When buying shares in an equity, where do you put the threshold of acceptable investing cost, i.e. broker fees, in relation to the price of the equity? We all know that keeping the TER low is important, but what about the broker fee? As a Mustachian, you will probably invest every month or every other month for a long period of time, so it is important to keep the broker fees low, too.

Looking at the usual brokers, the fee models differ, but all in all, it seems that a fee of up to 0.25% per share is achievable, when investing about CHF 2’000 at a time.

Here is a Google Sheet that does the math for you. Feel free to play around with it. Just input the different variables of your broker and play with the numbers.

If you want a detailed explanation, read on…

Per Transaction Fixed + Percentage Fee

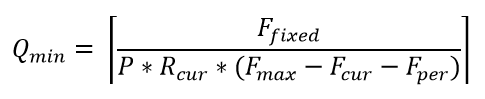

This is the model used by Degiro. The total fee per transaction is actually the most difficult to work out given that you can only have CHF and no other currency in your account. Therefore, you have to account for the conversion rate and conversion fee. The formula to find the minimum quantity of shares to order to stay below a set threshold is:

Where:

- Ffixed is the fixed fee per transaction in CHF

- P is the price in foreign currency

- Rcur is the conversion rate of said currency to CHF

- Fmax is the maximum acceptable transaction fee, in % of share price

- Fcur is the conversion fee, in %

- Fper is the percentage fee on the transaction

(For those unfamiliar with math notation, those brackets around the formula indicate that the result must be rounded up to the nearest integer. For example, if the result is 2.92, you would round it up to 3, as you can’t (most of the time) buy fractional shares in an equity.)

Of course, you also have to account for any monthly/yearly fees. In the case of Degiro, those are the yearly marketplace access fees. Take the number of marketplaces you invest in, multiply it by the fee per marketplace, divide it by the rough number of transactions you do per year, and add the resulting number to the fixed fee (Ffixed).

Per Share Fixed Fee with Minimum Transaction Fee

This is the model used by CornèrTrader and Interactive Brokers. With those, as you have the option of keeping different currencies in your accounts, the conversion fee is separate from the transaction fee, and not taken into account by the formula.

In this model, you have to work out two information:

- Minimum acceptable share value

- Minimum quantity per transaction

Given the fixed fee per share, the minimum acceptable share value is worked out like this:

![]()

Where:

- Fshare is the fixed fee per share

- Fmax is the maximum acceptable transaction fee, in % of share price

Then, once you know that your share has a value greater than or equal to the minimum acceptable price, work out the minimum quantity like this:

![]()

Where:

- Fmin is the minimum transaction fee

- P is the share price

- Fmax is the maximum acceptable transaction fee, in % of share price

In the case of CornèrTrader and Interactive Broker, the monthly/yearly fees can be added to Fmin once you work out those fees and the number of transactions you do, just like explained for the previous fee model.

Again, note that this model doesn’t account for currency conversion fees as those are separate. Depending on how you convert your money, your mileage will vary.