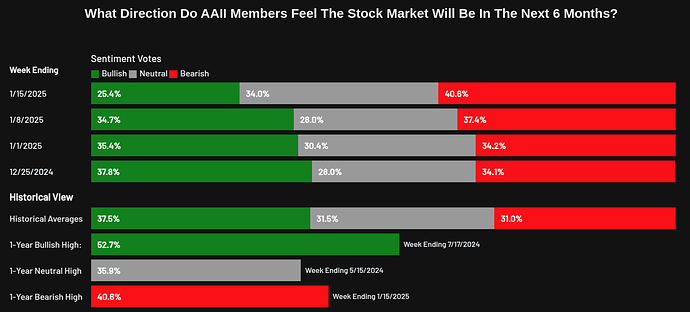

I didn’t realise sentiment had deteriorated so much last week!

Tariffs…

Yep, that is hard. Sales were the first part where I did implement mechanical strategies. You are (I am) always wrong, no matter what you (I) do. But at least with mechanical sells you are always wrong in the same way… ![]()

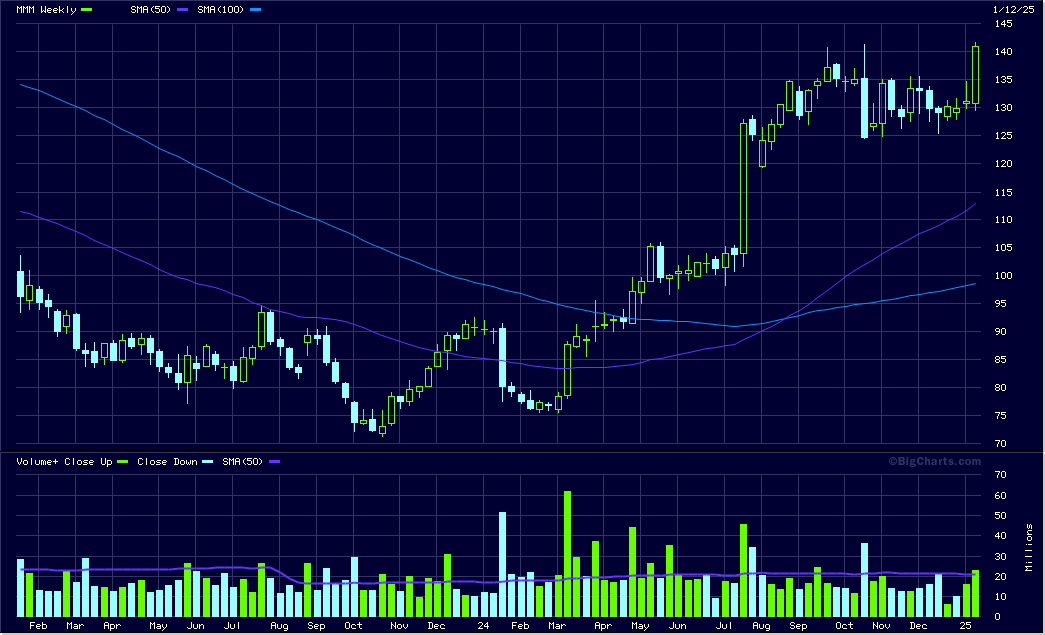

My take on MMM: chart looks like it just had found a reason to rise, 50/100 Weeks MA cross recently:

I would probably analize it as a dividend stock, there my mechanics are described completely in the mechanical investments thread:

Checking Edgar… yearly data fulfills criteria, but almost one year old. Quarterly data from today is still not available in Edgar but I suppose they were better than expected. So no, my mechanical strategy would not have sold.

The only reason it could go to hold at the moment is the dividend yield; after today’s rise it could slip under 2%. Last year they did sell more new stock than they did buy back, so that wouldn’t help. Tomorrow it could go from buy to hold if they don’t rise the dividend. However, they did pay back a lot of debt, which usually is a good thing.

As I already stated, my goal is to hold as long as possible but not longer. A rule of thumb: the longer the holding period the bigger the gain.

I’m not invested in MMM at the moment.

A little trick for google chrome users: customized search as an example of Edgar.

If I want to analyze a U.S. stock I usually want to see the official numbers the company had to send to the SEC. The SEC offers this data as a free service via the Edgar database.

