Invest the 300k into CHDVD.

CHDVD then delivers about 11k in distributions per year. Take out the remaining 7k per year by selling down CHDVD as necessary.

- While the dividends are taxable, it won’t matter much in her tax bracket.

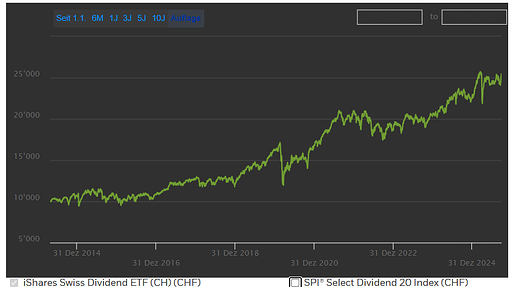

- Selling down parts of CHDVD will likely be addressed by CHDVD appreciating faster[$]

- Both dividends and capital gains will address inflation.

As others have mentioned, she’s probably entitled to Ergänzungsleistungen.

Edit:

Sir, you forgot compounding.

$ CAGR since inception in April 2014 to April 2025 has been a cool 8% or so.