GE was one that I was planning to look at when it bottomed out, but I never got back to it. I did buy GEV though.

I used to hold GE, lost quiet some money. It was one of the reasons I did change my mechanical dividend portfolio methods: instead of holding a period of 2 years I changed to sell immediately when the risk is not right anymore.

GE today: downsizing may have helped, debt situation is quite better. But it still has very bad EV/FCF ratio, meaning it does not work very effective with the capital. Numbers are almost a year old, maybe the situation is better now.

Managers used to fly to meetings with two private jets each, one could break down and their time is oh so important… ![]()

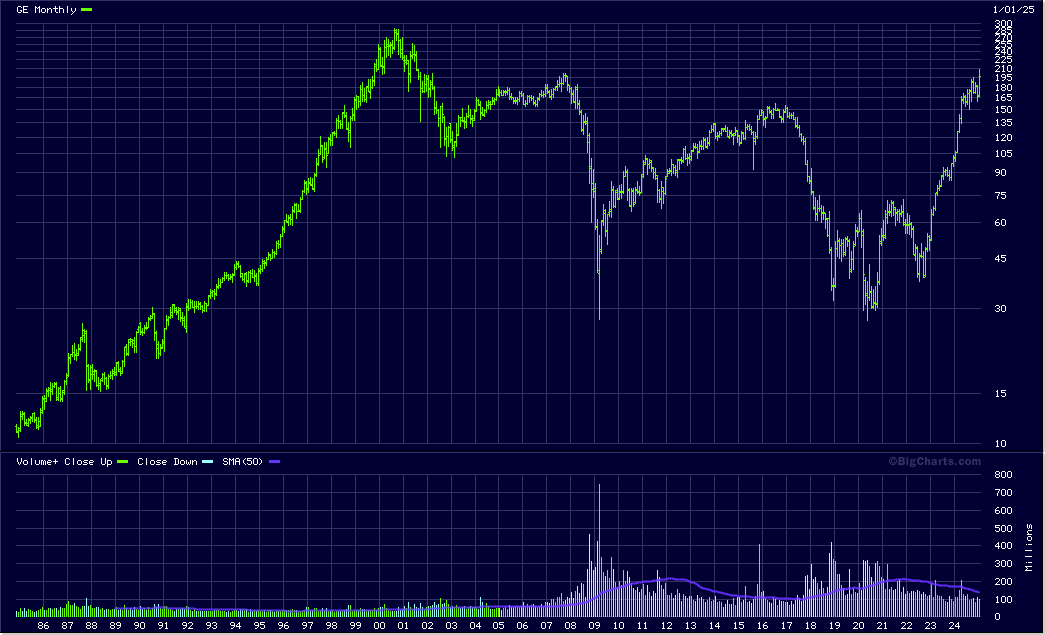

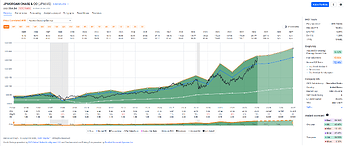

Still 25 lost years:

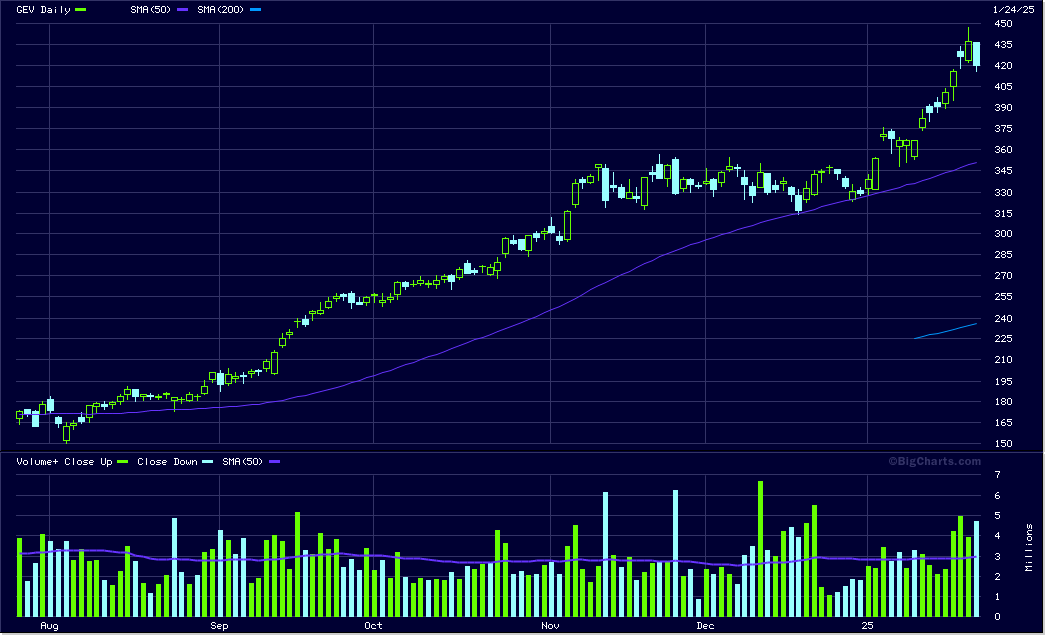

Sadly only a small position.

