If so, then 27% of your income will be taken away by wealth tax.

GE resident here. It is the only canton I ever experienced.

I was hoping that the high taxes on income and wealth were used to lower the health insurance cost… this is not the case apparently.

In terms of housing, it is incredibly expensive (like in any other big Swiss city I guess).

It’s a bit sad to see how much I could save in taxes (and health insurance) by just moving to Zurich. As a believer in the efficient market, I tell myself that salaries must take into account the higher cost of living and the higher taxes. But is it really the case? I’m not sure.

Unfortunately, GE has high taxes and high living costs. At least Basel housing is quite reasonable compared to GE and ZH.

The health basis cost différence in French speaking cantons could be explained by an aging population as most cross border French workers stay in their country of residence after not working.

French attitude is also to consume more health service than German parts.

On housing, you got little choice but to rent in Geneva. Most of the buildings are own and managed by pension fund that holds 25% of the assets in RE.

The cantons are supposed to be more social with good unemployment benefits but little chance to get public support for raising children.

However you get a local opportunity to work in an international organisation and pay no revenu tax. But expect salary to be lower.

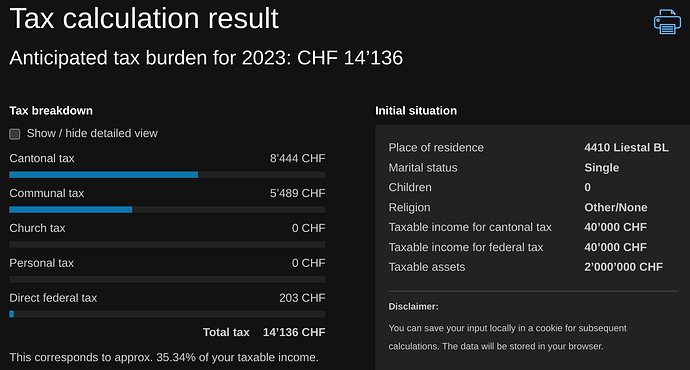

12.5% for a single person, no kids, living in Waldenburg, which seems to be one of the higher taxing Gemeinden of the BL Kanton. Taken on 80K total income and a wealth of 2M with the apparently standard 90K deduction on wealth.*

Still high, I grant you, but not 34% high (more like 20% with income and wealth taxes taken into account, still more or less in the ballpark of the 2 months of income put forward by @IL-BOSCO ).

*calculated using the federal tax office’s calculator (thanks @Moustachienne !): https://swisstaxcalculator.estv.admin.ch/

I also used the same calculator. Note that I said taxable income and wealth. Maybe you input gross numbers into the calculator?

From what I see, at least in IT, the salaries in GE or VD are (much) lower than in ZH. There is also less job offers, so… it’s really bad from all dimensions ![]()

Sorry, I don’t get it.

If the old cross-border workers remained in France once retired then in GE there should be more young healthy people, driving the health insurance cost down.

It’s since I arrived that I’ve been trying to understand which factors are playing an important role in the difference in taxes and costs.

I never understood it either. I lived in 4 different cantons and was surprised by how much health insurance costs could change - even with the same provider.

I could only guess that maybe costs are more expensive in one canton vs another and so the insurance has to charge more?

Yeah you are correct I mixed things up.

You should be healthy and not consume lots of medical cost before your 60ies.

So French cross-border workers pay a half price contribution to LAmal (189 by month with Helsana for 300 franchise).

They are usually healthy until they will switch back to the French CMU once retired.

So in Switzerland we just got aging people that retire to Switzerland.

The price difference should be only the difference of consumption of medical services between French and German cantons.

Geneva resident, marginal tax rate incl AVS ~45%

What can you do about it?

- Leave

- Work less

- Prefer capital gains (versus dividend income or interest)

I chose 2 & 3.

Note that Geneva is one of the cantons which currently has “bouclier fiscal” to prevent confiscatory taxation. It means if you have large wealth tax and low income, wealth tax is capped. Basel Stadt may have something similar , but not BL

Is there not a 4th option where you could also buy a property and perform energy efficiency build and repair ?

5th start a family life with 1 kid and put them on daycare. You could deduce up to 26kchf of the cost

We’re getting at roughly the same level of nominal taxes but yes, I have related that tax amount to gross and not taxable income. If we’re going to consider wealth tax in relation to income, and not wealth, using the FIRE way of linking the two with SWR, I don’t see a reason not to count the 50% tax exempted income coming from capital gains. Having high “deductions” and thus low taxable income shouldn’t be used to generate artificially high tax rates: if I’m taxed at 100% on 1% of my income, my tax rate isn’t 100%, it’s 1%.

The way it’s designed is that costs are assessed on a cantonal basis (and subcantonal basis for cantons with several regions of price) with half the costs being paid for by insurers (so, insurees) and half by the cantons (so, taxpayers). This is before taking into account subsidies which increases the share of the costs paid through taxes and reduces the one paid by lower income insured people.

There are many factors at play that contribute to costs in a given canton/region, two of which are the efficiency of the health system (mainly determined by how the canton handles its hospitals) and the kind and quantity of healthcare used (people closer to a hospital have a higher likelihood of using costlier emergency care while people more remote are more likely to resort first to their family doctor or to completely give up on some level of care (which can be costly too), so cities would have higher costs than the countryside).

Of course, there are a whole lot of other factors at play, some depending on our insurance system and insurers themselves (administrative fees, for example, insurances are also somewhat allowed to use some reserves from some cantons to secure their funding level in other cantons, there’s been some publicity about how the high premiums in Vaud had been used to allow for lower premiums elsewhere a few years back), some on healthcare providers (unnecessary care being prescribed), some on political policies (what drugs and/or care are being reimbursed, which can favor the pharma industry or the consumer) and so on.

While I generally agree, one caveat is that the total return also needs to compensate for inflation. And I think calculating taxes as percentage of inflation-adjusted return may be reasonable. Depending on the investments, the taxable income might make up more than 50% of the total inflation-adjusted return.

In Geneva if you are someone who would otherwise invest their savings, buying a property is usually a lifestyle decision and not the best way to optimize your wealth. Consider low yields (2.5%), high purchase taxes (~6%), opportunity cost, high taxable rent in GE

If you have a special skill or insight on the market (property developer or tradesperson) or would otherwise leave your savings sitting in the bank then it might be different

Might reduce taxes but certainly not total expenses !

As a high earner in Geneva I feel the same…

Optimizing my capital gains investments rather than improving my work/entrepreneurship because my bonus/side-gigs are taxed at 50% vs capital gains at 0%. Stupid system.

Would move to another canton if I didn’t have a good job already here. I see 0 personal benefit to higher taxes here vs level of social services and general public office efficiency compared to other cantons.

You have to be aware that those tables compare only the Kantonshauptorte, meaning the capital of each canton (Liestal for BL). I m pretty sure there are Geneinden in BL that have a lower tax rate then some of the gemeinden in SO.

I think best is to us the ESTV tax calculator with geographical comparison as others have mentioned already.

BL resident here. Yes, My rent situation is incredibly cheap. <1k for 2ppl. at 70 sqm + garden, river view. But it was an ultra lucky shot.