I think this the material for structured products which will allow us to extract much higher fees create more value for everyone involved.

NVidia.

It’s still not for me (as I want that cash flow now), but I really enjoyed the FASTgraphs reading out loud analysis of NVidia on YouTube by Colton Carnevale.

Is this Chuck’s son? Chuck’s more fun to watch, I feel!

Now nVidia FOMO…felt it so many times since buying at $200 and selling at $400, now I tell myself I already got my tech bet in TQQQ. Told myself tens of time already ![]()

I bought, sold and even shorted it ![]()

You heard of the TACO trade, well, today was the PMACO trade.

I sold: MDT, VTRS, AMD, SPPP.

Wait, what?

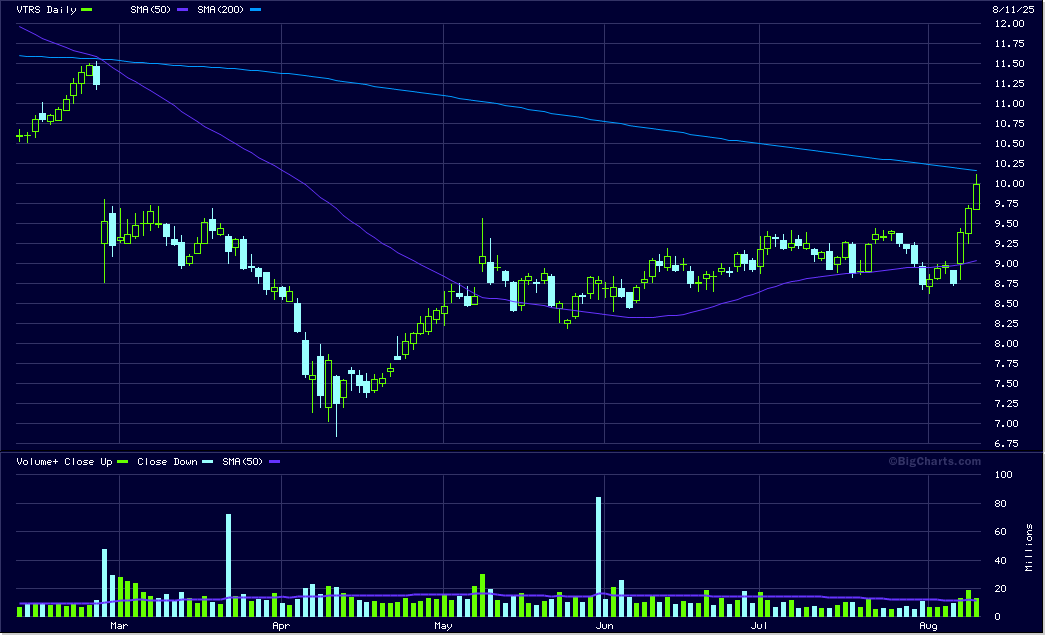

A seller needs a buyer, I added twice in July and once in August to my VTRS position. Nice run since the numbers, closing the gap:

Nice run

Yeah. The numbers for VTRS still look great. I can understand why a momentum buyer would also purchase.

Actually it is in my dividend strategy, not in the momentum one. The last rest of Pfizer from the old days that remains there…

I forgot to say, I decided to gamble on some speculative areas: silver miners and junior gold miners via ETFs: SIL, GDXJ.

I am an absolute dummy in physics, but I had to think a lot about this. Why can there be so many different momentum strategies with stocks if the formula for momentum is that easy and clear?

Because some parts of the formula are probably not that clear. What exactly is velocity?

The dictionary says “The speed of something in a given direction”. OK, now we have speed and direction. Direction is clear, there are only two possibilities and zero: up or down. We want that thing to go up. But what the hell is speed?

Again the dictionary helps, but opens more questions: “The ratio of the distance traveled by an object (regardless of its direction) to the time required to travel that distance.”

We have two unknowns more, distance and time. I know of momentum strategies that want those two variables being “gentle”, like easy, not too much volatility. I think Clenov describes something like that in his second book about stock momentum strategies.

But what about time? In any given moment in time the distance traveled is exactly zero. We need time to measure speed. What time?

So now we have a base for my “endless possibilities to calculate momentum”. Distance and time.

