Thanks for your answer.

I’m sorry I should have done more research on the forum.

Your answer is pretty clear.

No worries. To be honest after reading so many posts on that topic on the forum I started doing some research on the issue (you find a lot when looking for “gewerbsmässiger wertschriftenhändler” on google. I’ve been filling taxes in ZH for the past 15 years and the year we bought a flat we had a 500k turnover on our portfolio and some of those positions we had hold for less than 6 months. This did not triggered any red flag. I also do some options for fun, without much success I must say and that never triggered any audit of my taxes.

Reading the reports from the kantonal / federal courts on the matter you see that the amounts involved are massive, in the range of several 100 of thousands of profits in a year. To be honest I guess only a handful of people can be affected by this…

Because what if you‘re RE and more than 50% of your income comes from capital gains? Will all of the capital gains from selling then be taxed?

There are no capital gain taxes in Switzerland.

I know. What if all your income comes from the stock market (non dividend) → professional trader → income tax

We‘ve had that discussion regarding the professional trader status over and over again (though it‘s somewhat scattered around the forum). I‘ve recently quoted criteria from the ESTV Kreisschreiben. By holding „a lot“ of Vanguard Funds and living off of them, you’d clearly breach one of those. But it’s a formal fallacy to think this alone would make y a professional trader.

Except that’s not how the classification works…

I get your points, not sure what happens if you start selling and live on it and what the tax office thinks of it. And laws can change, I stick to distributing.

They can and have.

The tax office is going to make no distinction between VWRL and VWRA - or accumulating and distributing funds in general - from a tax perspective. To the contrary, the tax admin put considerable effort and into making sure accumulating and distributing funds are taxed the same.

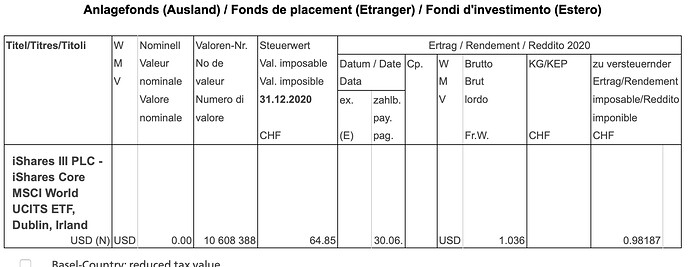

An accumulating ETF‘s (retained) income is taxed as your personal income, even though you as the investor don’t receive a payment but only see a capital gain in your account statement.

All that I know. I’m talking exclusively about the RE phase and what happens then. Higher costs for selling then for sure, you might make it up with automated reivestment during the acummalating phase of your wealth…

I probably pay like 3 CHF when I trade 40k, it hardly matters.

Though that’s not what the qojenniffa asked in his/her original post. ![]()

In any case, you can switch from one ETF to the other later on, if need be or the tax situation changes, i.e. before a new comes into force. Might Switzerland introduce a capital gains tax? Maybe. The Germans even did it retroactively. Kind of. Limitedly. Switzerland though? No way.

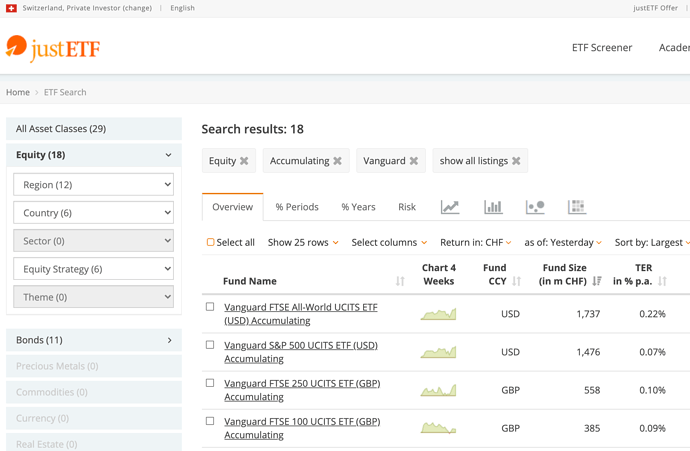

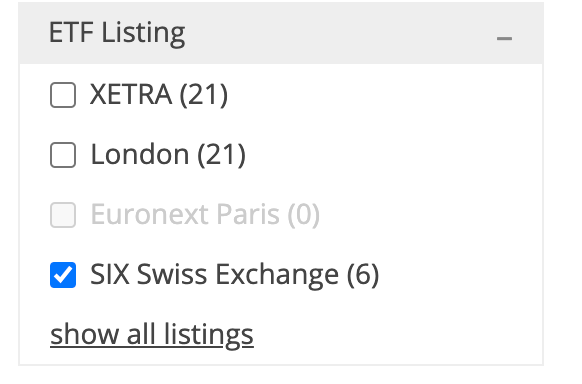

VWRA is not listed on SIX. You can make it visible on JustETF when you click “show all listings”

