It is an interesting discussion. I never really thought about it but now that i did, I tried to formulate the equation. I am going to ignore the impact of witholding tax rate for foreign dividends for now but i know that is also different for swiss residents.

Higher level understanding from my side is that 3rd pillar defers the taxes to later period and is often taxed at lower rate (lump sum) than marginal tax rate…BUT the whole amount is taxed for lump sum tax and this is important to consider. Taxable account like IB would obviously reduced effective income yield but it is not taxed at the end of the period for capital gains.

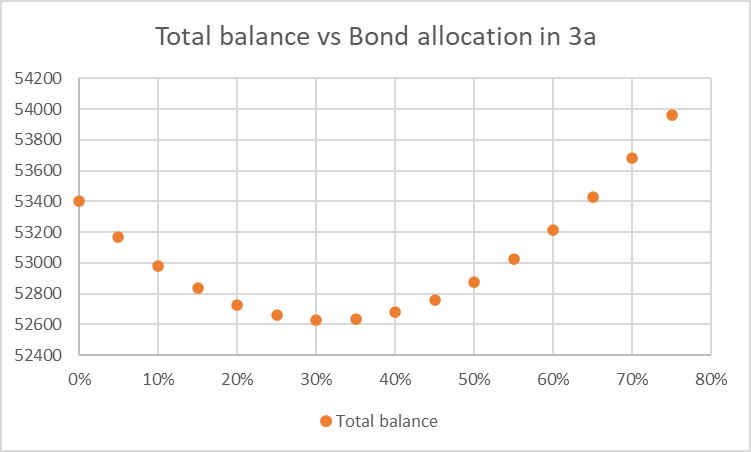

Wolverine already highlighted his thought process which i think makes total sense. However i just wanted to do the math ![]()

| N = Number of years to retirement | |

|---|---|

| r = income yield of investment | |

| t = Tax on income on yearly basis (defined by marginal tax rate) | |

| r* = r*(1-t) effective yield post tax | |

| c = capital gains yield | |

| Lt = Lump sum tax at withdrawl (defined by residence domicle at time of payout) | |

| Value of 3a account at time of retirement | ((1 + r+c)^N) * (1- Lt) |

| Value of IBKR account at time of retirement | ((1+r*+c)^N) |

So i tried to simulate this. But there are many variables which can affect the decision. Some are below

a- If your contribution to IBKR is more than contribution to 3a OR NOT

b- what is your assumption for expected income and capital gains yield for asset class (Stock vs bonds)

c- what is your marginal tax rate

d- what is your lumpsum tax rate

e- What is your overall asset allocation (stock vs Bonds) across IB /3a

An example

- Assumed bond etf income yield = 1%

- Assumed bond etf capital gain yield = 1%

- Assumed stock etf income yield = 2%

- Assumed stock etf capital gain yield = 4%

- Contribution to IBKR annually is 2X of 3rd pillar contribution (i.e 14K in IB and 7K in 3a) and I will only simulate one time contribution and not yearly contributions

- Holding period 20 years

- Marginal tax rate 30%

- Lumpsum tax rate 10%

- Targeted overall Bond allocation = 25% (IB + 3a)

Variables that can change are following

- Bond allocation in IB

- Bond allocation in 3a

- Constraint is that weighted average bond allocation needs to be same as 25% target

Conclusion - model is suggesting to put all bonds into 3a. But i found it interesting that having a split strategy is reducing the overall returns. I would love to see if someone can challenge this conclusion. I have a feeling i might have missed something.

To me intuitively this makes sense because the objective of 3a is to have tax deduction at the time of contribution and i believe the lumpsum taxation at the end reduces the incentive to grow this account. So if this account does not grow that much, then it doesnt matter much. However, this might change if Lumpsum taxation was much lower or much higher. I would let you simulate

P.S - I wanted to attach my excel simulator but i dont know how to do that on this forum