So, I was looking for a permanent home for the funds temporarily put into MO.

I even looked at some large and mid cap value funds such as VTV and VOE:

And was very surprised that a value fund could have a PE of >20.

Looking at the holdings, I like VOE a lot more than VTV.

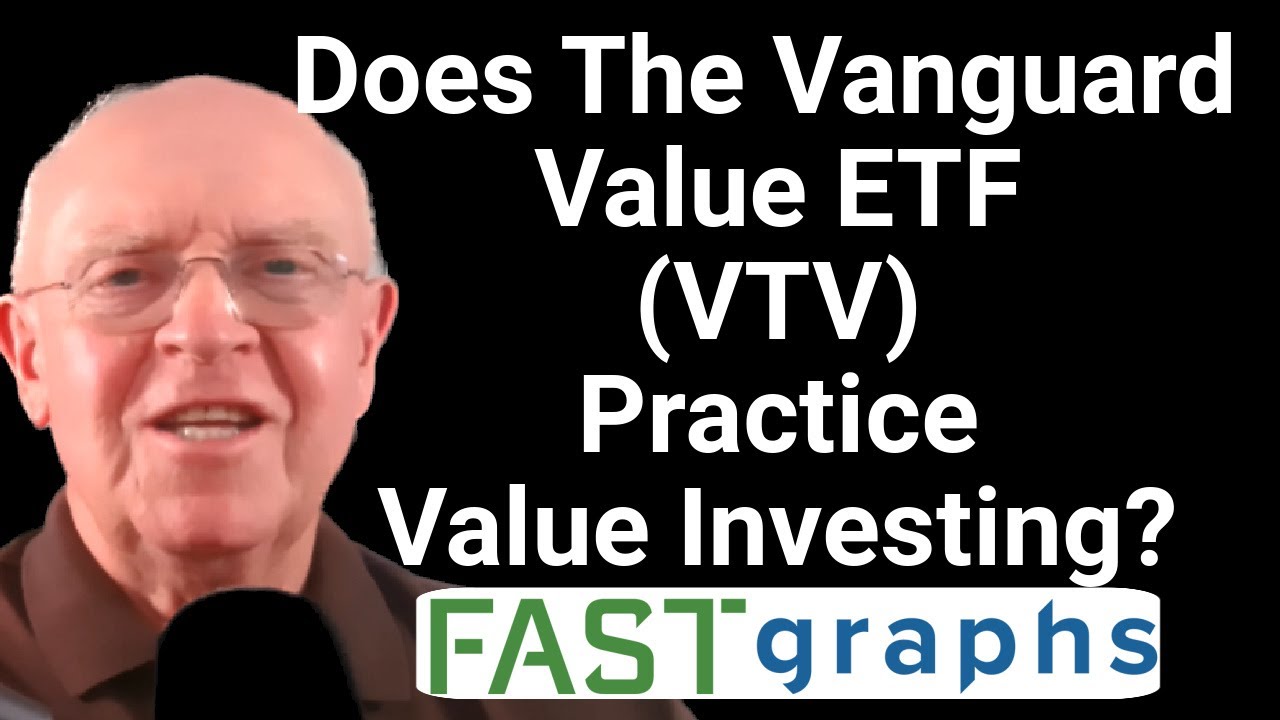

Don’t remember who it was, maybe Chuck Carnevale, who looked into several “value” funds and found big positions which were grossly not value ![]()

If you find that article/video, please share!

This thread is about investment strategy. To the topic of “ethic investments”: I don’t do it. Ethics is a difficult term to describe, very subjective. I use mechanical investment strategies and I choose U.S. markets because they are cheap to trade and have a public information system available for free and offered by the SEC, the Edgar database.

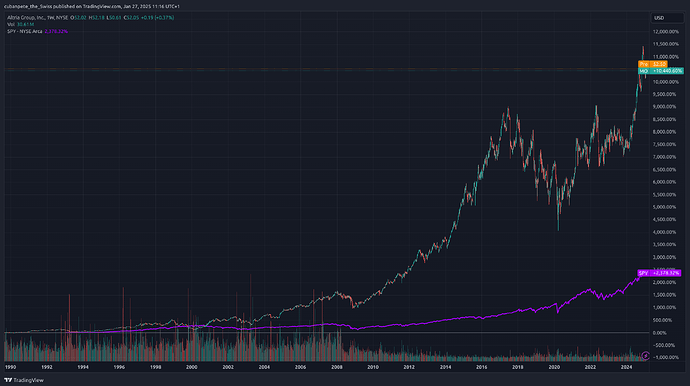

I think companies that are not owned by funds or people because of ethics offer an additional return, but I have no proof of that. My biggest dividend payer is Altria/Philipp Morris. I don’t smoke, but this seems to be good business and I don’t care for anybody to smoke while he does it out of my breathing. I also own Lockheed Martin.