Went nice, so far.

Not sure as well, if I should sell PLTR, huge gains within three weeks. Maybe buying an MSCI World with that money, why not.

Edit: what do you guys think about commodity futures in an ETF, as e.g. CTA? Nice beta.

Intro

Narrator: “Just one sentence by @cubanpete_the_swiss, but a swath of paragraphs and footnotes by Goofy … Read on at your own peril waste of time.”

Goofy: “I’m a non-momentum Physicist investor theorizing about financial momentum considerations, so probably best to ignore my comments.”

Reply

I think I have to apologize. I was just being a smartass flexing with a simple physics formula.[α]

Momentum in physics is easy to define – and that’s really just it, you define it (mainly so you can do further calculations and definitions and state laws of physics by using fewer terms – as it depends on two fundamental physical properties alone, mass and velocity.[Ω]

Then, maybe more on the language side of things, the term “momentum” has its variants of interpretations, even different in different languages … In German, “momentum” – Impuls – is fairly restricted to phyics, and if not in physics, it’s maybe best translated as “Schwung” (closer to the English momentum), but Impuls can also be something that someone spontanously has the urge to do, based on some intuition or sudden insight.

In English, the term momentum is more closely defined – language wise speaking – although I am not a native speaker. I believe it’s more closely aligned with the original physics definition of it: something is big and has velocity, and it willl have impact the larger its momentum should it hit something (like a ceiling price level).

With financial instruments, I believe you can – and probably should – use any number (aka not just two) of properties of the underlying (and the surrounding objects, aka the market) to define momentum – maybe not any number, but certainly as many as seem suitable or interesting – that it seems to me infeasible to define a momentum in stock price.

Actually, let me backpedal: infeasible to define one universally valid stock price momentum formula. You may define one for yourself and your strategy in your portfolio, and it might work just fine for you. For many years even.

But if everyone knew of this formula that has worked so well for you while you kept it to yourself and they would now start applying your momentum strategy to their portfolios … some would replicate your strategy and it would be successful for them for a while, too, but eventually the reflexivity of that setup would become so extreme that fundamentals would kick in and even the most optimistic hyperbole would collapse.

E.g. a company with initial positive momentum but eventually without any free cash flow running out of money (perhaps running on empty even for many many years), then price would eventually follow, too …

Anywho, I’m a non-momentum Physicist investor theorizing about financial momentum considerations, so probably best to ignore my comments.

α While Goofy actually has a Physics degree see Goofy entering that middle school on the first day of the school year:

Ω Yes, there’s angular momentum, too, for completeness, but same line of thought: momentum is conserved, a fundamental law of physics and a direct consequence of Newton’s Third Law of Motion.

If the correlation to stocks is that low as they claim, you could make Shannon’s demon work a bit.

Shannon’s demon says something like if you re-balance two non correlating investments regularly you can make money even if each of those investments lose money.

Thanks, good points.

I did not publish the exact formulas for my momentum strategy. I did however for the dividend strategy.

The main reason for not publishing the formulas is the liquidity of some of the traded instruments (I want to trade first). And, of course, it works nice but the time is too short to proof anything, only trade this since 5.5 years.

If this strategy can maintain its performance level I will probably soon hit size limits, but by then having made more money than I can reasonably spend.

(But then spending money not reasonably is probably easier than making money…) ![]()