The google chrome search allows for shortcut searches. I want to see a list of yearly reports when I type “e ”. As “e MMM” would give me the numbers for 3M.

To add the shortcut search go to “settings” “search engine” “manage search engines…” “add”.

There put in the name field “Edgar” (or whatever you like), shortcut “e”, URL “https://www.sec.gov/cgi-bin/browse-edgar?company=&match=&CIK=%s&type=10-K&filenum=&State=&Country=&SIC=&owner=exclude&Find=Find+Companies&action=getcompany”

Done. Did something similar for the quarterly reports, for charts and a lot of things more.

Utilities dipped a bit today, so took the opportunity to buy some.

Could not buy any utilities since a long time. Had some 10 years ago in my dividend portfolio, but had to sell because of the cashflow (my mechanics). They all have a cashflow problem. Most utilities create new debt every year just to pay dividends. This seems to me like taking out money from one pocket to put it in the other pocket, but with some tax inbetween.

They get away with it because analysts say there is no risk. This is bullshit, nobody knows the future and there is always risk. Paying dividends with new debt is not only risky… it is nonsense.

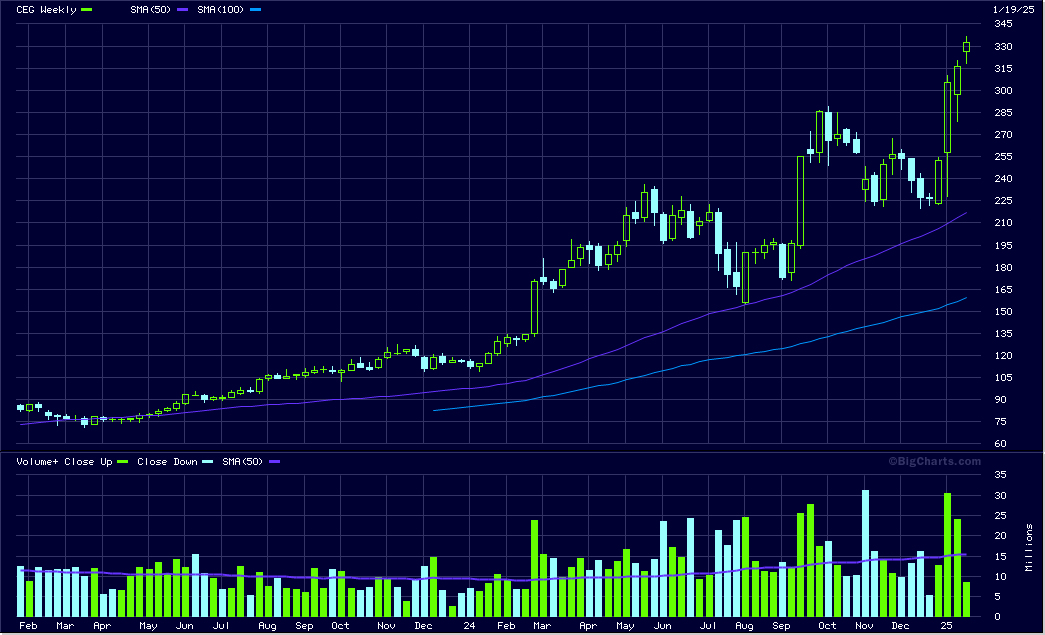

The only utility I own at the moment is in my high-risk portfolio where Cashflow isn’t that important. Constellation Energy (CEG), mainly nuclear plants. Nice run, gain of 471.19% in 30 months including dividends.

What stocks did you buy?

CEG chart:

I own the below:

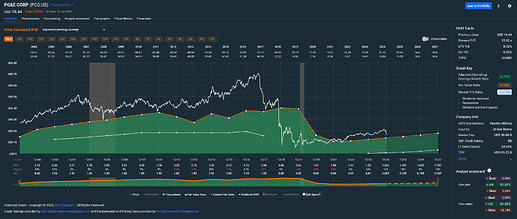

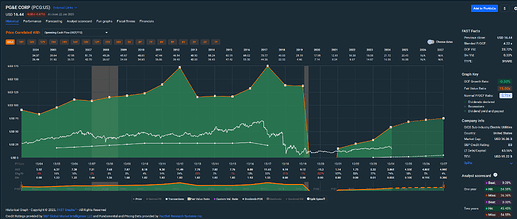

PCG

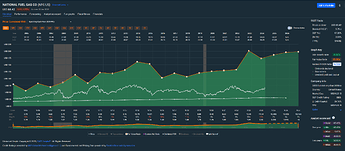

NFG

ES

NG.L

SO

AES

Had some of those too, but don’t hold actually.