I actually prefer these anti-ethical investments. Previously I held huge amounts in: tobacco, defense, alcohol, coal, oil, mining. The ESG trend gave a nice opportunity there.

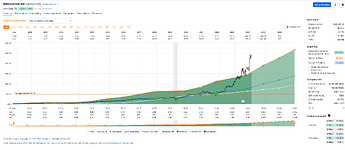

MO pays a nice dividend of 7.84%. It is very cheap, forward P/E of under 10. And it fulfills all the criteria in my mechanical dividend strategy.

When I started investing there were no ETF. Later I thought that I can do better by just leaving out some stocks and using a mechanical method. Many ETF do the same, but with other criteria. I prefer the criteria adjusted to my personal situation. That it performs better is a nice add-on but probably is just luck, 11 and 5 years are too short a time for statistical proof of that.

TradingView provides charts including dividends. MO had a really nice run. Comparison chart with SPY, both containing dividends:

VTV just hugs the CRSP US Large Cap Value Index which “represents the Value Style for companies covering top 85% of cumulative capitalization of CRSP US Total Market”.

Not sure how you can pick value when you want to cover the top 85% of CRSP US Total Market which in turn “represents 100% of the US investable equity market” …

VTV’s top 10 holdings:

- 3.19% BRK.B. (Blended)* P/E: 23.16

- 3.13% JPM. P/E: 14.52

- 2.51% AVGO. P/E: 46.91

- 2.16% UNH. P/E: 19.16**

- 1.85% WMT. P/E: 38.29

- 1.83% PG. P/E: 24.21

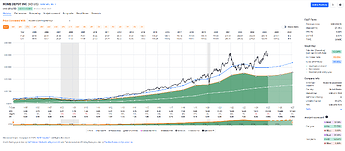

- 1.79% HD. P/E: 27.45

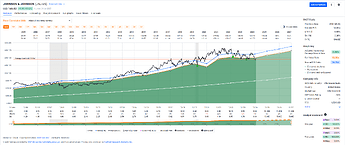

- 1.62% JNJ. P/E: 14.65

- 1.46% ABBV. P/E: 15.46

These are all great companies (and I own some of them) but only JPM, JNJ and ABBV are fairly valued (but not undervalued).

* FASTgraph's blended P/E is based upon a weighted average of the most recent actual or estimated value and the next forecast value.

** Down from 22x from before their CEO got shot at their last earnings call.

From the top 10, at current valuations, I think only JNJ would make it into my portfolio. ABBV I previously held and now I see it is up slightly from when I sold it almost 3 years ago.

I think I owned almost all of the top 10 (didn’t own HD) and sold for a lower price than they currently sit at! So what do I know?

I hold AVGO (hold), JNJ(buy) and ABBV(buy).

Will check out my criteria on the others, BRK.B, JPM, UNH, WMT, PPG and HD later. As I have a sector and number of position limit they would probably be OK for my mechanical dividend portfolio, but it is already “full”.

Similar here: I hold AVGO, JNJ, PG and ABBV.

Here’s the FASTgraphs for VTV’s top 10 for anyone interested:

BRK.B is OK (no dividends, but treasury stock buyback).

JPM not OK, negative cashflow (but tons of cash). Would need further investigation…

UNH OK

WMT not OK, too much debt, too low EV FCF efficiency

PPG OK

HD OK

Just the mechanical rules. Financials like JPM need further investigation, at first look negative cashflow. Walmart seems to have higher risk than in the past, probably because it has risen that much. Would probably be on “hold” if it would be already contained in my dividend portfolio.

After the Deepseek crash, I had a look today at some stocks e.g. Siemens Energy down >20% but is still outrageously expensive.

And wouldn’t you know it, BTI jumps 4% right after I sell ![]()

Premarket another 3.5%…

You know my recipe… mechanical sells cannot prevent that, but at least you know what to do when and always do the same.

I do sometimes verify the sold positions. Some are like this, but most are not. So, doing the same in the same situation is OK for me.

Eyeballing it with my personally trained quantum computer – i.e. my brain leveraging physics, chemistry, biology – and an at least 2-3 year holding period I find none of them investable. If pressed hard, I’ll pick JNJ.

Just not enough of a margin of safety for these prices for me …