Where you or any able to compare the % fees vs. Swissquote?

I am personally thinking about it, and will consider Swissquote for simplicity but the fee looks too high, which I wonder if it really is needed. Example: Buying stocks with UBS or Swissquote vs. IB.

From what I have seen so far:

Kraken: https://www.kraken.com/en-us/features/fee-schedule Approx 0.26% (I am looking for more fees that are not transparent, anyone can confirm those fees? )

Coinbase: 0.5%

Swissquote: 1%

So far, and based on the limited amount of purchase I plan to do, I might stay with Swissquote. Life is complex enough ![]()

Blockquote

But I decided to buy some, just a little, as a vote of no confidence for the fiat currencies in the World. I don’t like that they are under the control of central banks that artificially lower interest rates.

Blockquote

I share the exact sentiment as you. I’m considering buying ETH since the launch of ETH 2.0 now. But just like you I’m battling this in my head.

If you are searching for simplicity,

checkout https://swissborg.com/

it’s swiss based, easy, simple and act as the skyscanner for cryptos by scanning the price of Binance, HitBTC, LMAX and Kraken and letting you buy for the cheapest one.

I recently tried Hodlhodl and I really like it. It is a multisig P2P Bitcoin trading platform that works seamlessly and a few users are trading in CHF.

I like it because you can deposit directly into your hardware wallet and they don’t required KYC.

- Send CHF to Revolut (free)

- Exchange CHF to EUR at Revolut (almost free)

- Send EUR to Coinbase (free)

- Buy BTC & ETH at Coinbase (0.5% extra spread over market rate)

- Transfer BTC & ETH to Ledger Nano S

I did step 1 and 2, but then at 3, I tried buying ETH using my Revolut credit card at Binance.com.

It did not work. Binance was declined as an “Unsupported merchant”. Will Coinbase not be an “unsupported merchant” as well?

It was a long time ago, but I didn’t pay via credit card, I made a bank transfer from Revolut to Coinbase, just like you charge you IB account.

Kraken works with a liechtensteinien bank intermediary for its CHF transaction (LI IBAN). Don’t know if Postfinance treats this as an onshore transfer though.

Transfers to Kraken (at least from ZAK) are considered national ones, hence you do not incur any fees.

UBS never made problem with large amounts of CHF coming from exchanges. I thought they would ask a few questions to check that I am not a drug dealer or a money launderer. Nope. Instead, they called me and proposed to open an account in euros  (no chf at the time on Kraken).

(no chf at the time on Kraken).

Swissborg are getting swiss banks partners few weeks from now, so that you will be having no fees anymore cause it will be an CH iban account

Hello everyone,

I usually buy my cryptos on Coinbase.

Are there any disadvantages or advantages for a Swiss resident to buy these cryptos on swissborg?

Thank you for your feedback and advice.

I found out about the SwissBorg project and opened an account with them. The registration and validation of the KYC was done in 1 hour (very simple). I also transferred bitcoin I had on Coinbase to my SB portfolio.

A positive point from the SB project is that they will use different exchanges (Binance, Kraken,…) to get the second you need to buy crypto currency, the best possible price for your purchase and the lowest fees.

For those who are interested, I give you my link to download the application. It’s a referral link that makes you get a bonus and a lottery ticket as soon as you deposit 50€. You will win a ticket and I will win one in return. The lottery ticket can go up to 100€. As for me, when I registered I received a ticket with €26. https://join.swissborg.com/r/nicolaBZYZ

If you have any questions, don’t hesitate.

I have an odd feeling about SwissBorg. Apart from the number of referral codes that pop up here and in other forums, I wonder how this is going to work long term. The more you trade in an exchange, the lower the fees. The interest of the exchanges is not to have a service as SwissBorg use a business account to propose low fees and redirect business to competitors. Will the exchanges accept that or revoke the account of SwissBorg ?

I need less than 5 minutes on their website to concur.

You will find all information about fees here: https://swissborg.com/legal/wealth-app-fees

To be premium and have no fees on most currency cryptos, you have to buy 50’000chsb (token from SwissBorg) Cours du SwissBorg (BORG), Graphiques, Capitalisation | CoinMarketCap

Those who made the ICO, got the premium for 5’000chsb.

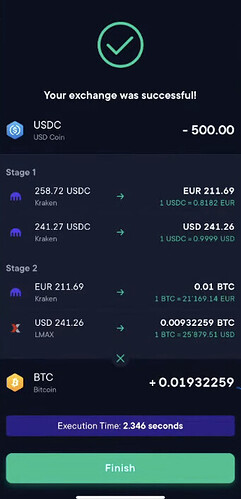

With SwissBorg, when you want to buy cryptos, there is a detailed report of how your money is spent to get to the crypto. It’s a bit like the trivago or the skyscanner of currency cryptos. They are constantly analyzing the rates on the different exchanges (Binance, Kraken, Lmax) and depending on the crypto you give it, it will transform this crypto to another target crypto or sell it or whatever so that you get the best rate.

Here is an example of a detailed report for the exchange of 500usdc in BTC made yesterday (I took this picture from a video of a French crypto investor)

For my part, when I make a transaction with Coinbase, in addition to the exchange fees that apply, there are hidden fees of between 1% and 2%, which gives me a much lower amount of Bitcoin than SB gives me.

At the moment there are still too few assets available. Positive point: They give users the possibility to vote for the assets they want to see on SB.

They will soon offer “cryptos bundles”. It’s a bit like the indicators used on the stock market like SP500, CAC40,…

These are basically indicators that will allow you to invest in a concentrate of different stocks. For example, investing in a bundle that includes decentralized finance (Defi), different values of coinmarketcap in general and different values that are all in electricity and blockchain.

I’m going to use this application mostly to accumulate, it’s not really made for short term trading but they indicate the profit/ost of each wallet (total, realized or in progress) and that’s really great.

Here is the information that I have and that I can give you at the moment.

Gosh, I did not even see that. Scary.

“Earn up to 22.01% p.a.* on USDC” → yeah, sure, fortunately there is a *. Ah no, this is just to say that you should get a premium account, not that this number is bullshit.

And I now see that it is linked to tokens issued in an ICO. They really check all the boxes.

Guys, I have been in this field for many years. I might be wrong but I would strongly advise everyone to stay away.

Unsurprisingly.

Rather surprising on the other hand may be the prestigiousness of their address in Lausanne.

Rue du Grand-Chêne 8 sure does accommodate an astonishing number of doctors.

And lawyers.

Swissborg’s top executives must have an awfully long commute to work there, by the way.

This reminds the recent warning I got from my bank (which was actually pretty sensible), something like “there’s lots of financial offers around, if it looks really good, think about why”.

And now it states “19.11% p.a.*” - they must have become more reasonable within the past 19 hours. ![]()