Sorry, in retrospect my tone might have sounded too attacking. ![]()

I was rather wondering but perhaps expressed it a bit harsh.

I understand it might not be a “target” allocation per se that you are optimizing towards, just a snapshot of the state - and that is perfectly alright.

Gold and Bitcoin!

I don’t want to sound overly alarmist to you all, but the rules of the game have changed. All those investing books we all read, they’re going to need to be re-written. What the US Treasury and Federal Reserve have done this past month (along with virtually every single central bank) is a direct attack on the long-term viability of every fiat currency. We are all watching a small unelected group of people determine the economic fate of the entire planet using a game plan that they are writing as they go along. Asset allocation? Passive or active? Hedged and liquid? These all need to be re-thought and re-interpreted in the coming years. I mean, let’s just pause for a moment and let this sink in: oil --the resource that literally fuels the world’s economy-- is presently “worth” less than nothing. For all of us who believe in efficient markets: what does the oil market know that the equities market does not (yet)?

Bitcoin doesn’t “perform” in any way you could generalize.

(And it lost 60% within this period even faster than the markets managed, and is still 30% down from the 10k of mid Feb - so even the low correlation piece kind of falls under water)

No you got that wrong.

Oil is still worth something.

The price of the (physical) delivery pack related to futures that were expiring those few days ago went to negative because no one had the demand on their books to fill.

Yet, despite your wish - you do, at least to me. ![]()

This too shall pass in one way or another (be it recession or depression).

And “this time it’s different” is a much heard expression with every economic turmoil.

I agree with you however that the moves made by Fed (actually ever since the 2008 events onwards) were crap.

- The question wasn’t concerning performance, but rather hyperinflation.

- Yup. That’s why I put worth in scare quotes " ". Of course it still has worth. My point is that the oil market is likely signalling something important. Here’s a hint: oil is one of the ONLY markets the Fed cannot directly manipulate. Hmmm.

- Ok, we have a difference of opinion on this one. But at least you must admit we’re waaaay out into uncharted territory, and that–in terms of what the Fed just did: This time its different.

So many remarks here.

-

I don’t get why people keep comparing bitcoin with gold. The point about precious metals is that once all the metal is mined, there is no more metal available. With Bitcoin on the other side, although the current algorithm states that Bitcoin supply is limited, there is absolutely no guarantee that it will stay this way:

- Provided with enough incentives, the developers in charge of the network may change the algorithm

- or failing that, once there is not enough Bitcoin, we could start a second ledger from scratch

- or we can use other crypto coins, as there are so many already.

- the point is: in the digital world, marginal costs of replication are negligible and thus supply is infinite. Believing that the supply of crypto-currencies will be finite one day is farfetched.

- History repeats itself: people thought that the US dollar was backed by gold, until it was not. People think that the supply of crypto will be limited, until it won’t.

- the main point of blockchains is that they allow to have a decentralized ledger of transactions/operations. But thinking that the supply will be limited is naive in my opinion.

-

Regarding your macro forecasts, i am not buying it yet. Central banks have done all they could to get at least 2% of inflation per year, in vain. That’s quite surprising, right?

- For what it’s worth (and it might be very little) if i had to guess i would not be surprised if we were instead headed for deflation, like during the long european depression of 1873 to 1896…

- At the time, Europe was suffering because a new industrial power (USA) was able to produce more goods for cheaper prices. We have the same repeating with Asia competing with the western world, with prices pressured to go down, not up. And not only for goods, but for services as well…

-

On a final note, i tumbled upon the following quote recently.

Why is everyone putting words in my mouth?

-

I didn’t say there would be hyperinflation. I merely recommended gold and bitcoin as two assets for a hyperinflationary event.

-

Bitcoin developers already “changed the algorithm”, twice! One is called Bitcoin SV and the other is called Bitcoin Cash. They are no longer Bitcoin. If developers vote to make another change, it will be represented in (yet another) fork from Bitcoin. Meanwhile, Bitcoin will remain Bitcoin, and well, that’s kind of the whole point of a distributed ledger (aka blockchain).

-

Bitcoin mining costs are not negligible nor is the supply infinite. If those fundamental aspects of Bitcoin were to be changed, refer to point 2.

-

Other crypto coins (of which there are literally thousands) are not Bitcoin. Many of them share nothing in common except that they operate on blockchain. Comparing them to Bitcoin is apples to oranges.

-

I fully, 100%, unequivocally, unreservedly agree with you that the US dollar is backed by the might of the US military… and more importantly, the trillions of dollars in US denominated global debt. The US dollar will destroy and devour all other currencies as citizens, corporations and nations service those debts, starting with the weak ones, and ending with the pound, euro and franc, before itself succumbs. That might take several years… so, I don’t know when, but in my humble opinion, I do believe its inevitable.

Somewhat tangential:

Which actually might become it’s downfall. Once there is no (or not enough) reward just for mining a block (excluding transaction fees), the optimal strategy for a miner is not anymore to follow the proper protocol, but actually to leave transactinons outstanding. This way, there will be an ever growing backlog of unprocessed transactions. Reference here

Because of that, I honestly don’t see bitcoin surviving as long as gold.

