Because of sheer amount of flows. The actives dont have anything to sell if all the 401ks keep relentlessly flowing money to buy everything

In that scenario, the competition would be between stocks as an asset class and other investing opportunities. Either stocks justify their value relatively to other opportunities and buying them even at very inflated prices keeps making sense (because there is no alternative) or they don’t and other investing opportunities should start thriving, with potentially passive, indexed ways to invest in them getting on the rise, balancing things out.

Not sure if you are serious?

USD 99 trillion and 900 billions have been invested passively in index funds. The remaining 100 billions in active investors have a slightly different optinion. They can move prices at the margin with their 100 billion budget.

At month end (at the latest) another 100 billion (or maybe just 50 billion, or maybe actually 150 billion or maybe 200 billion) passively enter the market, pounding on the relentless bid.

The 100 billion from active investors? They just wouldn’t matter, except for our amusement and speculation here.

I’d say there’s a bubble in active: too many really bad active managers.

If there were more active managers who persistently outperformed the market over 15, 20 years or more, money would flow to them immediately. But, as SPIVA clearly shows, they suck.

So, dear Michael Green, go develop some actual skill instead of whining about passive bubbles ![]()

Buying market index funds is an active bet on the market and increases the value of the market relative to other investments. This can be a bubble.

If the index is constructed well (maybe free-float market cap weighted), it will impact the prices equally, leaving no (additional) opportunity for arbitrage within the index.

If intelligent active capital is too small to arbitrage inefficiencies from “passive” index investment and dumb active investment, their return will increase. They will outcompete other investors and their wealth share will grow until all inefficiency is arbitraged (at least) down to friction constraints.

In the end isn’t the issue more like an equity bubble? If everyone keeps piling into equity, prices will go up, regardless of active vs. passive.

Is that your conclusion, or AI’s?

If the latter, is AI maybe “bullshitting” us again? ![]()

![]() (I mean no offense to you (although I don’t care about AI’s feelings). I hope no offense taken!)

(I mean no offense to you (although I don’t care about AI’s feelings). I hope no offense taken!)

…Or at least not giving us the whole picture.

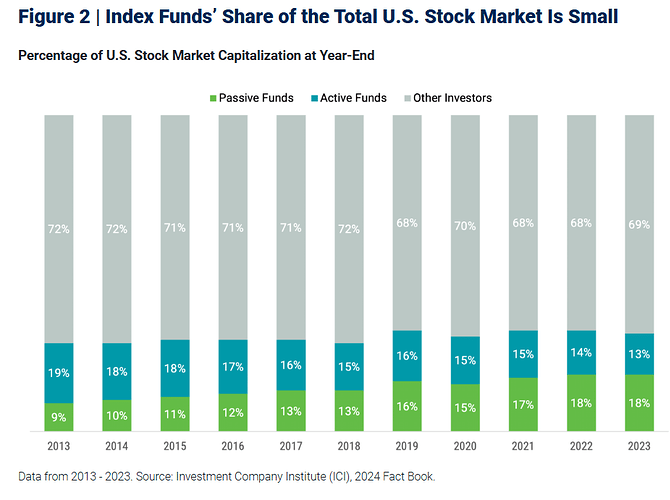

These points seem to be taken from these charts in that report.

I’d summarise somewhat differently.

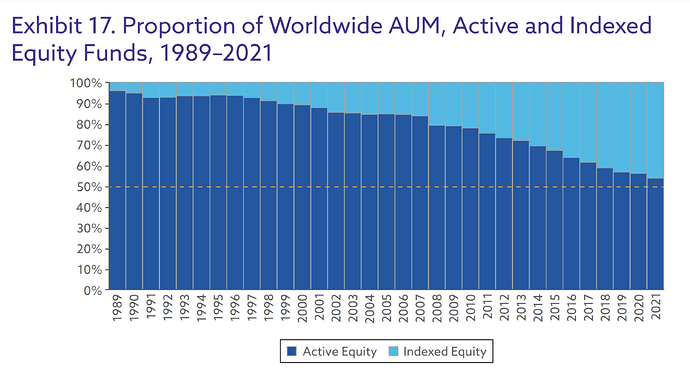

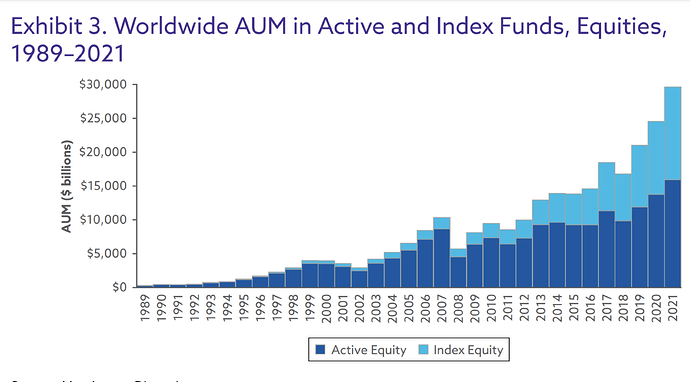

Passive fund is about 60% of total fund AUM.

But total fund AUM is only about 20% of total Equity market value (120 trillion). Isn’t the value outside funds “active” too? @Your_Full_Name 's stockpicking etc. ![]() is in the 90 trillion outside of funds and efficiently & correctly values the equity.

is in the 90 trillion outside of funds and efficiently & correctly values the equity.

source BEYOND ACTIVE AND

PASSIVE INVESTING

THE CUSTOMIZATION OF FINANCE

MARC R. REINGANUM AND KENNETH A. BLAY

So total passive fund is only 10% of total market cap?

→ don’t panic and carry on VT’ing? (if that’s your thing)

Good point, we should always look at total. For US stocks itself, about 18% is index funds and 69% is non-funds

We acknowledge that this still may not provide a complete picture of the ownership of companies attached to passive strategies, given that there may also be passive approaches managed in institutional and retail separate accounts. A recent study considered this reality and estimated the actual ownership of passive strategies between 30% and 35%.1 So, while it’s difficult to determine the total share of passive investing, we know it becomes much smaller when we expand our view beyond mutual funds and ETFs.

Interesting!

I wonder what ‘Other Investors’ are … I would have assumed that most assets are owned via funds (in the article’s terms this includes mutual funds and ETFs), but apparently not.

I think the article suggests that ‘Other’ is or includes “direct holding”, but it’s not entirely clear.

Anyhow, I like it!

yes that’s why they are estimating “passive” strategies to be 35% of market because other also includes family offices etc who might have index hugging strategies too

This is one of the times when stocks have made a significant appreciation and everyone is scared about the future.

It is quite possible that we’re seeing the “unpuzzling” of equity premium puzzle.

The stock market has been reduced to one stock: VTI or VT if you prefer global. The risk of VTI is lower than of any subset of the stockmarket. As we know that investors are compensated for only undiversified risks, the equity premium is reduced to the risk level of VTI.

Hence higher valuations and lower future returns.

PS although it is likely to be true, the returns in the next 10-20-30 years are unpredictable and will look more like noise.