That very statement reads like coming from a professional trader.

Does it (implementing that strategy) guarantee you’ll be considered one? Probably not.

I think its human nature to speculate ![]() . Not a professional trader haha.

. Not a professional trader haha.

Equipped with youtube, robinhood, and r/wsb everyone can become a professional trader in under an hour. ![]()

If you are holding it and the tax office decides that you are a professional trader, what would they tax you on? In my opinion you don’t make any taxable profit as long as you don’t sell it but I might be wrong.

Holding a leveraged, daily rebalancing ETF long-term is a losing propostion.

Backtests say otherwise. It’s veeery volatile, but will probably be worth it longterm.

Well I won’t be the one to say if it’s a smart investment or not but they said holding ![]()

On the other hand if the intent is to daily trade this ETF then I’m pretty sure the tax authority will have something to say about it.

The ones on and conveniently starting with the unprecedented tech-fueled US bull market of lately, you mean? ![]()

Going to a more “normal” performing market, we can compare

- LU0252633754 Lyxor DAX (DR) Acc

- LU0252634307 Lyxor Daily LevDAX Acc

The unleveraged ETF beat the 2x leveraged 120% to 70% since inception 14 years ago.

PS: Granted, that was shortly before a bear market, and if we’d start out three years later, the picture would reverse, with the LevDAX product beating the unleveraged 280% to 160%.

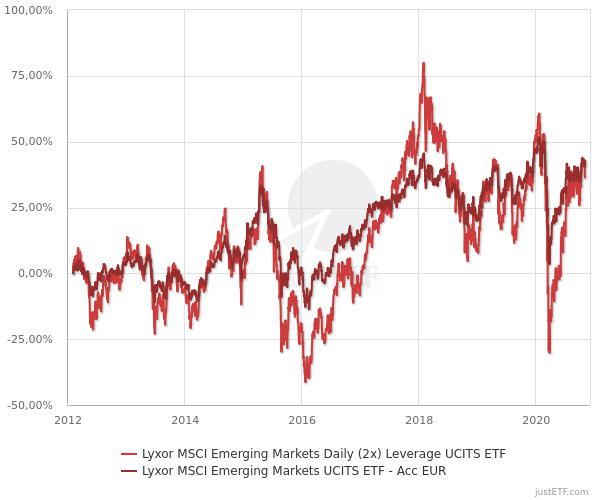

PPS: Or doing this for Emerging Markets ETF (from ETF inception, I’m lazy to backtest):

(That’s me having chosen “conveniently” the end date, for purposes of illustration, since the leveraged fund has overtaken the unleveraged fund by 15 percentage points over the last 5 or 6 weeks)

So why is everyone here so religious about VT?

At least did you put your money where your mouth is, with that overperformance of daily leverage? ![]()

Does anyone know if the professional trader sticks to you forever or is this evaluated yearly?

Well, basically I went pretty active this year and probably satisfy most of the criteria to be called a professional, with the exception of trading options.

The thing is, I do not have any capital gains that could be taxed. I’m accumulating all the winners and cut only the underperformers. I also use margin, but I have just enough dividends to cover the interest.

What’s in store for me in this case? ![]()

Even if you die, your children will have to pay taxes when they sell your assets in 50 years.

Afaik you can/will be re-evaluated. Regarding what’s in store for you, check if your canton’s tax office has any guidance on the topic. After reading that for my canton (and BE which I found first), I think people are too paranoid about this.

Considering how volatile the markets have been this year, the activity could be justified with portfolio management and trying to avoid losses. Btw, if you didn’t have any taxable capital gains, does that mean you made some losses by culling the losers? If you were classified as a pro, you could then deduct the losses.

In any case, would be great if you could share the outcome when the tax return is done.

I am holding leveraged ETFs - UPRO and TMF; would these qualify me a professional trader? Wondering if I should get out of these positions before 12/31

Regardless of whether it would or not (personally would be surprised if it does), going out before eoy won’t help you ![]() (or would make things worse as it would be a shorter term position)

(or would make things worse as it would be a shorter term position)

I am looking at the official criteria from Swiss Tax authority (translated by deepl)

The holding period of the securities sold is at least 6 months.

The transaction volume (corresponds to the sum of all purchase prices and sales proceeds) per calendar year does not exceed a total of five times the securities and credit balance at the beginning of the tax period.

The realization of capital gains from securities transactions does not constitute a necessity to replace missing or eliminated income for living expenses. This is usually the case if the realized capital gains amount to less than 50% of the net income in the tax period.

The investments are not leveraged or the taxable investment income from the securities (such as interest, dividends, etc.) is greater than the proportionate interest on debt.

The purchase and sale of derivatives (in particular options) is limited to hedging own securities positions.

If these criteria are not cumulatively met, professional securities trading cannot be ruled out. The corresponding assessment is made on the basis of all circumstances of the specific individual case (cf. no. 4).

My understanding is that you have to declare the open stock/ETF positions as of the 12/31. This what I have declared my last two years of tax returns (Basel Land) here in CH.

Yes, but since you’re also taxed on the income raised through dividends, I think it makes sense to also enter the details about the buys / sells you’ve made, especially if you bought much towards the end of the year.

I’m not speaking from experience, but I’d think that if you only list the holdings as of 12/31, the tax authority could assume you’ve been holding all that for the entire year and collected dividends on every single payout.

You need to declare dividends as it’s considered as income. Not declaring dividends is hiding part of your income.

They will ask a broker statement and check.

In all Tax programs (easytax, baltax) that I know it “leads” you through the fields including when you bought and how many.

And dividends are certainly a taxable and declarable income, if you omit it’s false declaration.

That said, you can get away with it for many years I’m sure, it’s difficult to find out as banks normally only give a EOY statement. And I’ve only ever been asked to, as a random spot-check, submit an statement of a dividend payout I declared, not prove that I didn’t actually get a dividend I didn’t declare ![]()

I suppose if you increase your wealth a lot by day-trading, that will ring alarm bells.

I clarified with my tax advisor recently and specifically asked if I need to report all transactions.

He said I only need to submit the EOY report with balances, dividends, and costs. On occasion the tax office might ask details about the dividends but typically this does not happen, he added. This is in ZG and my dividends are not significant so that’s probably why.

Depending on the dividend report’s contents, there might be enough info already. I also checked the tax form instructions for ZG and in their example for the form VW they only list the positions of the stocks, not the transactions. There are begin and end dates for other types of securities like open/close dates of accounts and I think entry/exit from funds.

Ok thank you, that’s good to know. I have only started out investing last year and only held a single (small) position and found the most straight-forward way of entering is just declaring my 2 buys over the year into the tax program which took care of correctly calculating the dividends I had earned (not even enough to fill out any reclamation forms ![]() ).

).

I traded with quite a bit of margin loans this year during the recovery period (not anymore though). Am hopeful not to get hit by the professional trader status, giving that most of the earnings remain unrealized. As far as I understand it, only the year I realize my earnings will be critical for the assessment.