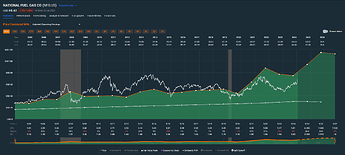

PCG NFG ES SO and AES have either negative FCF or a FCF payout ratio way over 100%. In other words, they use new debt to pay dividends. NG.L data I see only in yahoo finance and it seems to have a negative FCF too.

You will find dozens of articles that explain why this situation is not a problem for utilities. I say it is…

BTW: my utility holding, CEG, has a negative operating cashflow too, but some growth factors and fantasies, like the nuclear mini plants. Bought it when it was dirt cheap and as long as the momentum goes on I will hold. New all time high today…

While I think SMR would be great, I’m sceptical whether it can be achieved rapidly due to regulations and red tape (but who knows maybe DOGE will push it through).

For nuclear play, I invested directly into uranium companies and ETFs.

I agree on utilities, I’m not sold on them, but happy to diversify a little in case of a rotation to more defensive stocks.

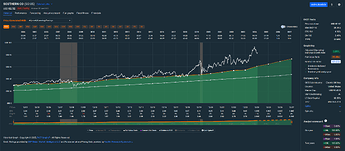

EDIT: I didn’t realise how high SO had reached. I wish I sold it at $90 or so. Just sold now anyway.

EDIT2: Decided to buy a new position: TROW with the proceeds.

I own Avangrid (beginner’s mistake), Eversource and Southern.

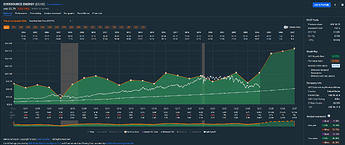

Eversource:

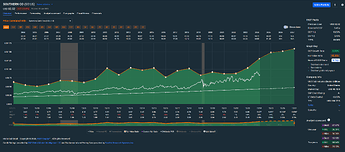

Southern:

Both ES and SO have been growing their dividends for multiple decades. Seems like a pretty sustainable business model, no?

Edit: I own NFG, too:

Edit 2: I don’t own AGR anymore. I need to have a stern talk with my portfolio manager … ![]()

Since you’re on a roll, would you mind posting PCG too?

Voilà!

Looks like something happened in 2020? Or, according to Adjusted Operating Earnings already two or three years earlier.

They had liabilities due to wildfires IIRC.

EDIT here:

In early 2019, PG&E filed for Chapter 11 bankruptcy after fires caused by its powerlines burned hundreds of thousands of acres in Northern California and led to more than 100 deaths. It paid out $25.5 billion to resolve its fire-related liabilities, and expects to spend $11.7 billion on strategies to mitigate wildfire risk between 2019 and 2022, according to the CDP filing that it submitted this year — in 2019, it projected spending up to $2.8 billion on programs for that year. And now, PG&E’s equipment is once again the focus of a Northern California wildfire that the utility thinks could cause it significant liability.

Interesting.

I really don’t like not having a single utility anymore in my dividend portfolio. But it is all about low risk and being able to hold as long as possible. And for me the risk rises with debt and paying dividends with new debt does not make any sense.

When pulling in a new company into my dividend portfolio I always seek in the sectors where I have the least capital invested, and that is utilities and energy (0) at the moment. I’m sure I’ll find something next time I need a new company, but probably more in the energy sector.

