RR about Gold history

Anyway on distributing phase having 5-10% of gold instead of bonds is not a bad idea. But nor during acc phase according to me

You highlighted my 3 assets in VIAC ![]()

what’s your time horizon and your allocation for those 3 assets?

At VIAC:

Approx. 15 years…

This Said… my allocation may (most probably will) change since then…

5% IBIT

15% Gold

79% world ex. CH

The gold price is currently at a record high, sparking speculation about the reasons for increased demand. Geopolitical turmoil and inflation concerns are contributing factors. However, some hedge funds are speculating about the US Treasury revaluing its gold stocks at market prices, which are currently undervalued in national accounts. This revaluation could inject $800 billion into the Treasury, potentially reducing the need for bond issuance. Treasury Secretary Scott Bessent’s pledge to “monetize the asset side of the US balance sheet” has fueled this speculation.

A potential Republican tax and spending bill could significantly increase deficits and interest costs, putting pressure on Bessent to find creative solutions. The Trump administration wants a weaker dollar to help industry but also wants to maintain its reserve currency status, creating a policy contradiction. Some analysts believe the administration might allow or encourage gold to surge against the dollar to resolve this contradiction.

The range of possible policy options is expanding under the Trump administration, including previously unthinkable ideas. Stephen Miran’s memo outlines potential tactics, including using tariffs for revenue and geopolitical leverage, and potentially engineering a dollar devaluation. These ideas are risky, but the fact that they are being considered is significant. In this uncertain environment, gold is outperforming bitcoin, and traders are moving gold to New York.

I’m somewhat confused by the CH gold ETFs, UBS’s and ZKB’s are all in USD and one (ZKB’s H - CH0139101601 - is CHF hedged). Doesn’t one take on currency risk with all three of them?

I understand the currency hedging part is meant to sidestep currency fluctuations, but I’ve read here (without understanding) that it adds costs.

Yeah I have no idea how it can make sense to currency hedge gold…

Yeah me neither. The question is whether there’s more risk here if one assumes the US$ continues to fall vs the CHF.

Gold is priced in USD. If USD decreases in value, gold will increase in value when measured in USD.

TY, so if someone wants a physical gold Swiss ETF, between ZKB in USD and CHF hedged (0.4% TER for both) the better solution would be UBS’s USD gold ETF with 0.23% TER and call it a day? You’ve said you’re long gold, mind sharing what you’re buying?

Anyone knows how to shed some light onto the noob that I am?

where did you look?

on “open market” or via Viac, True Wealth etc.

ZGLD is in CHF - CH0139101593

I’m invested in:

- GLD ETF - for liquidity

- Gold futures - for efficient gold exposure with little margin/capital required

- Gold mining companies - for leveraged gold exposure assuming their valuations catch up with the price of the underlying (hopefully)

The unhedged UBS Gold ETF is traded in both USD and CHF (and you should just ignore the hedged Gold ETFs, in my opinion).

Thanks, I am looking at justetf, no idea why it didn’t show me that one.

Choose “Professional Investor”, select all exchanges and play around with your country, especially changing between Switzerland and EU. Makes quite a difference.