Why so few professional investors

manage to beat the S&P 500 index in the long run?

Because the index is totally emotion-free, it just consistently

executes a very simple strategy (like investing in

the 500 largest companies) without overthinking and

changing its style, while most investors are not capable

of staying the course and sticking with their chosen strategy

in the long run. James O’Shaughnessy points this

out in his book What Works on Wall Street.

In theory, there is no difference between theory and

practice. In practice there is.

Anybody can fill pages with empty sentences about how to

invest wisely and what you need to know to succeed. The difference

is made by how these lines are implemented after the

talking is done.

Again, I would not sleep well if I would need to be afraid of how the governing country is changing their curse over taxation. By the way, did anybody think about it if all of us would pay that much of tax what we actually want that probably was not enough to cover the budget. I do not want to open pandora’s box with this question so please do not jump on it.

The Swiss budget often has a surplus, so not really an issue. And debt is often pretty healthy for a country, it’s not like household debt (some economists will say Switzerland is missing opportunities there, esp with the current cost of financing).

But that seems heavily off topic.

People don’t buy ETF because of tax efficiency but they do so because they don’t have better idea. Another way to mention they do not know better.

But because of your last input (dividends are distraction), here it is:

Dividends don’t lie, they cannot be cooked. A company either

has money to pay the dividend or not. While earnings and even

cash flow numbers can be distorted by unfair practices, the dividend

stands out as the single reliable item in corporate reports.

If a company has been able to pay growing dividends for decades,

that is a sure sign of its consistent earnings power. Taking this

argument one step further, it is no surprise that companies with

these characteristics tend to outperform.

More importantly they are more safe. So you probably pay more tax but your assets are at less risk. You may decide which one is more important but may be both.

“The importance of dividends in generating stock

returns is not just historical happenstance. Dividends

are the crucial link between corporate profits

and stock values.”

Jeremy Siegel

For those who like to mention Warren B, :

“Jeremy Siegel’s new facts and ideas should be studied by investors."

Warren Buffett

The problem is, you are missing out on large amounts of cash you could otherwise re-invest but cannot, because it is paid in tax. Your chart may be technically correct, but is not indicative of the absolute return for a Swiss domiciled investor.

Regarding absolute return: Dividend is part of it. There are other ingredients but the dividend is still part of the total return, in Switzerland as well. So you may let it out in order to not to pay tax after that. The result is the same, you are missing out a large cash. So you go for the index funds hoping that you can avoid withholding tax in spite of that you still receive the dividend because that is so with that well chosen index you may adore. Well, I don’t know if that is the best strategy. What I know is why I am not buying the Dividend Aristocrat index either in spite of that it outperforms.

My problem with buying this index (or any index for that matter) is that you are buying a basket of stocks this way. This means that you are buying the overpriced ones along with the reasonably priced and really cheap ones. I hate overpaying for something, so I prefer buying only the quality stocks that are available at good prices. I’d rather wait for the others. The Dividend Aristocrats index is full of quality companies, there’s no question about it! But quality alone is not enough to make a successful investment, you also need to pay attention to valuation.

I see that you are arguing on behalf of value stocks that churn out solid dividends – but that would have excluded Fang stocks such as Amazon. Probably the biggest and profitable investment theme of the last 10 years. Lastly, I rather get 2.3% dividend yield from VT and know that 9000 companies or so are funding that. That allows me to count on that income more than if it were ‘just’ 100 hand-picked individual stocks.

Separately, please write less and try to be clearer/ pointed/ structured. I really struggle with your convoluted writing style.

My argument is much more complex than just saying that "dividend is “good” or “bad” or “X” ETF is better than “Y” and I am trying to keep away from giving such sweeping statement for the subject of this post. Specially for first time investor…but I will take the feedback. Thanks

What’s “reasonably” and “cheaply” priced? There’s alsmost always reasons why a certain is priced as it is. To identify “cheap” ones and take advantage of it, you really need to have an edge over other investors - that goes beyond merely a few financial ratios, be it through having vast knowledge, good intuition and/or insightful reasoning.

I’d admire everyone who can do it for more than …say half a dozen stocks with great (longer-term) conviction and then follow up on it in his investment decision.

100 seems a lot and can be reasonably well diversified. Unless you’re having obvious large biases in your selection, I wouldn’t sleep worse than having the index fund, and don’t why your selection should fare much worse than the 9000 in the index.

if you have a better idea then the indexes, Interactive Brokers will allow you to execute your strategy very cheaper even if you have to pick hundreds of stocks!

Post your results how it goes, let us know

Is More Always Better?

Again for those who like WB

“We really can tell you in five minutes whether we’re interested in

something.” (Warren Buffett at Berkshire’s 1997 annual meeting)

As investors, we now have easy access to more information

than ever to guide our decision making.