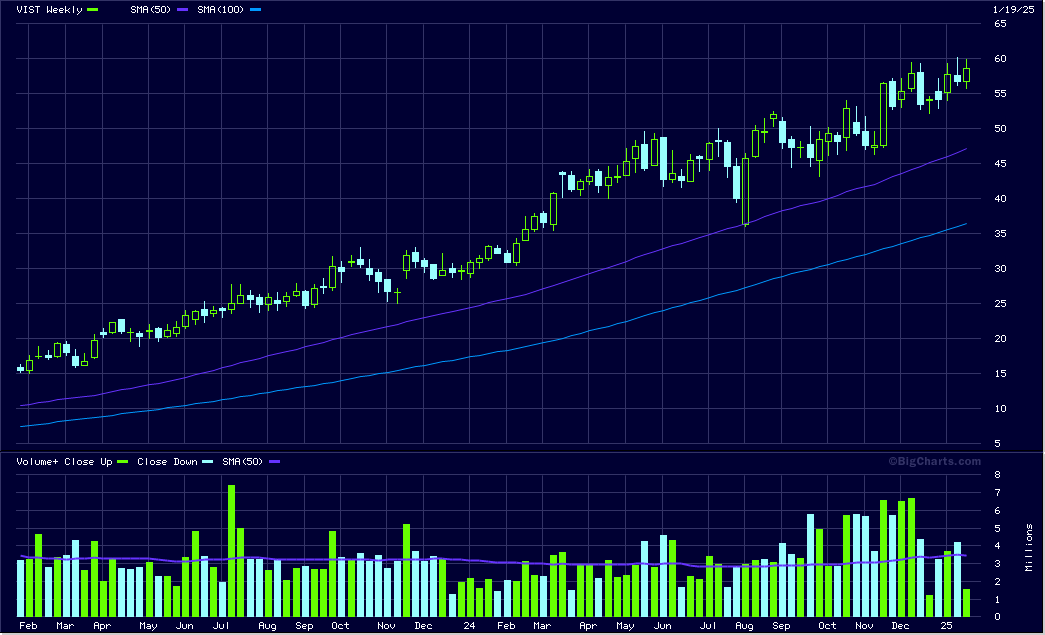

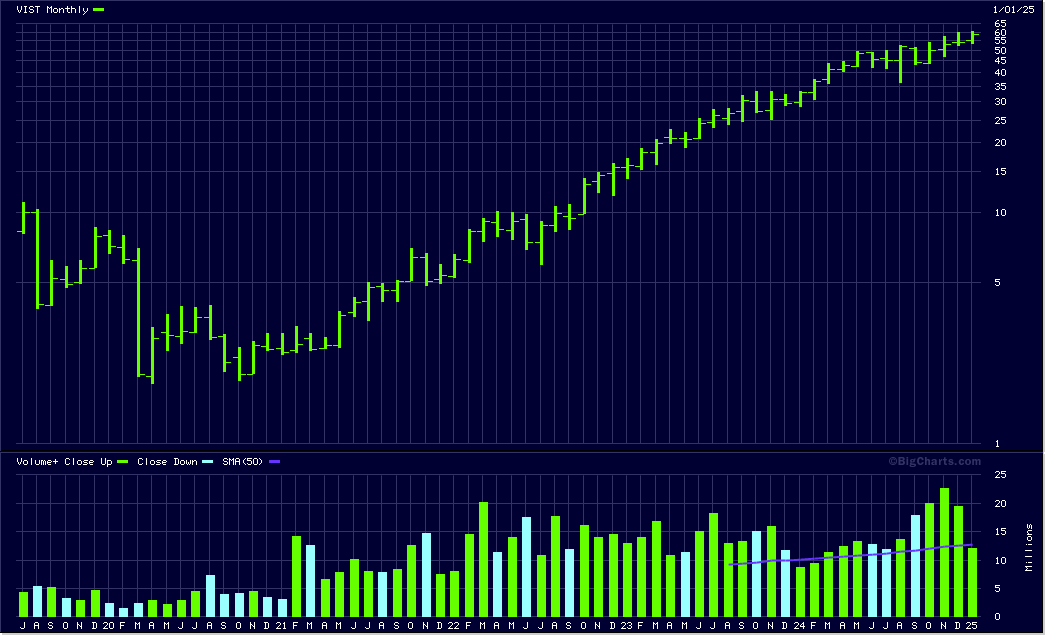

Fortunately in my risky growth and momentum portfolio I have quiet some energy and one utility stock: CEG, RNGR, WTTR, VIST and FRI, VIST being the actual best performer with breathtaking 1167% gain in 41 months. Best performer of all my stocks…

BTW: I have a lot of losing stocks of course. One has to lift a lot of stones to find a diamond. But there are diamonds.