The paper you referenced speaks about fee sniping. It’s been discussed for several years now, as part of a larger debate on fees, which is wrapped up into a larger debate on scaling.

Technical issues may ultimately prevent Bitcoin from becoming a viable currency going forward. For this reason I would never suggest you allocate the majority of your portfolio to Bitcoin. Indeed, I wouldn’t allocate more than 20%.

Gold is a protection of our assets. Bitcoin is a call option on the future system.

Those of you who hold gold and/or silver (and/or other precious metals) via ETFs, which ones do you use?

ZSIL and ZGLD for me.

When I was with Selma, I hold the UBS ETF (CH) - Gold and the ZKB Silver ETF - A Klasse. The silver performed very well instead of the gold who loss a lot of value since the recovery of the market.

I own gold indirectly through my 3a at Finpension where I have made up a custom strategy including 9% of CSIF (CH) II Gold Blue DB (CHF). That would be the fact sheet:

Sorry for hijacking this thread a bit.

Does anybody know if there is any significant difference between the ZKB (CH0139101593) and UBS (CH0106027193) Gold ETF?

Last year I started investing in the ZKB one, and I don’t remember why. They look exactly the same, except that the UBS one is half as expensive. So in hindsight I should have gone with the UBS one… Am I missing something?

The ZKB one can be redeemed for gold, that’s probably what the premium pays for.

I thought so too, but the UBS also allows that.

Right to redemption in kind: Investors can also have the relevant precious metals physically delivered – for the white metals, delivery is made exclusively in standard bars; in the case of UBS gold ETFs, in other standard trading units also ~ Precious metal ETF | UBS Switzerland

I probably was just stupid when I did my first research…

I don’t like owning any gold long term because:

- It is non income producing and has costs (storage, insurance). So if you own 1000g of gold one year after fees you may only own 995g 1 year later

- We are at historic low real yields and if those ever rise (as they have been recently) gold will get crushed

- Long term its return has been lackluster (and the last decades have been a fantastic environment for it)

The only time I would own gold would be for a shorter term trade. E.g. really believing in a hyperinflation narrative. However, a portfolio of stocks, cash, and real estate is a good enough inflation hedge anyway.

With that being said, if I wanted to own gold short term I would buy GLDM shares. I’d be surprised if you can find a TER < 0.18% for gold which is as liquid ($4bn AUM). The ETF is traded on NYSE so you buy through any broker (e.g. IBKR).

If you wanna play with the big boys you can own COMEX gold front month futures and continuously roll (never take delivery). %GC1!. But these get much more complicated and you have to start dealing with margins, implied financing costs, leverage, etc.

I imagine actually taking delivery of 100 oz of gold is much simpler than taking delivery of 10000 barrels of oil, or 5000 bushels of wheat or 37500 lbs of coffee… ![]() (those are the contract sizes for those commodities.)

(those are the contract sizes for those commodities.)

Ha yes but then you will have to front some pretty huge notional. $173k per contract whereas your maintenance margin would only be $10k or so.

In practice the majority of these contracts are never delivered. The functionality just exists to ensure prices align with the spot market and that some participants can arb it to alignment if not. Standardized contracts to allow hedging and easier leverage otherwise.

I’m working on a commodity derivs trading team in Geneva and it would be a mess if we had to take delivery of our OI.

That’s a risk, but it is unlikely that real yields rise so much that they turn positive soon (regarding EUR and USD).

Perhaps if consumer price inflation picks up we could have eventually a 1970’s-style scenario and at the end of it, a tough central banker imposing a CPI + n interest rate (n >> 0) which would be very bad for gold. Not yet there…

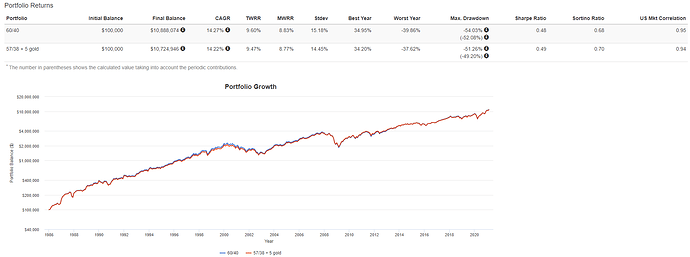

Tbh on backtesting I am quite surprised 5% gold didn’t have more of a drag on returns than it did.

That being said, US mkt correlation improvement only went from 95% with 60/40 US/Ex-US to 94%.

Also it is a personal point but I am still very averse to holding gold long term. I trust companies to be returning more earnings in 40 years time; I don’t trust an ounce of gold to be worth more. I also don’t think this backtester includes roll yield drag which can be substantial depending on how you get your gold exposure (e.g. 0.18% with GLDM).

As a side note, I saw someone mention above but don’t hold your gold exposure with VIAC. With untaxable investments (2nd & 3rd pillar) you want to be maximizing the dividend yielding portions of your portfolio. Think REITs, dividend stocks, and even bonds. These are taxed at marginal income tax rate (~35%) in taxable and 0% in untaxable.

Gold is not income returning thus the only gains come from capital gains. This is tax free in a taxable or a non-taxable account. Don’t waste your limited proportion of tax sheltered assets on gold.