Yes, it does use the same platform.

My girlfriend is in the process of getting an account with TrueWealth, which also uses Saxo Bank. Apparently you also get access to the underlying Saxo account, so I’m curious to see if you can also use their trading platform directly.

Well if I read the IB page right it really destorys the the other options.

if I read this page correctly https://gdcdyn.interactivebrokers.com/en/index.php?f=4969 I only have to pay 3$ per month of inactivity fee until I am 25, by then I should easily have 100k together. The other interpretation is that I have to pay an aditional 3$ per month.

But even in the worst case it looks pretty good, especially the trading fees. I discarded IB too quickly last time becuase of the bad software.

The main question is how this works tax wise, do you have to pay US taxes or reclaim them or something(for All world and swiss ETFs)? Anything else to take into account?

@Alex When I asked I could not get acces the account itself.

I even had to get the ID copy again for my actual account.

Yeah, IB is a pretty good deal, much much cheaper than any swiss broker. Currency conversion alone is insanely cheap: intrabank rates with just a few dollars on commissions.

Doesn’t much matter from tax perspective who’s your broker, it all works the same. They withhold some percentage of dividends, same as any other broker, and you may need to take additional country specific steps to claim it back.

For swiss stocks, 35% is withheld by ESTV and claimed back by declaring stock in your tax declaration.

For US taxes, you file W8-BEN with IB and they will withold just 15% from US dividends, which is fully reclaimable hassle-free with DA-1 on tax declaration.

For other countries it can be a combination of DA-1 and extra steps for above 15% withholding. It’s the same as with any other broker. If the stock’s country has no double tax treaty with CH, like for example HK, you’re screwed and double taxed on dividends.

I will really look into it again. I will definitely make another test account and ask customer support about the 3$ thing.

Saxo does not hurt that bat atm but it will reasonably soon.

I am also under 25 and I have opened an account with IB recently.

IB is between 5 to 3 times cheaper than any Swiss broker in my simulations. IB offers really good exchanges rates and trading on U.S exchange cost around 1$.

"

If monthly commissions are less than USD 3,

Activity Fee = USD 3 – commissions. Example:

Monthly commissions = USD 1.25

Activity Fee = USD 3 – USD 1.25 Activity Fee = USD 1.75" https://www.interactivebrokers.com/en/index.php?f=4969

If most cases, you will pay only 36$ (3*12$) by year including transaction (if only U.S market)

However, you need to transfer money from your Swiss bank account to IB, which will increase overall cost.

Well that looks great. I was not shure if it replaces the normal 10$ or costs extra.

I am planning to create a new testaccount today and check it out further.

I will also have to do something about saxo to not walk into the 180days inactivity period wich would cost me 100chf whereas a transaction costs 18$. The last transaction was like 175 days ago

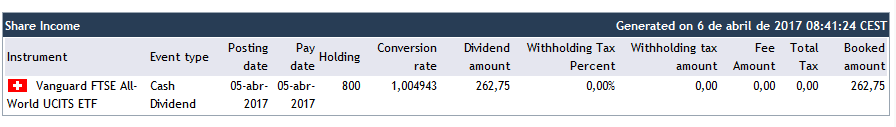

Just received my first quarterly dividend from the 800 units of VWRL:xswx I purchased last month at CornèrTrader, 262,75.-. That’s certainly a nice feeling and a good motivation to keep investing. I’m not used anymore in these days of 0% interest!

sweet, mine hit yesterday as well

ohh, i have to check too^^

@chestwood96:

when I looked for brokers i boiled it down to thse mentioned in MP’s blog post, Cornertrader or IB. I finally decided for CT because the juristicion would be in switzerland as opposed to IB. I can however not quantify this aspect in terms of CHF^^ But since the difference in costs for a passive portfolio is so tiny, I am willing to pay it.

I think the most interesting aspect is not having the 0.5% spread on FXCONV that CT applies. But as you say, I’m still on the fence as to whether that justifies going to IB (different jurisdiction/not sure how/if Brexit will affect things).

I just put an order in for one share of VWRD on saxo to avoid the 100CHF inactivity fee that I would get tomorrow, interestingly the fees were only 10CHF and not he usual 18CHF, no idea what is going on there.

IB does not even look as bad as I remember it and the fees are really low. There are the transfer fees which I will have to look into but it looks very promising. It also has the upside of being international so I could use it if i moved to another country which is very possible (this forum is filled with expats so you probably understand).

I also got dividends YAY.

Hi @pombeirp

How is it you didn’t get taxed? Is it because you trade it in CHF?

I have my Vanguard all-world in USD and got taxed 30%

I guess I will have to fill a DA-1 next year to claim it back. Have you guys ever done it?

It is indeed a nice feeling to get dividends paid

Cheers!

If you are trading U.S securities with a swiss broker, the tax is 30% on dividends, you need to fill DA-1 and RETENUE SUPPLÉMENTAIRE D’IMPÔT USA.

If you are trading with U.S securities with an U.S broker, the tax is 15% on dividends, you need to fill DA-1,

He didn’t get taxed because he bought the fund based in Ireland and you bought the fund based in U.S. The Irish fund has a ??% tax deducted directly from the fund which is not refundable.

It’s not strictly speaking about whether it’s a US broker or not. It has to be a “Qualified Intermediary” in the eyes of IRS and then if you’ve filed W8-BEN and treaty allows it, the US withholds just 15% tax.

The other 15% are withheld in Switzerland if you’re unfortunate enough to bank with a swiss broker, that’s the “zusätzlicher Steuerrückbehalt”, see: https://www.admin.ch/opc/de/classified-compilation/19981781/index.html#a11. DA-1 should let you reclaim both. Unlike with IE, LU, and other european funds, where 15-30% of the original dividends are irrecoverably lost along the way. The 0% withholding you’re seing with IE is after those dividends were already lost.

Hey @hedgehog,

where would I have to send the forms to?

The W8-BEN to my broker and the DA-1 to my cantonal Tax authority? do you know this?

Thanks!

hi @nugget,

yup, w-8ben to broker and da-1 to tax authority, you’re right on this one.

Hi @hedgehog. Are you saying that holding VWRL/VWRD which are based in IE at a Swiss broker, will always make you lose 30% of the dividends without possibility to recover them? Do you have any sources to that?

@pombeirp as far as i know when you declare it on your tax documents you get back the 15% withholding from the swiss side.