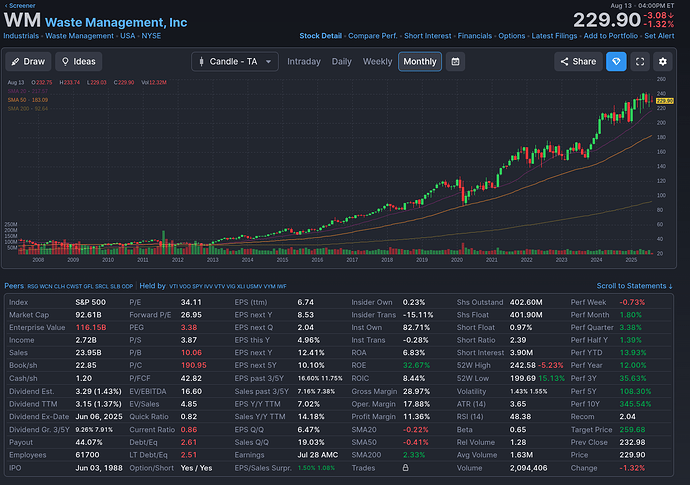

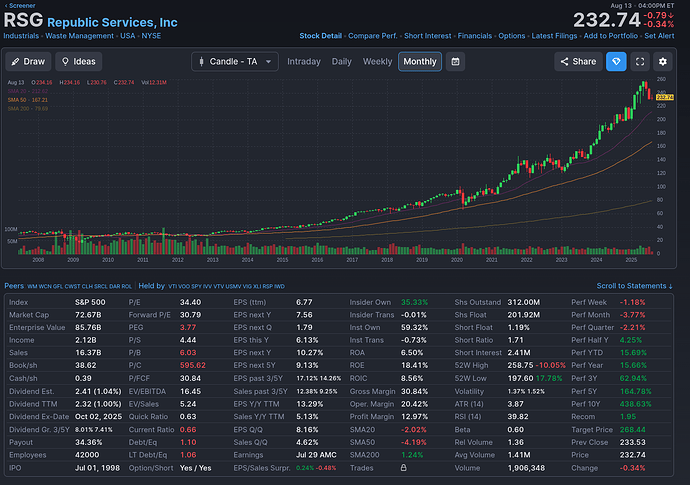

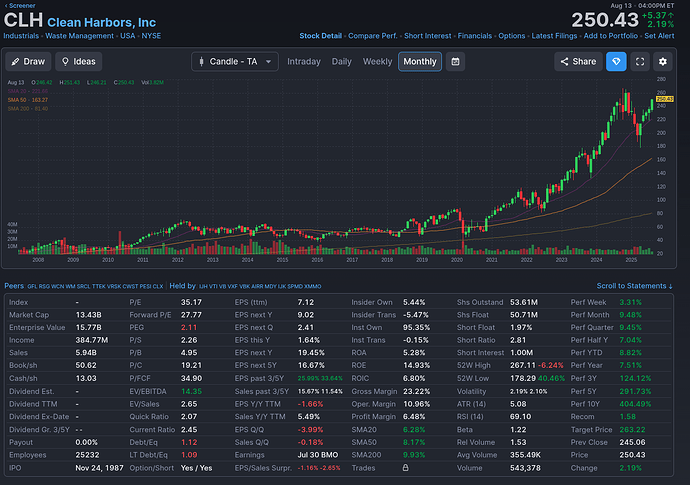

What is it with waste management companies? I thought of adding some to my portfolio and it seems I’m very late to this party:

To mix things up a bit, I asked ChatGPT to help me come up with a shortlist of companies that might be less volatile and more suited to a conservative portfolio. Here’s what it came up with:

| Symbol | Name | Country | Theme |

|---|---|---|---|

| TCL | Transurban | Australia | Toll roads (CPI-linked schedules) |

| BIP / BIPC | Brookfield Infrastructure Partners / Corp | Bermuda / Canada | Global infrastructure operator (inflation-indexed contracts) |

| DG | VINCI | France | Concessions & contracting (incl. French motorways; CPI-linked) |

| IG | Italgas | Italy | Regulated gas distribution |

| FER | Ferrovial | Netherlands | Transport infra & concessions |

| VPK | Royal Vopak | Netherlands | Tank storage (CPI-indexed contracts) |

| AENA | Aena | Spain | Airports (regulated/contracted elements) |

| ALLN | Allreal | Switzerland | Swiss – real estate (residential/commercial) |

| BALO | Bâloise Holding AG | Switzerland | Insurance (domestic focus) |

| BCGE | Banque Cantonale de Genève | Switzerland | Regional Bank (Geneva) |

| BCVN | Banque Cantonale Vaudoise | Switzerland | Swiss – regional bank |

| BARN | Barry Callebaut | Switzerland | Food & Beverages (domestic base) |

| BLKB | Basellandschaftliche Kantonalbank | Switzerland | Regional Bank (Basel-Landschaft) |