Then how does it work? Do you know 100% that there is no risk? I think @MUFC_OK raised a very good point. Once retired, if all your income comes from either dividend or selling your stock, you have two options. Let’s say you need 4% per year:

- option 1: 2% from dividend, 2% from selling stock. the capital gains from selling the stock are lower than 50% of your income, no need to worry

- option 2: since you own an accumulating fund, you need to sell 4% of your stock each year. Much more of your income comes from capital gains.

I think for a Swiss investor it’s just easier to invest in distributing ETFs. Since you do it periodically, you can just reinvest the dividend on top of whatever you planned to invest. The time not in the market is negligible.

It also makes it easier to rebalance over time. As long as you invest at least each quarter (best after dividend) you can put the money back in with your normal order.

I don’t think there’s any world where realizing capital gains when selling long term holdings is not “private wealth management”. The circular 36 even explicitly recognizes that dynamic management of wealth is allowed (so frequency of transaction doesn’t imply professional status).

The one clear thing that might be a trigger is using external financing (e.g. loans).

By the way the Circular 36 is fairly readable (chapter 4 explains how they would decide and the weighting of the criterias).

Searching around there’s some fun jurisprudence, e.g. 2C_389/2018 - 2019-05-09 - Finances publiques et droit fiscal - Staats- und Gemeindesteuern des Kantons Luzern 2014, direkte Bundessteuer 2014; where someone actually wanted to get the pro status (they had massive losses), when they were doing 88 transaction per year with 5M CHF. But since they were losing money they obviously can’t be considered professional ![]() (because professional would seek a profit).

(because professional would seek a profit).

You mean this thing?

1-036-D-2012-d vom 27.07.2012 (PDF, 254 kB, 12.05.2017)

Where do you find things like this? You read somewhere online or you did you stumble upon it at work? When I have a free minute, I will give it a look. Reading 8 pages of legal German is not my favourite free time activity ![]()

It’s easier for me since it’s available in my native language ![]()

The one thing I’ve found is that some cantons do publish some clearer guidelines, e.g. Bern: http://www.taxinfo.sv.fin.be.ch/taxinfo/display/taxinfofr/Commerce+professionnel+de+titres (less than 100 transaction per year gives you safe harbour)

That‘s good to know that our canton has this sorted out! So if you stay under 100 transactions and especially if you buy and hold as loads of us do we should be fine

What in life is 100% certain? There’s about as much 100% certainty in life as for the price of oil never becoming Zero (cause it costs money to produce oil, so it can’t drop below zero, can it?).

Otherwise the intention of the lawmakers and the interpretation of the tax authorities and the Swiss supreme court are pretty clear.

It’s just taxable income. Take a look at any accumulating fund (well, except VWRA, incidentally, cause they’re late reporting and it’s a new fund), and they’re taxable income:

…which will not be treated differently than in distributing funds.

Put differently: Not even today are dividends in accumulating funds treated as capital gains from a tax standpoint. For the very reason that this enables them to (transparently) tax them just the same as distributing funds.

I am using monthly investment plans to invest in ETFs. I’ll make 400 EUR payment to my broker - and the whole 400 EUR gets invested into the ETF I’ve chosen. It’s all automated, so I don’t have to worry about any remaining balance from dividends. Much easier than accounting for that each month.

If get 20’000 dividend and sell 22’000 (bought for 2’000 so capital gains are 20’000) then capital gains are 50%.

If I sell 42’000 (bought for 4’000, 38’000 capital gains) 20’000 of “virtual” dividend gets taxed. capital gains are 66%.

Not sure about the correctness of this calculation, but you see the problem? Anyway, maybe this circular 36 solves it.