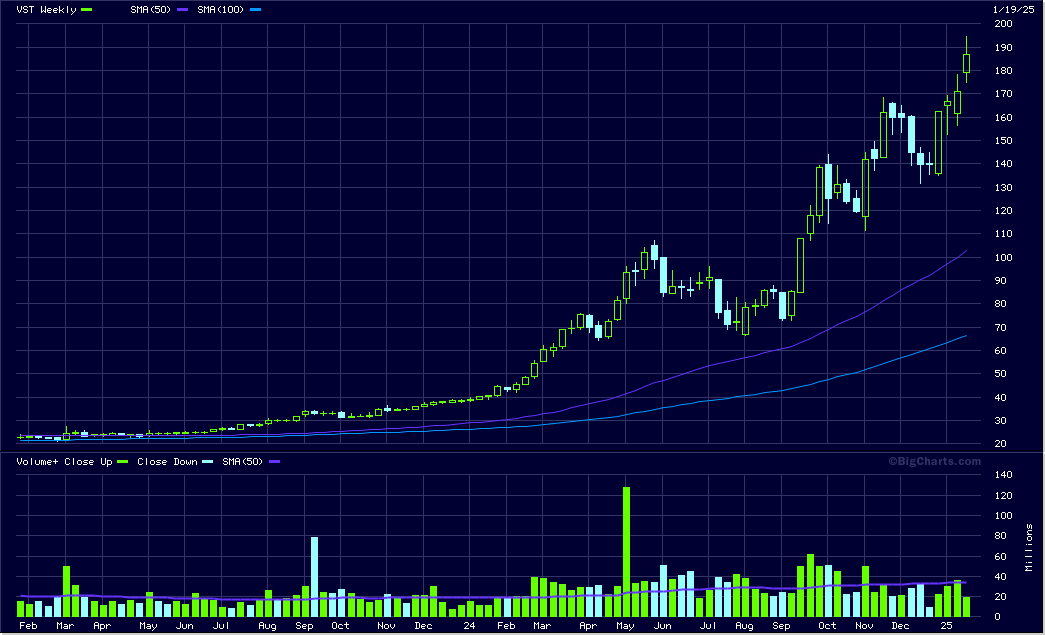

Oh. I forgot I had Consolidated Edison (ED) too. Is VIST related to VST? I severely regret not buying VST, it’s been going up and to the right for a while now.

No, Vista Oil and Gas is a small drilling company with main resources in Argentina and Mexico.

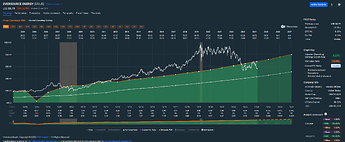

VistRa looks like a small nuclear power utility. And it seems to be a utility with a nice cashflow, not like the others mentioned until now. Except for the dividend yield this company would fulfill the criteria of my dividend portfolio.

The dividend yield is so small because they rose a lot. They bought back a lot of own stock too.

The chart is lovely ![]() :

:

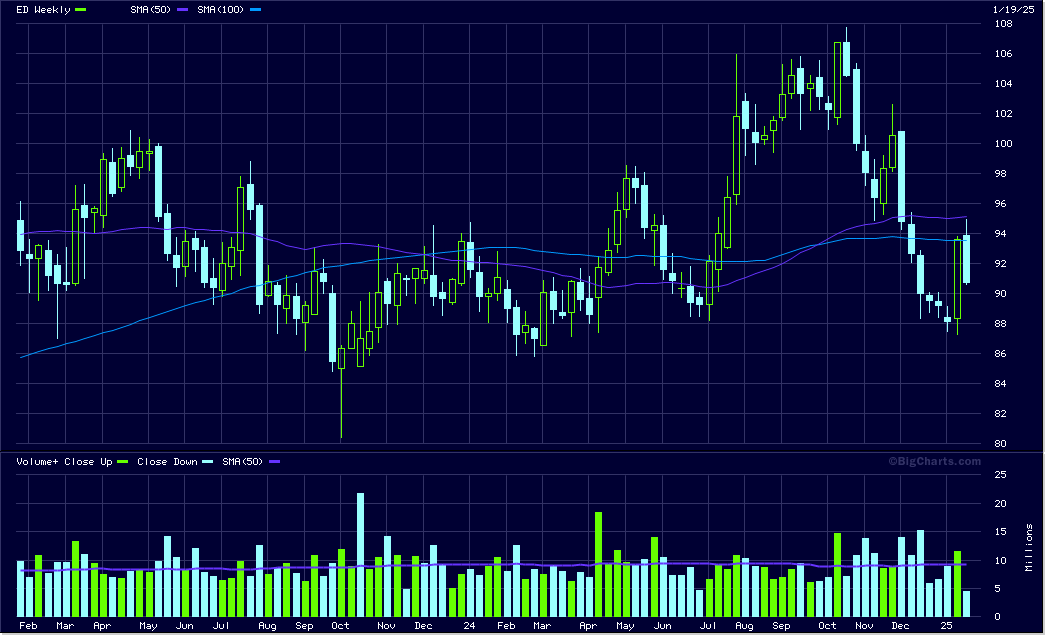

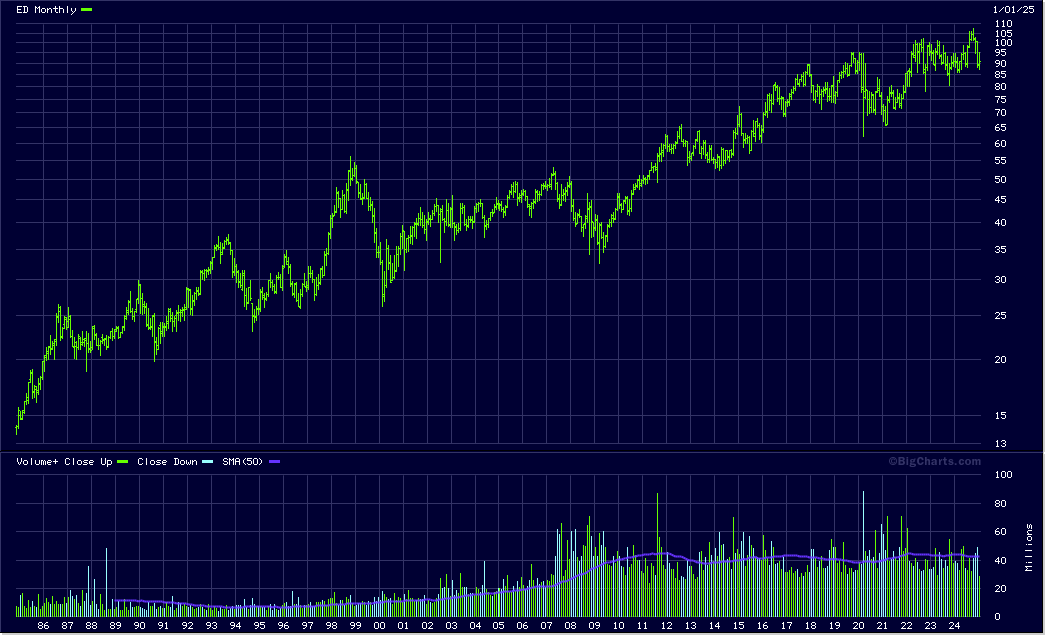

Consolidated Edison is a little more difficult to analyse because of the sell of a big part of the company in 2023 for almost 7 billion. Without the sell the situation is the same as the others: negative FCF. Debt was issued in almost the same amount as dividends were paid and own stock was bought back.

I don’t like such things, pocket to pocket exchange of money that is taxed in between and debt gets bigger and bigger, as almost all utilities. I wonder how the CFO of those companies get away with that policies… and why the analysts applaud to it.

The weekly chart looks kind of flat, the monthly long term log chart looks OK, but sometimes you had to wait 11 years for a gain:

I don’t have any energy stocks yet but I have RUI.PA on my high dividend paying stocks watch list.

I suppose you mean RUI.PA, Rubis the refiner with gas-stations and liquid storage facilities. Yahoo finance says the dividend yield is 8% but the free cashflow is negative, so no, wouldn’t enter in my mechanical dividend portfolio. But then yahoo financial is known to have wrong data on non-U.S. stocks.

I mainly invest in stocks that are listed on U.S. stock exchanges because the data is more easy to find and compare. And I never ever touch French stocks because of the tax they impose on trading their companies. France is a nice and beautiful country, but not for investments…