| BELL | Bell Food Group | Switzerland | Swiss – food staples |

| BEKN | Berner Kantonalbank | Switzerland | Swiss – regional bank |

| BKW | BKW | Switzerland | Swiss – utility / grid |

| CKWN | CKW | Switzerland | Swiss – utility / grid |

| EMMN | Emmi | Switzerland | Swiss – dairy staples |

| GALE | Galenica | Switzerland | Swiss – pharmacies & distribution |

| IVS | Investis | Switzerland | Swiss – real estate (residential/services) |

| MOBN | Mobimo | Switzerland | Swiss – real estate (residential/urban) |

| NESN | Nestlé | Switzerland | Swiss – consumer staples (global) |

| PSPN | PSP Swiss Property | Switzerland | Swiss – real estate (commercial) |

| REHN | Romande Energie Holding | Switzerland | Swiss – utility / grid |

| SGKN | St. Galler Kantonalbank | Switzerland | Swiss – regional bank |

| SUNN | Sunrise | Switzerland | Swiss – telecom / essential services |

| SLHN | Swiss Life Holding AG | Switzerland | Life Insurance & Pensions |

| SPSN | Swiss Prime Site | Switzerland | Swiss – real estate (commercial/mixed) |

| SCMN | Swisscom | Switzerland | Swiss – telecom / essential services |

| VLIT | Valiant | Switzerland | Swiss – retail/SME bank |

| ZUGN | Zug Estates | Switzerland | Swiss – real estate (residential/office) |

| ZURN | Zurich Insurance Group AG | Switzerland | Insurance (domestic base) |

| HICL | HICL Infrastructure | United Kingdom | Listed infra trust (regulated/availability revenues) |

| INPP | International Public Partnerships | United Kingdom | Listed infra trust (many inflation-linked assets) |

| LXI | LXI REIT (incl. former Secure Income REIT) | United Kingdom | Net-lease REIT (RPI-linked leases) |

| RESI | Residential Secure Income REIT | United Kingdom | REIT (RPI-linked residential leases) |

| RSG | Republic Services | United States | Waste services (inflation-linked pricing) |

| WPC | W. P. Carey | United States | Net-lease REIT (many CPI/RPI-linked escalators) |

Shortlisted

| Symbol | Name | Country | Theme |

|---|---|---|---|

| TCL | Transurban | Australia | Toll roads (CPI-linked schedules) |

| BIPC | Brookfield Infrastructure Partners / Corp | Bermuda / Canada | Global infrastructure operator (inflation-indexed contracts) |

| IG | Italgas | Italy | Regulated gas distribution |

| BALN | Bâloise Holding AG | Switzerland | Insurance (domestic focus) |

| BARN | Barry Callebaut | Switzerland | Food & Beverages (domestic base) |

| BELL | Bell Food Group | Switzerland | Swiss – food staples |

| BKW | BKW | Switzerland | Swiss – utility / grid |

| EMMN | Emmi | Switzerland | Swiss – dairy staples |

| NESN | Nestlé | Switzerland | Swiss – consumer staples (global) |

| REHN | Romande Energie Holding | Switzerland | Swiss – utility / grid |

| SLHN | Swiss Life Holding AG | Switzerland | Life Insurance & Pensions |

| SCMN | Swisscom | Switzerland | Swiss – telecom / essential services |

| ZURN | Zurich Insurance Group AG | Switzerland | Insurance (domestic base) |

What do you think?

So markets went crazy right after I sold. Funny how that happens every single bloody time!

Don’t worry, next time you don’t sell and they tank. ![]()

Happened to me a lot. Selling is the hardest thing. Belongs to position management and that was the first thing I did automate. No reason to decide on a case to case level, you are always biased if you hold a position. And the risk is great that by deciding on a case level you end up always in the slower queue.

You must have a reason to sell. Just write it down and think about it. Take a step back and try to generalize. That is probably the single most profitable thing you can do when investing…

I can give tons of tips how to do that, but maybe better in the mechanical investments thread.

UnitedHealth shares rose 10 per cent in after-hours trading following Berkshire’s disclosure.

Damn you Berkshire! I’m trying to accumulate on the dip and they have to go and increase prices by 10%.

So up 12% pre-market and even ELV (another stock I’ve been trying to accumulate) is up around 5%.