Most people believe that more information can improve the

accuracy of decision making, thus making us more confident

about our judgment. There have been numerous

studies in this area, however, and the conclusions speak

for themselves. In 2008, Tsai, Klayman, and Hastie tested the impact of

additional information on an individual’s ability to predict

the results of college football games and their confidence

in doing so correctly.

Not to be too long again!!! What’s the takeaway?

Most investors do not know

what the relevant information is, therefore, they tend

to include everything they can find.

You may also notice that more information

tends to feed our confirmation bias.

A bit over 3 years of investing (not long enough I’d say)

44 equities (so far, but I put no limit)

A bit under 10% annualised total return befor swiss tax

Doing my own mistakes with my own money ![]()

Which basically means you did NOT outperform VT. Where’s the point?

The VT has longer story since its inception and professional management, I am not arguing that. My 3 years in investing does not really relevant to compare I believe. What I see on todays market is that lot of money goes to low value investment and the VT is not exception. My stock selection on today market is much more careful and I am not in risk of high loss in case of market crash. I do not believe in free lunch and 10% yield in long term on today market. I will be very happy if I can make it ( keeping up the 10%) in longer run.

This is where you are mistaken. VT is not managed. It’s a passive ETF. Includes the whole market and lets it sort itself out through market capitalisation. It holds all the large, established, revenue generating companies in market-cap weighted proportions while at the same time holidng small ones some of which could and ceratiny will become the next Facebooks, Googles and Amazons.

I am using a rather symple method of identifying reasonably or cheaply (say mispriced) stock. I do not believe in too much information. I accept that I will do my mistakes and even if that happenes, I will not lose everything. What I believe more important in long term than high yield.

Regarding the number of selection of individual stock, as far as I know there is no blue print recipe but according to some researches after a certain number of equities a diversified portfolio does not deliver more safety or higher return, however it serves the more info bias.

“Management” I did not literally understand … anyhow I also understand what you are describing but what I say is that buying “everything” is not better than buying some of those same stock but not all the time and only when the market mispricese them. You are also absolutely right that I will not buy the next facebook and google but in my personal preference those are only having price on the market but do not deliver value. Additionally I did not start investing early enough to buy Apple. But I will buy Apple once the price will be on the desired level for me. Do I miss out the price development of Apple until then? Yes, I do but the life is such. And if I put together everything, it needs to be honey for me but not for everyone. I would not sleep well buying the market on today price. It is too high, I need to be very caustious and buying the market on today level is just not safe enough for me. And I also would not recommend anyone buying the market on such irrealistic high price. Still it can be that it will go even higher in short or long time but who can tell.

It’s more important to ensure survival under negative outcomes than it is to guarantee maximum returns

under favorable ones.” (Howard Marks)

The inception of the VT was exactly the time of correction 2008

There was no other direction but only up since then with a very few exceptional short time dips.

Of course it has a very nice return picture for now. How many time of real correction has been experienced? Non. What is the future? We do not know.

What we know: economists at the New York Fed noted that “long-term government bond yields are at their lowest levels of the past 150 years in advanced economies.”

Low interest rates have sent many investors flooding into riskier asset classes that provide the potential for higher yields and returns.

There is no common stock in the U.S. market today (probably the whole world) that yields close to 10%, has a well-covered dividend, maintains a healthy balance sheet, and does not face secular headwinds of some sort.

9-10% yield is considered super high in an environment where most quality stocks yield 2-3%

For disciplined investors, who stick to their risk management strategies, quality requirements and yield targets, real opportunities are getting scarce.

I am only investing in to individual stocks which already proven their ability of withstanding bad times too.

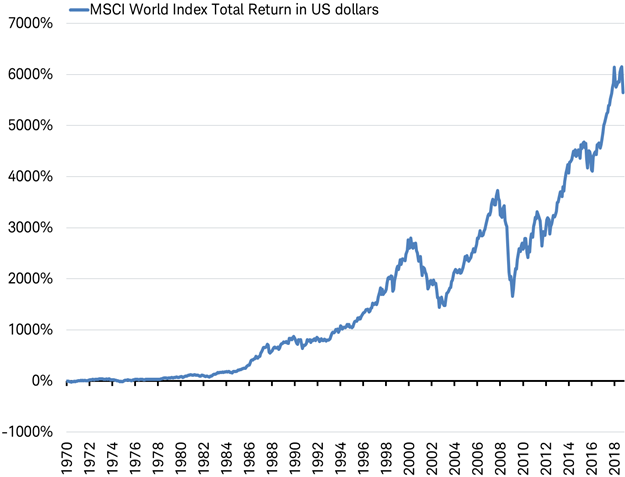

Yes we do. The stock market direction was nothing but up with a few short time dips for nearly 150 years. VT tracks the FTSE All World index which was established in year 2000. It’s entirely irrelevant when the VT ETF was launched. It may be tricky to find a chart of the FTSE All World, but you may look up MSCI World Index, which is very similar, for as far as 1970s.

(note the scale on the left)

You can see how much risk you have to get 30% or half of your money lost in short time if you invest in to this